Understanding Series-I Savings Bonds

Written by: Catherine Buck, CFP®

When inflation peaked in June 2022, many investors turned to Series I Bonds, commonly known as I-Bonds, as a safe haven offering government-backed returns tied to rising inflation. At the time, they provided an appealing combination of low risk and inflation protection. But now that inflation has begun to cool, do I-Bonds still make sense? In this blog, we’ll explain how Series I Bonds work and when they tend to be most advantageous.

What are I-Bonds:

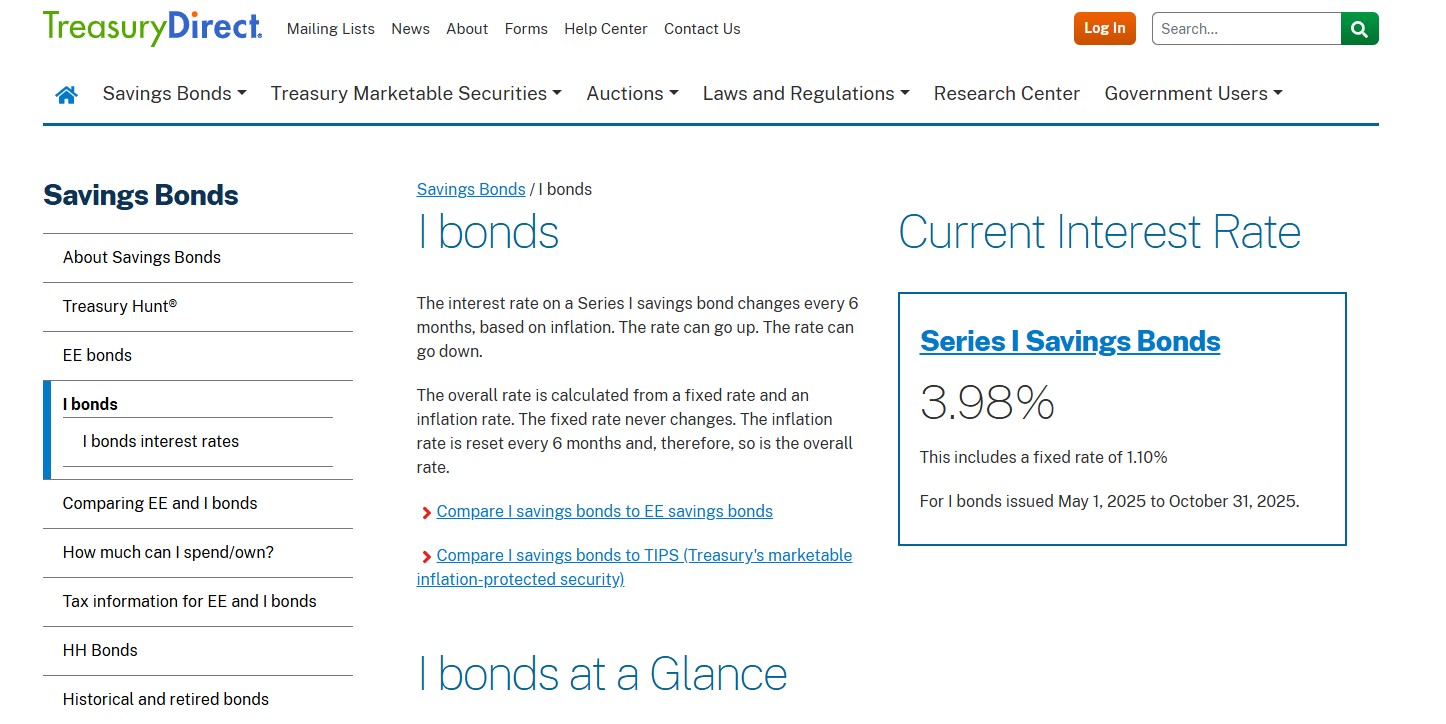

I-Bonds are U.S. government debt instruments designed to protect purchasing power, comprised of two interest rates. The first, is a fixed, annual interest rate set for the life of the bond. This fixed rate is announced every six months, once on May 1st and November 1st. The second interest rate, known as the inflation rate, changes every six months and is similarly set every May 1st and November 1st based on changes in the non-seasonally adjusted Consumer Price Index (CPI). From there, the I-Bond interest rate is calculated through combining the fixed rate and inflation rate. Interest is compounded semi-annually and added to the bond’s value. It is also exempt from state and local taxes. I-Bonds have a minimum term of 1-year but can be held up to 30 years. It is important to note, there is an early withdrawal penalty of three months’ interest if redeemed within five year and an individual social security number can purchase up to $10,000 in electric I-Bonds per calendar year.

When Do I-Bonds Make Sense?:

In general, I-bonds are a more conservative asset class and therefore apply to investors who are seeking low-risk investment vehicles with inlfation protection. The funds put aside for an I-Bond investment should not be needed in the short-term but rather are additional cash savings that are being put to work. Most importantly, purchasing an I-Bond is relevant to an economic climate where inflation is high or rising, which will result in a higher fixed interest rate. As of June 2025, the fixed rate component is 1.10%, the highest it’s been since 2007, making I-Bonds historically more attractive.

Conclusion:

The April Consumer Price Index rose 0.2%, bringing the annual inflation rate to 2.3%, just above the Federal Reserve’s 2% target. While inflation is showing signs of easing, uncertainty around tariff policy introduces the potential for renewed upward pressure. With interest rate cuts still uncertain, we remain in a wait-and-see environment.

I-Bonds are a viable choice for investors concerned about a possible uptick in inflation, especially with the current fixed rate at its highest level since 2007. As always, it’s best to speak with a trusted financial advisor to determine whether I-Bonds align with your individual goals and broader financial plan.