Personal Finance Strategies in a Higher Interest Rate Environment

Written by: Vincenzo Testa, CPA

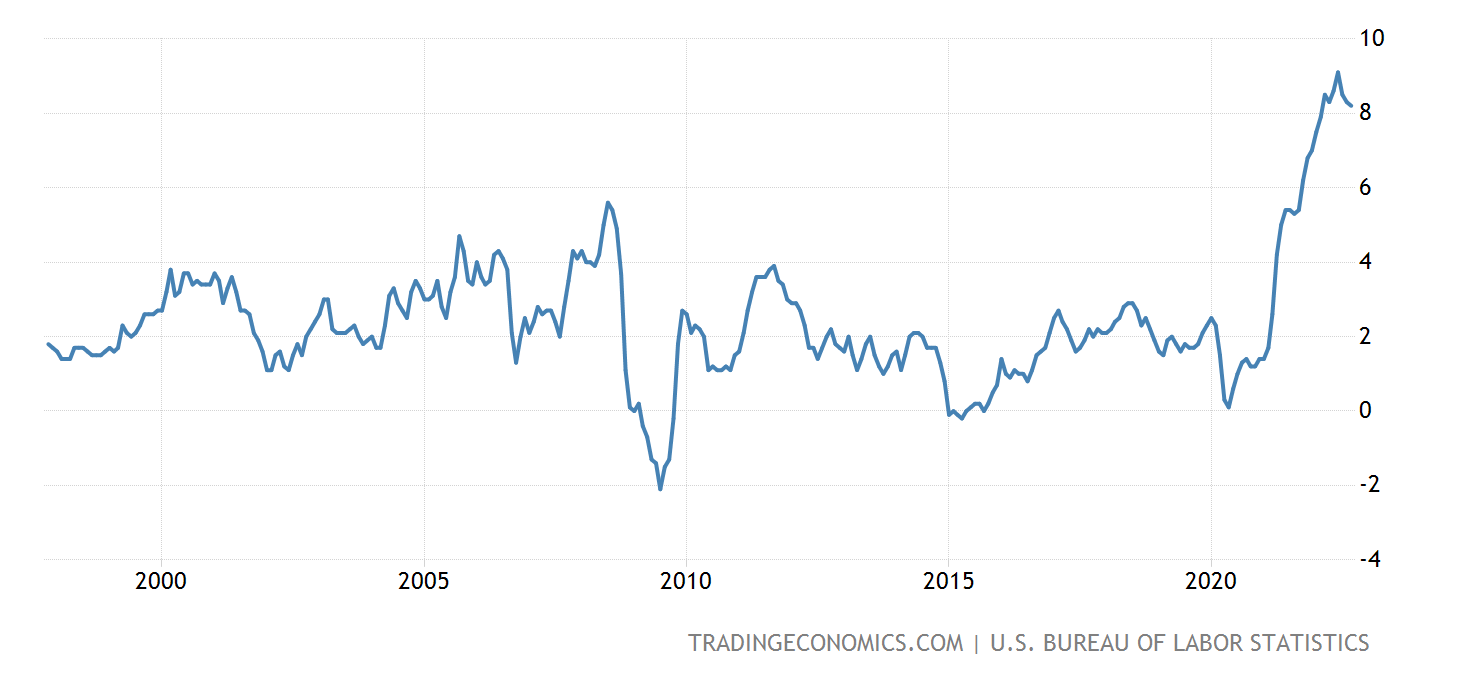

Inflation is a healthy evil when the cost of goods and services increase year-after-year at modest percentages. During the past 25 years, inflation usually ranged between 2-3% as shown in the exhibit below, which is an optimal increase in the cost of goods and services. The U.S. Labor Department announced that the annual inflation rate for the United States was 8.2% for the 12 months that ended September 2022 which is at an unsustainable level.

Inflation Rate in the U.S. Over the Last 25 Years

Source: tradingeconomics.com

To reduce inflation in the United States, the Federal Reserve began quantitative tightening in June of this year. Quantitative tightening refers to the reduction of debt instruments on the Federal Reserve balance sheet. The Federal Reserve enacts this process by either selling US Treasury bonds or letting them mature and removing them from their cash balance. This removes capital from the United States economy, which increases market interest rates and in turn decreases demand in the economy.

In another effort to reduce inflation, the Federal Reserve also began raising the Federal Funds Rate in March 2022. Through quantitative tightening and increasing the federal funds rate, the Federal Reserve is attempting to drive inflation back down to the long-term 25-year average of between 2-3%.

Because of these actions by the Federal Reserve, interest rates on consumer debt have increased across the board by significant amounts. With the looming high inflation and much higher interest rates than a year ago, U.S. consumers feel as if there is a death grip on their wallets when visiting the grocery store, purchasing real estate, or even purchasing a new vehicle. Mortgage rates are rising and interest rates on all consumer debt are also increasing. Along with the challenges faced by consumers, there are strategies that consumers can utilize to benefit from higher interest rates. We will review these three personal finance strategies that will help you make the best of a bad situation –

- Obtaining the Right Mortgage Product

- Utilize High Yield Bank Accounts

- Purchasing Risk-Free United States Bonds

Obtaining the Right Mortgage Product

When it comes to purchasing real estate in the current market – it’s difficult to find a bargain. On the supple side, there is a general housing shortage in the U.S., and it has become worse as current homeowners are reluctant to sell their homes because of their extremely low mortgage rates. Many homeowners are locked in at 3-4% fixed mortgage rates. If they sell their current homes to purchase a new home, they would be forced to apply for a new mortgage at 6-7% interest rates. The good news is that with interest rates increasing, demand for homes has begun to decrease.

When it comes to purchasing real estate in the current market – it’s difficult to find a bargain. On the supple side, there is a general housing shortage in the U.S., and it has become worse as current homeowners are reluctant to sell their homes because of their extremely low mortgage rates. Many homeowners are locked in at 3-4% fixed mortgage rates. If they sell their current homes to purchase a new home, they would be forced to apply for a new mortgage at 6-7% interest rates. The good news is that with interest rates increasing, demand for homes has begun to decrease.

Obtaining the correct mortgage product is crucial in this higher interest rate environment. It can result in thousands of dollars of savings in interest. When interest rates were low, getting a fixed-rate mortgage made the most sense. With higher interest rates, Adjustable-Rate Mortgages (or ‘ARMs’) are a useful product for real estate buyers looking to decrease their costs in this environment. ARMs provide the debt holder with a fixed-rate period (usually the first 5, 7 or 10 years of the loan) with an interest rate that is significantly lower than the interest rate on current fixed-rate mortgages. After the fixed-rate period is over, the interest rate adjusts to what the current benchmark on mortgage rates are at that time.

There is a reasonable chance that interest rates could be lower than they are now within the coming years. A buyer of real estate can apply for an Adjustable Rate Mortgage and lock in a lower than market rate loan – then subsequently refinance the loan to a fixed-rate mortgage in the coming years after the Fed decides to pivot and decrease the Federal funds rate. Using this strategy could result in thousands of dollars of savings in interest expenses for current buyers in the current market.

Utilizing High-Yield Bank Accounts

As financial planners, we almost always recommend that our clients have an “emergency fund” on their balance sheet. The general rule of thumb of financial planning is that individuals and families should keep 3-6 months’ worth of their expenses in cash. This, of course, is to be used if an unexpected expense comes forth and one is not forced to sell their investment at inopportune times to satisfy the expense.

As financial planners, we almost always recommend that our clients have an “emergency fund” on their balance sheet. The general rule of thumb of financial planning is that individuals and families should keep 3-6 months’ worth of their expenses in cash. This, of course, is to be used if an unexpected expense comes forth and one is not forced to sell their investment at inopportune times to satisfy the expense.

If an individual keeps significant cash balances in checking or savings accounts, they should be at least parking the cash in an account with as high of a yield as they can find. Since the Fed started to increase interest rates, many banks that will now pay customers 2.5%-5% interest on their cash. If you are going to keep your money in cash, move the cash to a bank where you will receive a decent interest rate. In high inflationary times, it is crucial to get the most out of your money in this inflationary environment.

Purchasing Risk-Free United States Bonds

United States Treasury securities are a debt instrument issued by the United States government to finance government spending as an alternative to the taxation of United States taxpayers. Treasury bonds are issued in various maturities and are considered risk-free assets. This means that it is as close as you can get to a guarantee that the investor will not lose their principal if the bond is held until maturity.

United States Treasury securities are a debt instrument issued by the United States government to finance government spending as an alternative to the taxation of United States taxpayers. Treasury bonds are issued in various maturities and are considered risk-free assets. This means that it is as close as you can get to a guarantee that the investor will not lose their principal if the bond is held until maturity.

The primary benchmark used by most investors is the 10 Year US Treasury Bond. The current yield of the US Treasury bond is about 4.17%, up from about 1.5% just a year ago. With interest rates as low as they were last year, investors had very few options to park their capital in conservative investments that provided an income stream that was worth the return. With the dramatic increase in rates over the past 12 months this environment has changed. The interest income from Treasury Bonds is also not taxable for state income tax purposes. U.S. Treasury bonds can be purchased in almost all taxable brokerage accounts, but it is important to understand the interest rate risk that all bonds hold. US Treasury Bonds are risk-free if held until maturity, but if you plan to sell US Treasury Bonds before maturity, an investor could lose part of their principal investment. It is important to work with an investment advisor to mitigate that risk by utilizing strategies like bond ladders. All in all - US Treasury bonds can be a great investment for the conservative investor in this higher interest rate environment.

If you have any questions regarding what to do in this higher interest rate environment, please contact our team at Bouchey to set up an initial meeting.

Bouchey Financial Group has local offices in Saratoga Springs and Historic Downtown Troy, NY.