December Market Insights: A Month of Headlines & Opportunity

Written by: Paolo LaPietra, CFP® and Edward Wilhelm

If it feels like a lot has happened in the last month, that’s because it has. The government reopened on November 13th, the jobs report landed shortly after, Nvidia once again took center stage during earnings season, AI-driven volatility picked up, and Fed cut expectations continued to shift. Somehow, all of that happened before Thanksgiving. Even with the constant flow of headlines, plus a brief subplot courtesy of the QQQ proxy vote saga, the market still offered moments worth taking advantage of.

The government reopening on November 13th ended a record 43-day shutdown and finally released the economic data the market had been waiting for. The first report to come through was the September jobs report, and it came in much stronger than expected with 119,000 jobs added versus estimates of 51,000. That was a meaningful win for a labor market that had been under scrutiny after several downward revisions. July payrolls were revised lower, from 79,000 to 72,000, and August saw an even bigger shift, moving from a gain of 22,000 to a loss of 4,000. Altogether, that leaves July and August employment 33,000 lower than previously reported.

The September report helped calm some concerns, but it did not resolve the bigger issue. The shutdown disrupted key economic releases the Fed relies on, including the cancellation of the official October jobs report, with partial data now expected to be folded into November. With that uncertainty, confidence in a December rate cut deteriorated quickly. Rate cut expectations fell from 70 percent on November 11th to below 30 percent by November 20th, and the S&P 500 followed the same pattern, pulling back roughly 5% during the same stretch.

Amid all of this, Nvidia reported earnings on the 19th, and the release carried real importance because their results now essentially reflect the strength of the broader economy. Nvidia delivered another strong quarter from top to bottom, including the highly anticipated data center results where revenue reached $51.2 billion, beating expectations of $49 billion. Even so, broader AI-related volatility remained elevated.

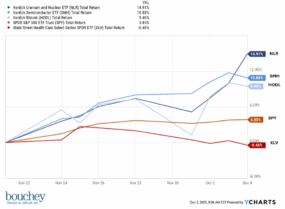

The combination of disrupted economic data, shifting Fed expectations, and AI-driven volatility created a moment where markets leaned toward panic. We saw an opportunity instead. On November 21st, we used the strength in one of our tactical positions, healthcare (XLV), which had been on a strong run and was up 18.25% since August compared to the S&P 500’s 6.25%, to fund three tactical ideas we had been watching closely: NLR, SMH, and HODL.

For a deeper breakdown of the rationale behind these positions, you can reference our trade letter here. Since executing the trade, the shift has worked in our favor, with strong outperformance relative to both the S&P 500 and healthcare allocation we used for liquidity.

As we look toward the end of the year, we feel confident in how our portfolios are positioned. The moves we made in November show the benefit of staying flexible and using market pullbacks to position portfolios for what we believe is still a supportive economic backdrop. December will be an important month for markets, with a wave of economic releases that will give us the clarity we’ve been waiting for. The Fed decision on December 10th, the jobs report on the 16th, inflation on the 18th, and GDP on the 23rd will all help shape the path forward. Our investment team will be watching each closely, not to react to every headline, but to stay aligned with the trends that matter. Through all of this, November reminded us of something important to every investor. Volatility doesn’t last, but long-term investors do.

As always, if you have any questions or concerns, please contact an advisor to discuss your situation.