In the News

Written by: Scott Strohecker, CFP®, EA As the year draws to a close, charitable organizations ramp up their fundraising efforts-and many individuals begin thinking about how to give back. For donors, year-endcharitable giving isn’t just an opportunity to make a meaningful impact; it’s also a valuable moment for thoughtful tax planning. While working with clients on…

Play Video Click here for our 2025 Year End Tax Planning Checklist As we approach the end of 2025, our team will be discussing year-end tax planning to help you identify opportunities to optimize your tax strategy. Our webinar will be led by Scott Strohecker, CFP®, EA, and Vincenzo Testa, CPA, CFP®. Topics include:…

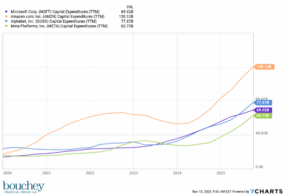

Written by: Paolo LaPietra, CFP® Every generation gets its defining investment story, and right now it is AI. Not the harmless “let’s ask ChatGPT” version, but the trillion-dollar, power guzzling, data center everywhere version that is reshaping the market. The numbers have reached a point where they barely feel real. Nvidia reached a five trillion-dollar…

Watch our latest market update webinar where we unpack what shaped the markets and economy during Q3, review the major factors influencing performance year-to-date, and share our outlook as we move into the final quarter of 2025. The discussion is led by Chief Investment Officer Ryan Bouchey and Portfolio Strategist Paolo LaPietra. Topics Include: Q3…

Team Bouchey recently spent the day volunteering at the Ronald McDonald House in Albany, preparing a fresh salad and pasta bar for families staying at the House. It was a meaningful opportunity for our team to come together and support an organization that provides comfort, care, and stability to families with children receiving medical treatment.…

Washington has delivered another sweeping piece of legislation packed with major tax changes that could impact nearly every American household. In this timely webinar, we’ll break down the key tax provisions of the recently passed One Big Beautiful Bill Act, from what’s been made permanent to what’s newly introduced, and how these changes could affect…

Stay Up to Date

Join our newsletter to receive useful tips and valuable resources delivered directly to your inbox.

January Market Insights: Economy, the Fed, and AI

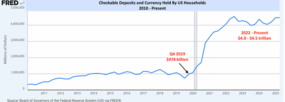

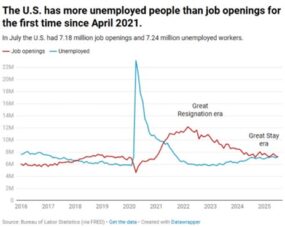

Written by: Paolo LaPietra, CFP® As we move into 2026, the economic backdrop remains constructive. Earnings continue to hold up; the labor market, while cooling, remains healthy by historical standards, and consumer spending has proven resilient. Recent GDP data reinforced that underlying strength, even as markets digest choppier short-term signals influenced by reporting delays and policy uncertainty. On the policy front,…