Posts by Catherine Buck

Q3 2025 Market Update

Shutdown, Slowing Jobs… And All-Time Highs? Written by: Ryan Bouchey, Chief Investment Officer Download Report Here Market Update We begin the fourth quarter in the midst of a government shutdown, slowing of the labor market, worrying headlines and….all-time highs. Quite the backdrop for the current state of markets and the economy, but one…

Read MoreShutdown, Slowing Jobs… and All-time Highs?

Bouchey Newsletter Written by: Ryan Bouchey, CFP®, CPA As we enter the fourth quarter, it wouldn’t be unreasonable to ask: “Are we really still at all-time highs in the market?” Despite a government shutdown (with little sign of resolution on either side), a cooling labor market, and no shortage of headlines to scare us away,…

Read MoreSimplifying Your Estate for Your Loved Ones

Written by: Catherine Buck, CFP® Estate planning starts with the establishment of estate documents: Will, Health Care Proxy, and Powers of Attorney. However, if you have ever been the Executor(rix) of an estate you know there is much more complexity and many roadblocks to hurdle when organizing a loved one’s Estate. Of course, these…

Read MoreHow will Consumers Respond to Tariffs – Testing Economic Theory

Written by: Martin Shields, CFP®, AIF® Throughout my Economics Master program in Virginia Tech one of my favorite areas of study was consumer theory. The discussion was centered around how consumers reacted when the price or quality of a good and service changed. In some cases, they could control the variables and in…

Read MoreNarrowing the Gap Between Sentiment and Reality

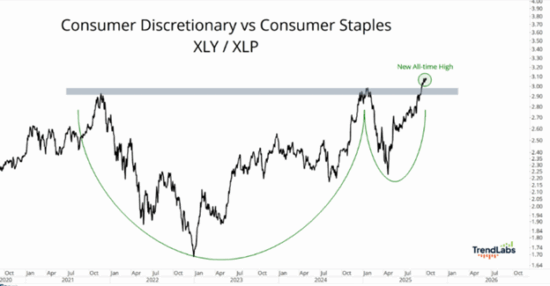

Written by: Ryan Bouchey, CFP® Chief Investment Officer & Chief Strategic Officer One of the themes we’ve been discussing all year—especially since what we’ve referred to as “Liberation Day” on April 2nd—is the disconnect between soft data (consumer sentiment) and hard data (economic reality). For much of the year, what consumers were feeling didn’t…

Read MoreThe Big Beautiful Breakdown: What’s In the New Tax Bill?

Written by: Vincenzo G. Testa, CPA, CFP®, ECA On July 4th, 2025, the “One Big Beautiful Bill” was signed into law, bringing with it the biggest changes to the U.S. tax code in nearly a decade. While the news coverage has focused on the politics, our priority is helping you understand what…

Read MoreQ2 2025 Market Update

What a Ride It’s Been Written by: Ryan Bouchey, Chief Investment Officer Download Report Here Market Update What a ride 2025 has been so far – and to think we’re only halfway through it! Truth be told, I feel much better about where we stand today than I did three months ago when I wrote…

Read More