January Market Insights: Economy, the Fed, and AI

Written by: Paolo LaPietra, CFP®

As we move into 2026, the economic backdrop remains constructive. Earnings continue to hold up; the labor market, while cooling, remains healthy by historical standards, and consumer spending has proven resilient. Recent GDP data reinforced that underlying strength, even as markets digest choppier short-term signals influenced by reporting delays and policy uncertainty.

On the policy front, the Federal Reserve has clearly moved into an easing cycle. After rate cuts in both 2024 and 2025, expectations around additional cuts this year have become an important input for markets. Historically, periods where the Fed is easing while the economy avoids recession have supported equities, particularly when earnings remain intact.

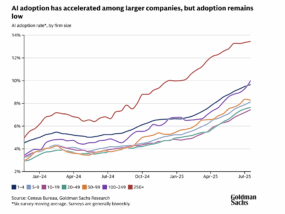

AI also continues to move beyond a market narrative and into a broader economic driver. While its near-term impact is difficult to quantify, longer-term adoption trends point toward meaningful productivity gains over time. Adoption remains concentrated among larger companies, indicating there is still room for expansion across the broader economy as this cycle develops.

Source Census Bureau and Goldman Sachs Research

We’ll be sharing our full Q4 2025 Market Update next week, where we take a deeper look at how these dynamics are shaping markets and portfolio positioning as we head further into the year.

As always, if you have any questions or concerns, please contact an advisor to discuss your situation.