Interest Rates

Written by: Catherine Buck, CFP® The Federal Funds Rate is the interest rate banks charge other institutions for lending overnight and is set by the Federal Reserve (Fed). It is one of the primary monetary policy tools the Fed uses to maintain their dual mandates of promoting maximum employment and price stability.…

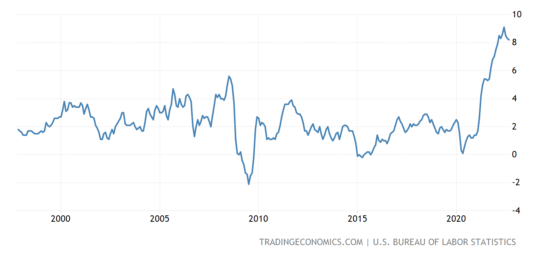

Written by: Vincenzo Testa, CPA Inflation is a healthy evil when the cost of goods and services increase year-after-year at modest percentages. During the past 25 years, inflation usually ranged between 2-3% as shown in the exhibit below, which is an optimal increase in the cost of goods and services. The U.S. Labor Department announced…

Written by: Paolo LaPietra, CFP® With the Federal Reserve projecting three rate hikes in 2022, a recurring question I’ve been receiving is “How will rising interest rates affect my stocks?” It’s an important question to ask, especially with so much negative sentiment towards rising rates for equity investors. We’ve seen volatility so far this quarter,…

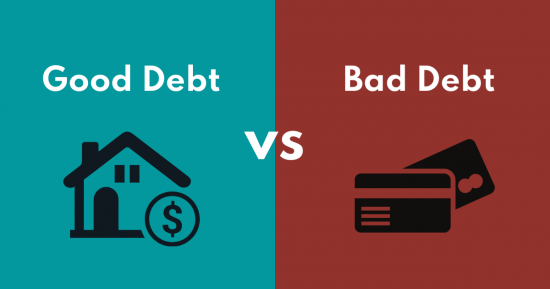

Written by: Samantha Masey – Associate Wealth Advisor I recently had a conversation with someone who shared that his parents taught him that all debt is bad, and it has significantly influenced his financial decisions. Since becoming a financial planner I hear this sentiment more and more from clients, friends, and family. Many people believe…

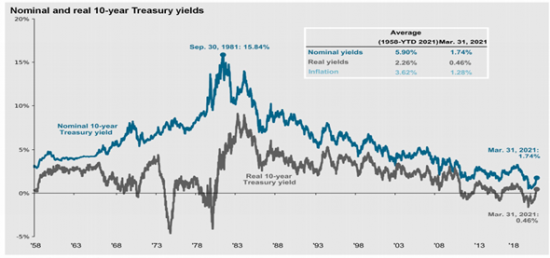

Author: Martin X. Shields, CFP For most investors, bonds play an important role in their portfolio of providing income and capital preservation in times of volatility. For the past 40 years, having a bond allocation in a portfolio has been very beneficial because the U.S. 10-year Treasury rate has declined from a high of more…

What Investors Need Now Is Patience and Fortitude

Written by: Steven B. Bouchey, CFP® As seen in The Saratogian. The headlines in 2022 have been overwhelming; the Russia-Ukraine conflict, Covid-19 lingering on, China’s lockdowns adding to supply chain disruptions, and inflation at 40-year highs!!! So, what has changed on the inflation front? The May consumer price index (CPI) was red hot, rising +1%…