Newsletter

Written by: Paolo LaPietra, CFP® and Edward Wilhelm If it feels like a lot has happened in the last month, that’s because it has. The government reopened on November 13th, the jobs report landed shortly after, Nvidia once again took center stage during earnings season, AI-driven volatility picked up, and Fed cut expectations continued to…

Written by: Ryan Bouchey, Chief Investment Officer I’ve been thinking a lot about the economy and, more specifically, the missing jobs reports from September and soon to be October. Many headlines over the past few weeks have included job cuts from major U.S. employers – Amazon slashing 34,000 jobs and almost 10% of their office workforce,…

Bouchey Newsletter Written by: Ryan Bouchey, CFP®, CPA As we enter the fourth quarter, it wouldn’t be unreasonable to ask: “Are we really still at all-time highs in the market?” Despite a government shutdown (with little sign of resolution on either side), a cooling labor market, and no shortage of headlines to scare us away,…

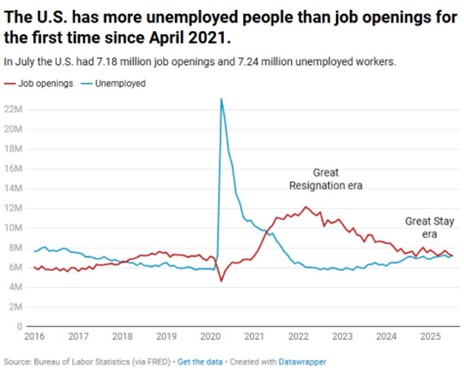

Bouchey Newsletter Written by: Ryan Bouchey, CFP®, CPA If once is an accident, twice a coincidence, and three times a pattern, then this latest labor report may be pointing to a more consistent signal about the underlying strength of the U.S. economy. The August jobs report showed a continued slowdown in labor market momentum, with…

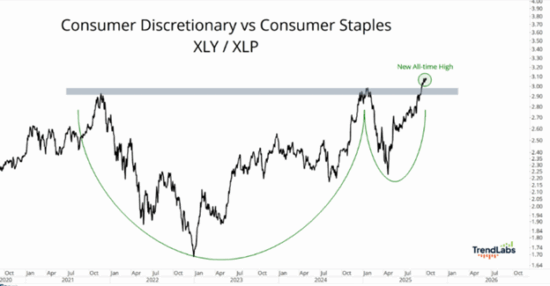

Written by: Ryan Bouchey, CFP® Chief Investment Officer & Chief Strategic Officer One of the themes we’ve been discussing all year-especially since what we’ve referred to as “Liberation Day” on April 2nd-is the disconnect between soft data (consumer sentiment) and hard data (economic reality). For much of the year, what consumers were feeling didn’t…

For two years now we’ve been hearing a negative narrative about market expectations, while at the same time experiencing strong market performance. In 2023, it was all about the incoming recession. This year, the public concern centered around the pivotal presidential election. Well, fast forward to three days post-election, and we have another year of…

January Market Insights: Economy, the Fed, and AI

Written by: Paolo LaPietra, CFP® As we move into 2026, the economic backdrop remains constructive. Earnings continue to hold up; the labor market, while cooling, remains healthy by historical standards, and consumer spending has proven resilient. Recent GDP data reinforced that underlying strength, even as markets digest choppier short-term signals influenced by reporting delays and policy uncertainty. On the policy front,…