Don’t Put All Your Eggs in One Basket

Is the Saying True?

Is the Saying True?

Written by: Nicole Gobel, CPA – Wealth Advisor & Tax Planner

We’ve all heard this advice countless times throughout our lives from parents, trusted friends or our own internal voices attempting to keep us from experiencing failure. But what does not having all your eggs in one basket look like when it comes to your long-term financial plan and portfolio?

In this article we will discuss:

- Looking at your Overall Financial Picture

- Identifying and Mitigating Risks

- Understanding Diversification

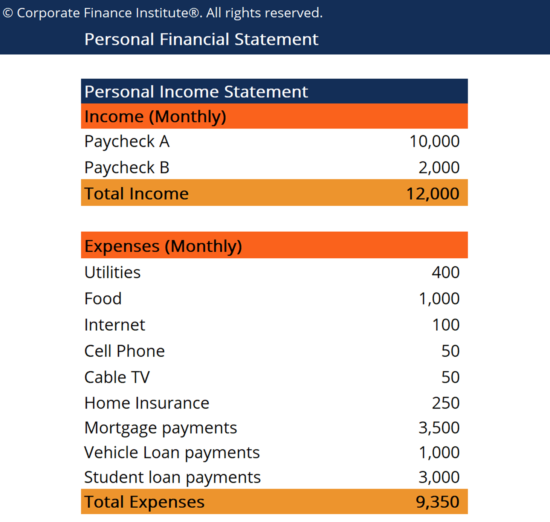

Your Personal Income Statement and Balance Sheet

Just like a well-run company, you should have an overall understanding of what your income and expenses look like each year along with your total assets and liabilities. During your earning years, this allows you to understand what amounts are available to be saved towards big purchases or longer-term goals like funding college for children or retirement. However, if you’re a business owner you may also be putting your savings back into your company.

In general, most experts say to target 10-15% of your pre-tax income toward retirement savings to ensure you have enough to cover around 80%-90% of your pre-retirement income later in life. This can be difficult for some and requires that you either reduce expenses or increase income to fund all of your goals.

It is also important to use debt when appropriate. Even though mortgage rates have increased recently they are still very low historically speaking. If you are able to spread payments toward a home over 30 years at a low fixed rate it makes more sense to put those extra funds into other savings vehicles. Other large ticket items such as a car depreciate immediately upon purchase, so it also makes sense to utilize low-interest rate loans in these instances. Using debt wisely allows you to take advantage of compounding returns in your retirement or college savings account.

Once retired it’s just as important to understand your income and expenses and to ensure you’re taking distributions from the appropriate retirement accounts to avoid undue income taxes. Although Social Security benefits include a cost-of-living adjustment, many pensions are fixed and due to inflation end up covering less of your overall cash flow needs over time.

Source: https://corporatefinanceinstitute.com/resources/knowledge/other/personal-financial-statement/

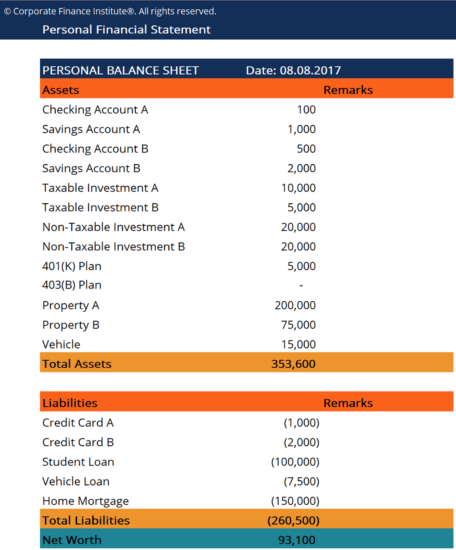

Your balance sheet or net worth statement should include all of your assets and liabilities. Most individuals have a portion of their wealth in residential real estate in the form of their primary residence or could also own rental or vacation property. You may own all or part of a business or have employer stock. Hopefully, you also have begun saving in an employer retirement account, Traditional or Roth IRA along with saving after-tax funds in a brokerage account. We always recommend keeping 3-6 months of cash in an emergency savings account as well.

When thinking about your liabilities you have good and bad debt. It makes sense to have a mortgage, home equity line of credit, car loan or business loan. You may also have student loans. However, it’s important to avoid high-interest variable rate debt such as credit cards.

Where Am I Vulnerable and What Action Steps Can I Take

Once you have a full picture of your income statement and balance sheet it’s time to assess where you’re at risk. If the majority of your household income comes from one employer and you also have the majority of your savings in that employer’s stock, you could be overexposed to the success or failure of that specific company. Many individuals will continuously receive stock awards and vesting of existing awards each year that can add up quickly along with taking advantage of purchasing shares at a discount in an employee stock purchase plan(ESPP). It’s important to evaluate whether it makes sense to begin selling part of that company stock each year to diversify into other investments and limit your exposure, regardless of whether you feel the company will grow in the future. It’s also important to understand the tax treatment of the vesting and sale of your awards so make sure you’re speaking with your advisor or tax professional beforehand.

Many retirees would prefer to not have debt. However, liquidating portfolios, especially during a market downturn, paying income taxes on IRA distributions or capital gains and paying off low-cost long-term debt does not make sense. You are taking assets from a place where you can access them for emergencies, such as health care costs, and paying off an asset that you cannot use towards other expenses without taking out another loan. While long-term we expect the housing market to continue to grow, you face liquidity risk. In addition, while rental real estate can provide a good source of income during your lifetime, you also have risks as a landlord and will owe taxes on any depreciation deductions you have taken once you sell an investment property.

Another risk that is very real currently is inflation risk. While it may feel good to keep a great deal of wealth in cash, when you’re earning 0.02% in your bank account and inflation is above 8% you are losing purchasing power. It’s important to have the majority of your assets invested in a manner that is intended to at least keep up with inflation long-term. By working with your advisor, you can determine the right mix of stocks, bonds and alternatives that is expected to achieve the required long-term investment return you need for your financial plan to be successful, without taking on any unnecessary risk.

While historically bonds have provided a great way to preserve principal in a more conservative portfolio, today there is risk due to both inflation and interest rates. Bonds have been down over 10% and on average have only earned 3.3% over the past 15 years. As we expect the Fed to continue to raise rates to combat inflation this means that the interest payments from existing bonds is lower than those being issued and there is downward pressure on bond prices.

When evaluating your investment accounts, it’s also important to diversify the tax characteristics of your accounts. While it may feel great to receive the tax benefit of putting all of your savings into your employer retirement plan pre-tax, keep in mind that distributions from those accounts will be fully taxable at ordinary income tax rates in the future. Also, any pre-tax retirement account balances, along with Roth 401(k) balances, are subject to Required Minimum Distributions(RMD) and you will need to begin withdrawing at age 72 regardless of whether you need those funds. Retirees may expect to be in a lower tax bracket after they stop working but if all of your funds are in tax-deferred accounts that may not be the case.

It’s important to build up after-tax savings in a brokerage account and, if eligible, fund Roth IRAs or utilize the Roth option within an employer plan. Your advisor can help you to determine the right strategy based on your income, timeframe and available options. It’s also not too late if you’re entering retirement with large tax-deferred balances as you may be able to convert a portion to a Roth IRA in any lower income tax years to provide for future distributions.

What Does Diversification Look Like for My Investment Accounts?

I’ve often had individuals comment that they don’t want all their eggs in one basket and have left old 401(k) plans at former employers, have assets at different custodians, or are working with multiple advisors. It is important to understand who you are working with, their roles and the inherent risks. If you’re working with a larger custodian such as Charles Schwab or Fidelity they are really just holding your funds, collecting any transaction fees but do not pose a risk since they are large diversified businesses and the company’s performance does not affect the underlying investments, unless you are utilizing their products. It is not necessary to have accounts across multiple custodians in this case.

We also do not recommend keeping former employer plans with those custodians but rather combining into a Rollover IRA at one custodian. We recently held a webinar on this specific topic to discuss the reasons for this including avoiding unnecessary fees and only having access to a limited number of investments that tend to be mutual funds or employer stock. By combining old accounts into one IRA, this also allows you to only have to worry about one required minimum distribution later on. If there are Roth or after-tax balances in the account that can be rolled into a Roth IRA that’s even better as a Roth IRA is not subject to RMD whereas a Roth 401(k) must make distributions.

Another risk is working with a single advisor. While we have many individuals who come to us because they had a relationship with an advisor who is now at retirement age and does not have a well thought out succession plan, it doesn’t mean that you have to spread assets across multiple organizations. Ask yourself if your advisor has a team of professionals you can access vs. being a “one-man shop”. Also, are they selling you proprietary products or using a diversified portfolio of publicly traded securities. Do they use a large custodian that allows them access to a large universe of investments or are they limited by working with a smaller custodian that may only have several fund families to choose from. Does your advisor also coordinate with your other professionals such as your estate attorney, insurance agent or tax preparer to ensure that everyone is working in tandem for you and no investment or distribution decisions are being made in a vacuum? Is your advisor providing you with comprehensive financial planning vs. only talking about investments?

Last but not least, what is the ideal mix of assets for you? As noted earlier make sure that you’re looking at the big picture and considering what real estate, business interests and cash you have outside of your investment portfolio. Next consider the tax status of the accounts you have. Finally, what investments are you choosing within these accounts. Utilizing an exchange traded fund (ETF) or mutual fund allows you to gain access to a broad group of stocks through a single ticker. We prefer ETFs in our portfolios as they tend to be lower cost and more tax efficient. Ensure that you’re not concentrated in any one asset class or area of the market as well. Depending on your goals, timeframe and risk tolerance you will want to have some percentage of your portfolio in large and small cap stocks along with bonds and alternatives. Ensure you’re working with your advisor not only to determine the right mix of investments but that they are actively monitoring the markets and economy to determine if adjustments should be made. They should also be communicating with you regularly to check whether any life circumstances warrant a change.

If you have any questions around the risks related to diversification or if consolidation makes sense for you, please feel free to contact our team.

Related Information:

Bouchey Financial Group has local offices in Saratoga Springs and Troy, NY.