Posts by Samantha Masey

Why Is Planning Around Your Employee Stock Options So Important?

Written by: Vincenzo Testa, CPA Equity compensation is one of many benefits that employers are offering more frequently to hold onto their valuable employees. Sure, in general, employees know when they are granted their stock options, when they vest or their strike price. But are those same employees able to calculate the potential significant tax…

Read MoreDon’t Put All Your Eggs in One Basket

Is the Saying True? Written by: Nicole Gobel, CPA – Wealth Advisor & Tax Planner We’ve all heard this advice countless times throughout our lives from parents, trusted friends or our own internal voices attempting to keep us from experiencing failure. But what does not having all your eggs in one basket look like when…

Read MoreSeries I Bonds – The One Thing That Improves With Inflation

Written by: Marty Shields, AIF, CFP® In this time of high inflation, rising interest rates and volatile equity markets, it is difficult to find investments that can provide a rate of return that is greater than inflation and not volatile. Well one does exist, and it has become very popular recently. It is the Series…

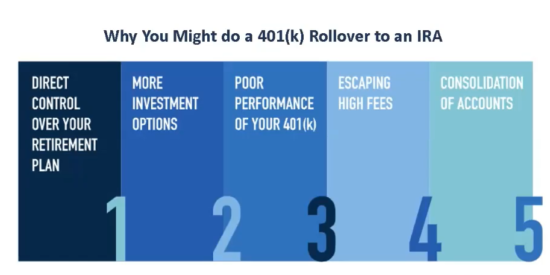

Read MoreWEBINAR: What Should I Do With My Old 401(k)?

The average American changes jobs 12 times in their lifetime. With each of these job changes, many people leave behind an old 401(k) because they aren’t sure what to do with those assets. In this 30-minute webinar, we will explain your options when it comes to handling an old 401(k), the benefits of a direct…

Read MoreIs This What Capitulation Feels Like???

Capitulation means “to surrender or give up” when it comes to investing. I’m not sure how close we are to the low point of this market correction for the S&P 500 and bear market for Nasdaq, or just maybe we hit it already. We never know until time passes and we look back. I do…

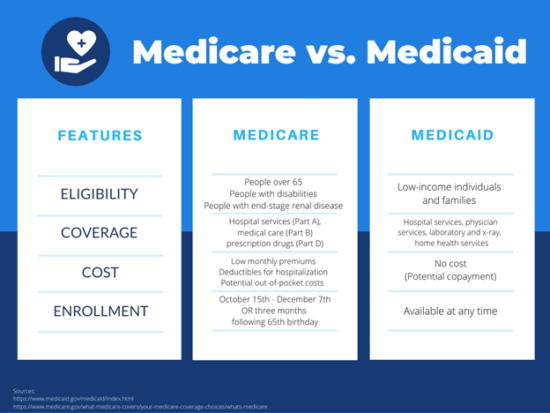

Read MoreWhat Is The Difference Between Medicare and Medicaid?

Written by: Jenny D. Foley, CPA As the baby boomer generation continues into retirement, a common financial planning question we hear is, what are the best options for medical insurance and long-term care needs for retirees? This article will answer: What is the difference between Medicare and Medicaid? Who is eligible for Medicaid? How does…

Read MoreWebinar Recording: Q1 2022 Market and Economic Update

After strong market volatility in the first quarter, the BFG investment team will provide guidance on what to expect with the markets and the economy with the Federal Reserve raising interest rates, higher inflation readings and the war in Ukraine. Listen to Steve, Marty and Paolo discuss these important topics.

Read More