What Is The Difference Between Medicare and Medicaid?

Written by: Jenny D. Foley, CPA

As the baby boomer generation continues into retirement, a common financial planning question we hear is, what are the best options for medical insurance and long-term care needs for retirees?

This article will answer:

- What is the difference between Medicare and Medicaid?

- Who is eligible for Medicaid?

- How does one plan for a potential future Medicaid need?

What is the difference between Medicare and Medicaid?

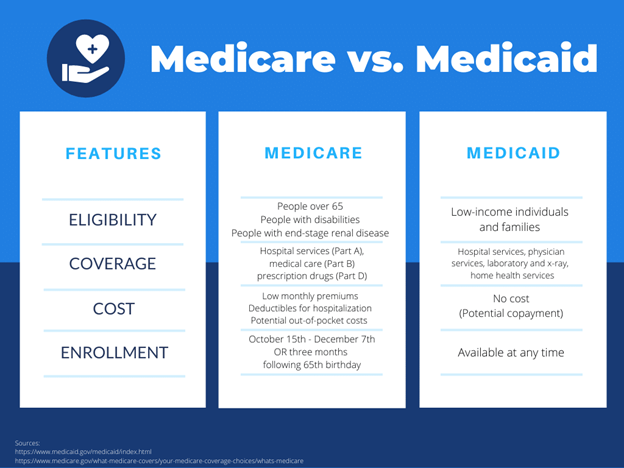

The terms Medicaid and Medicare are often confused or used interchangeably. They sound alike, but these two programs are actually quite different. Each is regulated by its own set of laws and policies, and the programs are usually designed for different sets of people. However, it is possible to be eligible for both programs. To select the correct program for your needs, it is important to understand the differences between Medicare and Medicaid.

Medicare is a federal program designed for U.S. citizens aged 65 and older who have difficulty covering the expenses related to medical care and treatments. This program provides support to senior citizens and their families who need financial assistance for medical needs. People under the age of 65 living with certain disabilities may also be eligible for Medicare benefits. Each case is evaluated based on eligibility requirements and the details of the program.

Medicaid is a program that combines the efforts of the U.S. state and federal governments to assist households in low-income groups with healthcare expenses. These costs may include major hospitalizations and treatments as well as routine medical care and long-term care assistance.

Who is eligible for Medicaid?

Medicaid is a joint federal and state program so the rules governing Medicaid eligibility differ by state. Eligibility for Medicaid is based primarily on income. Whether or not someone qualifies depends on income level, family size, and asset level. The Affordable Care Act has extended coverage to fill in the healthcare gaps for those with the lowest incomes, establishing a minimum income threshold constant across the country. To find out if you qualify for assistance in your state, visit Healthcare.gov. For most adults under age 65, eligibility is an income lower than 133% of the federal poverty level. According to Healthcare.gov, this amount for 2022 is approximately $13,590 for an individual and $27,750 for a family of four.

The Medicaid asset limit, also called the “asset test” is complicated. There are several rules one should be aware of before trying to determine if they would pass the asset test. First, there are “countable assets” and “exempt assets.” In most cases, one’s home, home furnishings, vehicle, and certain retirement accounts are exempt. Second, all married couples’ assets, regardless of whose name the asset is in, are considered jointly owned and are counted towards the asset limit. Third, asset transfers made by the applicant or their spouse up to five years (or 2.5 years in California) immediately preceding their application date are scrutinized. This is referred to as the Medicare look-back period, and if one has gifted countable assets or sold them under fair market value during this timeframe, a period of Medicaid ineligibility will be calculated. Furthermore, eligibility can be different based on the type of care needed. Most people want to understand Medicaid options for nursing and assisted living care.

Nursing Home Eligibility:

Eligibility for Medicaid nursing home care is comprised of financial requirements and care requirements. The financial requirements are comprised of income and asset limits described above. There is also a level of care requirement which simply means that the applicant must require the level of care typically provided in a nursing home. “Nursing Home Level of Care” (NHLOC) is a formal designation and requires a medical doctor to make this designation. Furthermore, the rules around what defines NHLOC change in each state. Nursing home care by Medicaid is an entitlement. This means if one meets the financial and level of care requirements, a state must pay for that individual’s nursing home care.

Assisted Living Eligibility:

It is helpful to understand how Medicaid pays for assisted living. Persons residing in assisted living residences receive assistance from Medicaid either through Home and Community-Based Services (HCBS) waivers or through the state’s Aged, Blind and Disabled (ABD) Medicaid.

HCBS Waivers are designed for persons who require a nursing home level of care but prefer to receive that care while living at home or in assisted living. This may include “memory care” which is a type of specialized assisted living for persons with Alzheimer’s disease and related dementias. HCBS Waivers will not pay for the room and board costs of assisted living, but they will pay for care costs. Waivers are not entitlements. They are federally approved, state-specific programs that have limited participant slots. Many Waivers, especially those intended to help persons in assisted living, have waiting lists. One can be financially and functionally eligible for an assisted living waiver but be unable to enroll due to a waitlist.

The eligibility criteria for Medicaid assisted living services through a Medicaid HCBS Waiver are the same as the eligibility requirements for nursing home care. Candidates must require a “nursing home level of care” and meet the financial requirements.

Aged, Blind and Disabled (ABD) Medicaid provides help for persons in assisted living, but as with Waivers, it will not pay for assisted living room and board, only for care. Nor will ABD Medicaid necessarily pay for all the individual’s care needs. The good news about ABD Medicaid (when compared to Waivers) is that ABD Medicaid is an entitlement. If the applicant meets the eligibility criteria, the Medicaid program must provide them with the assistance they require.

How does one plan for a potential future Medicaid need?

A key takeaway to understanding Medicaid is that it is very complex and advance planning is crucial. An elder law or estate planning attorney can assist to ensure if or when the time comes for a need for Medicaid that an individual will qualify. This includes advising how to spend down “countable” vs “exempt” assets as well as transferring assets to an irrevocable trust or in NY a so-called Medicaid trust before the lookback period or penalties could apply. A Medicaid trust can be established to shield your assets from being considered when it is time to determine Medicaid eligibility. These trusts are irrevocable meaning once one grants assets into this trust, they lose their control over the assets. A trustee would be appointed to oversee the assets of the grantor and distribute them to heirs at the grantor’s passing. Here at Bouchey Financial Group, we are here to help with all your various financial planning needs and guide you to the most appropriate solutions.

Understanding and planning for Medicare and Medicaid is an important piece of retirement. If you would like to speak with an advisor on this topic, please contact our team to set up a meeting.

Recommended Resources:

Bouchey Financial Group has local offices in Saratoga Springs and Troy, NY.