A Trump Presidency and What Lies Ahead

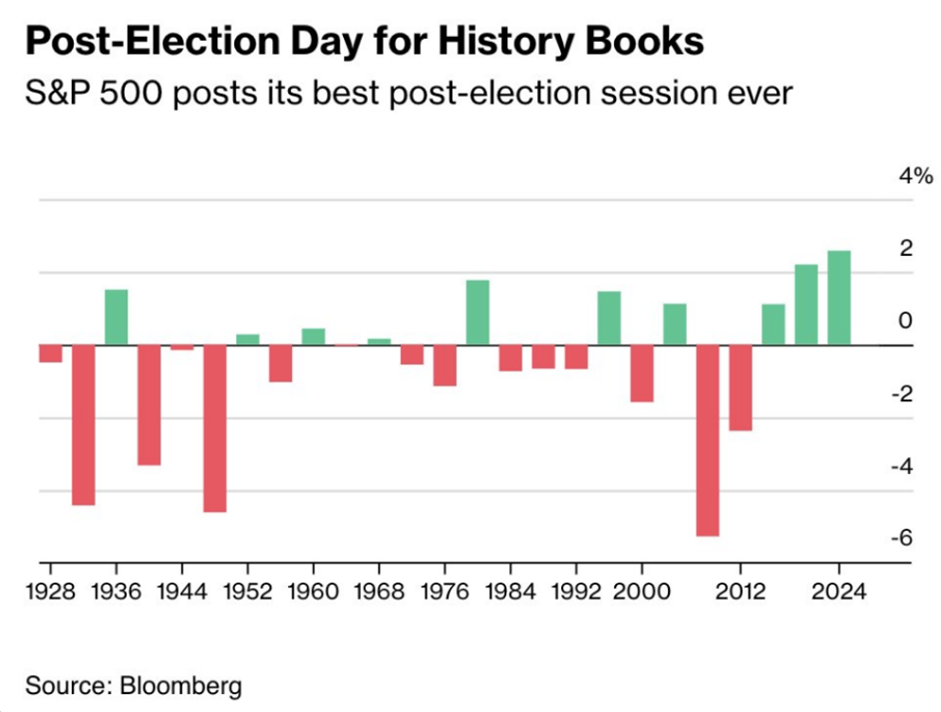

For two years now we’ve been hearing a negative narrative about market expectations, while at the same time experiencing strong market performance. In 2023, it was all about the incoming recession. This year, the public concern centered around the pivotal presidential election. Well, fast forward to three days post-election, and we have another year of 20% plus gains for the S&P 500 and experiencing the best post-election-day market performance (see the chart below), so much for all the volatility!

What does Tuesday’s election results, plus the recent move by the Fed to further cut interest rates, mean for the markets? Well, if you take a step back, there are multiple elements in place leading to our continued optimism for what lies ahead:

- The economy continues to be on solid footing.

- Based on the past few days in the market, overall consumer economic sentiment is improving.

- We are currently in an interest rate environment meant to encourage and spur growth.

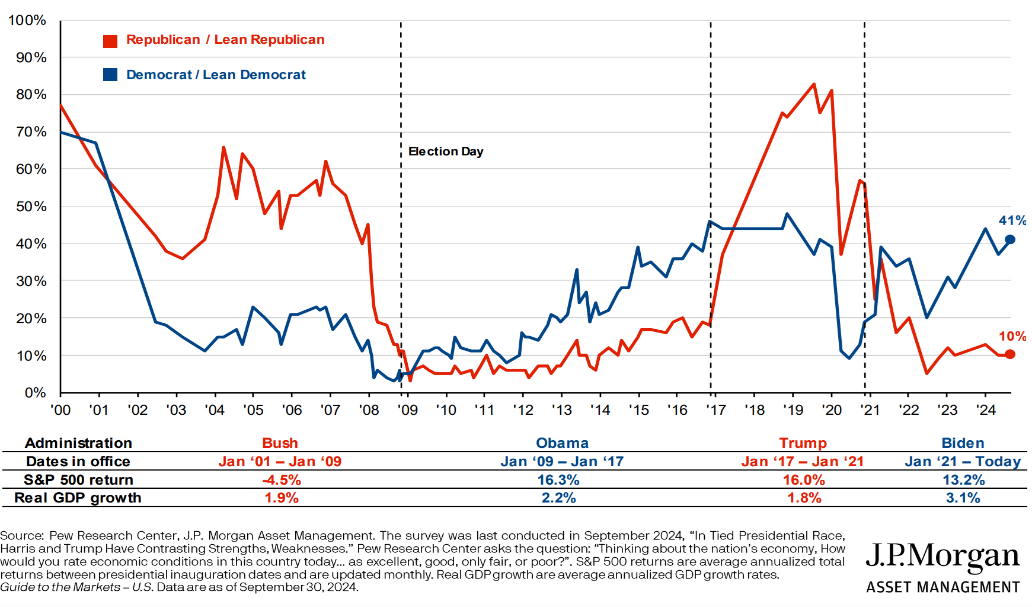

- We have been here before. The fact of the matter is we’ve already experienced four years of a Trump presidency. It may not have been perfect, but from a market perspective, things were relatively stable. Markets continued to move higher, and the three years up until Covid were some of the least volatile market conditions we’ve seen over that period of time.

Some of you may be more concerned and less optimistic about the outcome of the election. Below I’ve included a chart that I discussed in our Q3 2024 Market & Economic Update Webinar and I think it’s worth sharing again. Consumer sentiment is strongly driven by party lines, and you can see how sentiment flips depending on whether a Republican or Democrat is in office. Sentiment which is driven on emotion more than anything. Our job as wealth managers is to be politically agnostic and manage your wealth while taking the emotions out of our investment process.

As we’ve shared throughout this year, we strongly believe that the election will not have the greatest effect on the overall markets. The biggest driver will be the underlying economy and strength of corporate America, the most innovative and growth-oriented market in the entire world. This is something we should all be proud of and should be the focus of what lies ahead when it comes to the stock market and the economy.

Should you have any questions or concerns about all that has happened this week, please don’t hesitate to reach out. As your trusted advisor, we will continue to act as a steward for you and your family's wealth through whatever lies ahead.

Kind regards,