Why it almost NEVER makes sense to Contribute After Tax Dollars to an IRA

Written by: Martin Shields, CFP®, AIF®

In 2024, you can contribute $7,000 annually to a Traditional IRA and if you are 50 and over you can contribute an additional $1,000. The primary way to contribute to a Traditional IRA is through pre-tax contributions. Pretax contributions are a powerful way to save for retirement because they increase your total contribution as state or federal taxes are not deducted and they will grow tax deferred until they are distributed during retirement.

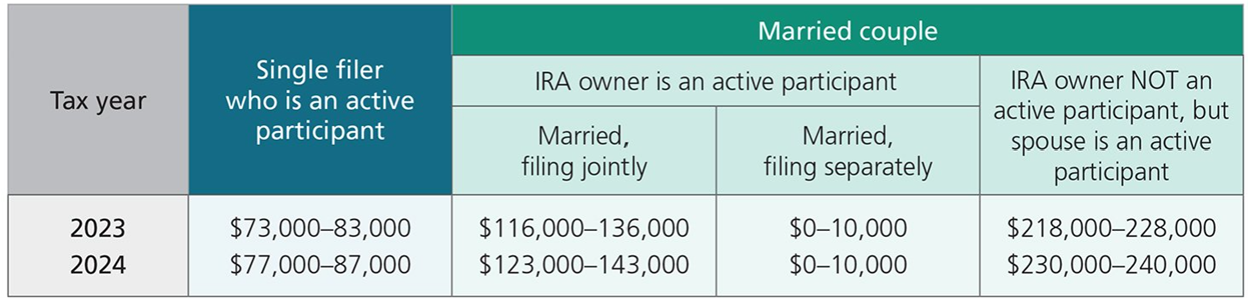

*Active Participant in an Employer Retirement Plan

In certain circumstances, the tax deduction for an IRA contribution may be phased out or eliminated based on your income and participant status in an employer retirement plan. However, it is always possible to make an after-tax contribution to an IRA regardless of income and participant status. Contributing after-tax funds is recommended only in specific situations and can make sense with the guidance of a financial advisor, for example, when making a backdoor Roth contribution. However, it almost never makes sense to contribute to an IRA with after-tax contributions for the pure purpose of funding an IRA.

Tax Treatment of After-Tax Contributions to an IRA:

In the year you make an after-tax contribution to a traditional IRA you will need to file a Form 8606 with your tax return to document your after-tax contribution amount. This will need to be done for every year you make an after-tax contribution to an IRA. This method is IRS sanctioned but is certainly a nuisance. Additionally, if you make after-tax contributions to an IRA whenever a distribution is made part of the distribution will be considered after-tax and the remainder will be considered pre-tax and will be taxed as ordinary income. The after-tax amount used for the distribution will be a weighted average of all the after-tax funds versus pre-tax funds across all of your traditional IRAs. This process will need to occur for the remainder of the IRA owner’s life and will even need to occur when the IRA is inherited by heirs. Tracking this information annually is a substantial burden and is frequently tracked inaccurately, which typically increases the taxes paid from the IRA distributions.

Investment Alternatives to After-Tax IRA Contributions:

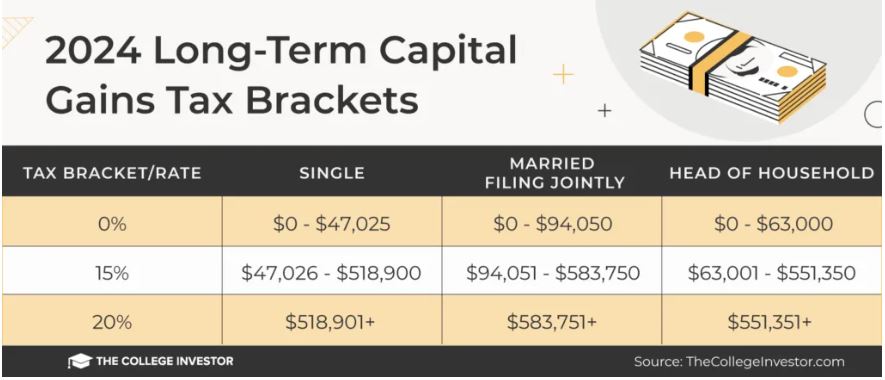

An alternative to contributing post tax dollars to an IRA is to contribute to a taxable brokerage account. In a taxable account you can minimize your tax rate to a long-term capital gains range of 0% - 15%, depending on your filing status and taxable income for all investment income and gains. On the other hand, IRA distributions will tax gains and investment income as ordinary income which can be at a rate greater than 35%. Additionally, you can access funds within a taxable brokerage account at any time, whereas you will incur a 10% penalty taking funds from an IRA prior to age 59 ½, some exclusions apply. Another favorable characteristic of taxable brokerage accounts is the step to fair market value of the account’s cost basis at the owner’s date of death. The step to fair market value means the account will have little to no unrealized gains and can allow the account’s heir to access the funds tax neutrally for a time. When inheriting an IRA, the heir will be required to withdraw the account over a 10-year period and pay ordinary income tax on those distributions. If the heir does not draw down the account balance of the 10-year term, penalties will be incurred.

Conclusion

Contributing after tax dollars to an IRA can add additional complications to your tax situation as you will need to record contributions and balances annually. There are other alternatives to investing after-tax dollars that can put you in a more favorable tax bracket when taking distributions and provide access to funds prior to age 59 ½. If you are considering contributing after-tax dollars to an IRA, please consult with a financial advisor to ensure you are making the best financial decision for your situation. If you have any questions regarding your investment or retirement strategy, please feel free to contact our office to set up a time to talk.