Understanding Marginal vs. Effective Tax Rates — and Why It Matters

Written by: Vincenzo G. Testa, CPA, CFP®, ECA

When most people talk about how much they "pay in taxes," they’re usually thinking of one number. But there are actually two tax rates that matter—and they tell very different stories: your marginal tax rate and your effective tax rate.

Understanding the difference can help you make smarter financial decisions and avoid costly mistakes.

Marginal Tax Rate: The Rate on Your Next Dollar

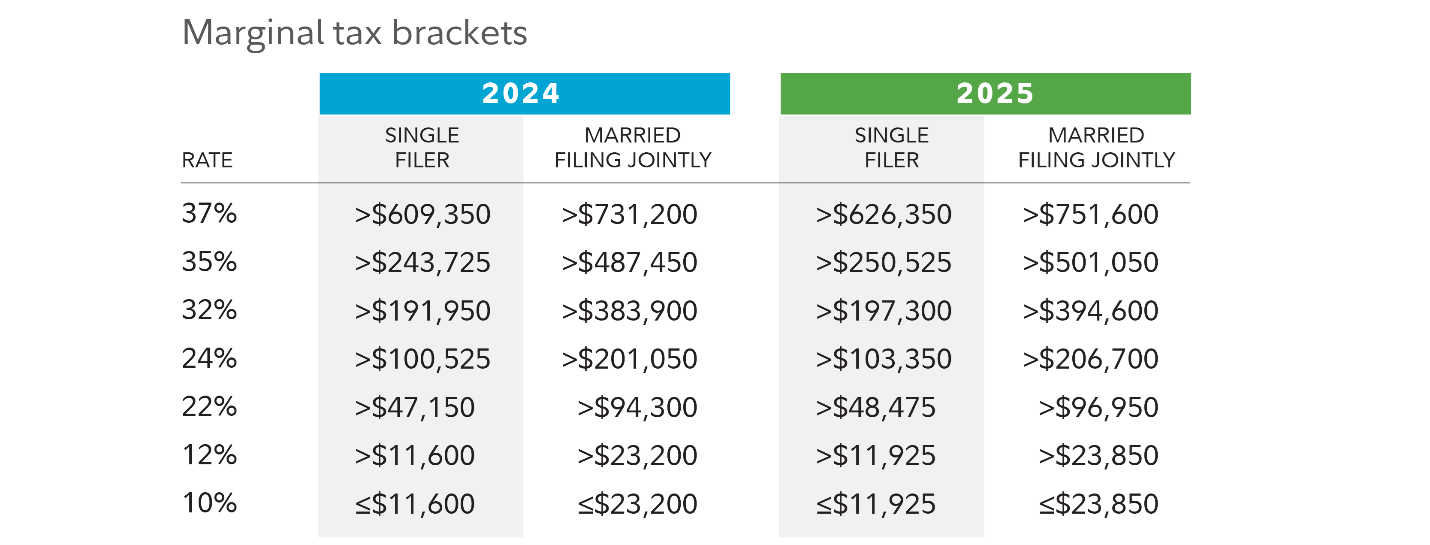

Your marginal tax rate is the rate you pay on your next dollar of taxable income. The U.S. tax system is progressive, which means your income is taxed in chunks or brackets - as it increases. Only the income that falls into each bracket gets taxed at that bracket’s rate.

For example, if you're in the 32% bracket, only the income above a certain threshold is taxed at 32%. The rest is taxed at lower rates.

Why it matters: Your marginal rate is the one that impacts decisions like whether to take a bonus, convert to a Roth IRA, or realize capital gains. It’s the rate used for planning.

Effective Tax Rate: Your True Average

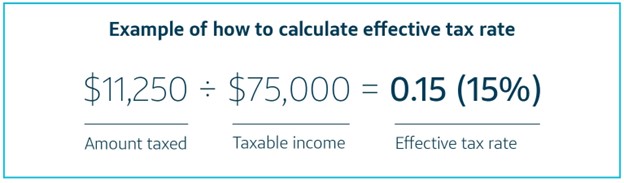

Your effective tax rate is the average rate you pay on all your taxable income. It’s calculated by dividing your total tax bill by your total income. Since the first dollars you earn are taxed at lower rates (10%, 12%, etc.), your effective rate is always lower than your marginal rate.

For example, if you earn $200,000 and pay $35,000 in federal taxes, your effective rate is 17.5% - even if your marginal bracket is 32%.

Why it matters: This is the number that tells you what percentage of your income you’re actually sending to the IRS. It’s great for budgeting, tracking your overall tax burden, and comparing year-over-year changes.

Why the Difference Matters

Confusing marginal and effective tax rates can lead to bad financial decisions. For instance, someone might avoid picking up freelance work or worry about taking a raise because they “don’t want to lose 32% of it to taxes.” But that’s not how it works—only a portion of that income would be taxed at the higher rate.

Knowing the difference helps you see the full picture and take advantage of strategies that can lower your overall bill.

Final Thoughts

Your marginal tax rate helps guide strategic moves, while your effective tax rate shows your real-world tax burden. Both are important - but they serve different purposes.

If you want to get proactive with your taxes and keep more of what you earn, understanding these two numbers is a great place to start. If you want to learn more about your tax situation and the tax planning we offer to our clients please contact our office.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.