Q4 2025 Market Update

A Market Built on Capital, Earnings, and Policy

Written by: Paolo LaPietra, Director of Portfolio Strategy

Market Update

The start of a new year has always been my favorite time of year. There’s something about the calendar flipping that gives you a clean slate and a fresh perspective, especially when it comes to markets and long-term financial planning. It’s a chance to step back from the noise, reassess what actually matters, and think clearly about where we’re headed next from a portfolio and wealth management standpoint.

That said, not every fresh start is created equal. If you’re a Las Vegas Raiders fan like me, “new year, new season” came with the reality of a last place finish and the first overall pick. That’s a true rebuild. Markets, on the other hand, don’t find themselves in that position. After finishing 2025 up roughly 18%, this is not a reset, it’s momentum. As we head into 2026, the backdrop is still being shaped by continued investment in AI, the prospect of lower interest rates, and an economy that has proven far more resilient than most expected despite ongoing market volatility. This year isn’t about starting over. It’s about building on what’s already working within a disciplined investment strategy.

Equity Overview

AI was clearly the darling of 2025, and nothing about the underlying trend suggests that changes in 2026. If anything, it becomes more important from a long-term investing perspective. What continues to stand out is not just the innovation itself, but the sheer amount of capital being deployed behind it. The chart you’ll see highlights capital spending from the five largest hyperscalers: Amazon, Meta, Alphabet, Microsoft, and Oracle, rising from roughly $395 billion in 2025 to $514 billion in 2026, with projections approaching $600 billion in both 2027 and 2028. That level of investment doesn’t just support the AI ecosystem; it acts as a meaningful tailwind for broader economic growth and equity market fundamentals.

This environment was central to our decision to add semiconductors through SMH and nuclear via NLR back in November as part of our portfolio strategy. Both have meaningfully outperformed the market since we made those changes, which is exactly what we hoped to see as AI demand continued to accelerate. Just as important, the earnings backdrop has reinforced the thesis. Last quarter, 85% of S&P 500 companies beat earnings expectations, and more than 94% of technology companies did the same (Source: Fundstrat, FactSet). That mattered to us because we wanted to be sure this surge in AI-related investment wasn’t coming at the expense of profitability or balance sheet strength. The data shows it hasn’t. As the market evolves this year, we’ll continue looking for opportunities to thoughtfully strengthen AI exposure across portfolios, staying focused on where long-term fundamentals and capital are pointing while managing overall portfolio risk.

We also made a small but deliberate addition to portfolios by introducing Bitcoin through HODL. Our view is that the regulatory and institutional backdrop around digital assets has shifted in a meaningful way. With greater regulatory clarity in place, many of the barriers that once kept large institutions on the sidelines have been reduced. We saw that play out in real time last month when Vanguard began allowing clients to access crypto ETFs on its platform, something that would have been hard to imagine not long ago. When Bitcoin pulled back below $85,000, near 2025 lows, we viewed that as a compelling entry point within a longer-term adoption trend. So far, that positioning has been rewarded. As with any emerging asset class, we remain disciplined in sizing as part of prudent risk management, but we believe this represents another area where structural change is creating opportunity rather than risk.

We also reshaped our market-cap exposure in portfolios last quarter as part of ongoing portfolio management. Specifically, we reduced our small-cap exposure as we continue to see that part of the market as structurally more challenging. The chart below tends to surprise people. Small caps are now more expensive than both large and mid-cap stocks based on forward P/E. At the same time, they are far less profitable, with roughly 39% of small-cap companies currently unprofitable. To put this into perspective, the long-term average is closer to 27% before the financial crisis. Add in the fact that small caps also experienced the largest downward earnings revisions, nearly 20%, the risk-reward simply isn’t as compelling from a valuation and earnings quality standpoint as it once was.

(source is JP Morgan)

Stepping back, we believe the small-cap landscape itself has changed in today’s market environment. The growth of private equity has fundamentally altered the public market opportunity set. Many of the most successful small companies are staying private for far longer than they used to, with the median time to IPO stretching from about five years in 2000 to closer to fourteen years today. In our view, that shift has made the mid-cap space more attractive from both a quality and valuation standpoint for long-term investors. That’s why we continue to focus our exposure through our mid-cap holding, VO, where we see a better balance of growth, profitability, and long-term opportunity within diversified portfolios.

Economy, the Fed, and AI

Looking ahead, we remain optimistic on the markets and see 2026 as a year that continues the momentum built in 2025 from a macroeconomic and investment perspective. The foundation is still there. Earnings remain strong, the consumer and labor market continue to hold up, monetary policy is supportive, and AI adoption is becoming a meaningful economic driver rather than just a market narrative within the broader economic outlook.

On the policy front, we expect the Federal Reserve to continue easing as part of the monetary policy cycle. After cutting 100 basis points in 2024 and another 75 basis points last year, our base case is an additional 50 to 75 basis points of cuts in 2026. The next Fed Chair is also expected to be announced this month, and President Trump has been clear about wanting a more dovish successor to Chair Powell. Whether it is Kevin Hassett, Kevin Warsh, or Christopher Waller, all three have publicly reinforced a preference for lower rates. Historically, periods where the Fed is easing while the economy avoids recession have been a powerful tailwind for equities and long-term market performance, as shown in the chart below illustrating S&P 500 performance following rate cuts near market highs.

(source is JP Morgan)

From an economic standpoint, the labor market has cooled, but it remains healthy by historical standards. Data has been choppy due to the government shutdown and reporting delays, and while job creation has clearly slowed, unemployment still sits around 4.4%, which is low by historical standards. That resilience continues to support a strong U.S. consumer, which was a key driver of the 4.3% GDP growth we saw in the third quarter and overall economic stability. Additional fiscal support, including the recently passed “Big Beautiful Bill,” should further reinforce consumer spending in the months ahead and support near-term economic growth.

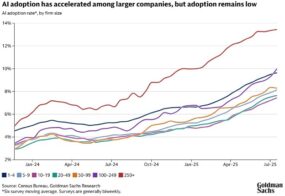

Finally, there is AI. It continues to remain difficult to quantify its near-term impact with precision, but the longer-term thesis is straightforward from an economic and productivity standpoint. Increased AI adoption should drive faster productivity growth, allowing the economy to expand at a more efficient pace. This is particularly meaningful given how disappointing productivity growth has been for much of the time since the Global Financial Crisis. The chart below shows adoption accelerating among larger companies, while remaining relatively low across much of the broader market, which suggests we are still early in the cycle of long-term technological adoption. That gap is exactly where future productivity gains lie.

As we move through 2026, our focus remains simple, stay aligned with long-term fundamentals, be disciplined in risk management, and thoughtfully incorporate opportunities across traditional markets and emerging asset classes, including digital assets, when market fluctuations create them. Markets will never be free of volatility, and headlines will always find a way to test conviction. But when you strip away the noise, the underlying story still points in the same direction. Corporate capital is being deployed at historic levels, earnings remain healthy, consumer and labor are holding up, and monetary policy continues to be more supportive rather than restrictive for investors. That is not the setup for a reset. It’s the setup for continued progress. Our job is not to predict every twist and turn, but to position portfolios in a way that lets long-term trends do the heavy lifting while managing the risks along the way through thoughtful wealth management. As always, we’ll stay thoughtful, opportunistic, and focused on what actually drives durable results.

Please make sure you join us on January 28th for our quarterly webinar, and as always, don’t hesitate to reach out with any questions.

Paolo