Narrowing the Gap Between Sentiment and Reality

Written by: Ryan Bouchey, CFP®

Chief Investment Officer & Chief Strategic Officer

One of the themes we've been discussing all year—especially since what we’ve referred to as “Liberation Day” on April 2nd—is the disconnect between soft data (consumer sentiment) and hard data (economic reality). For much of the year, what consumers were feeling didn’t match what the numbers—particularly labor and spending—were telling us. That gap may finally be narrowing.

Looking at today’s economic landscape, a few key themes stand out:

- The U.S. remains in a slow-growth economic environment

- Equity valuations are elevated, driven largely by AI enthusiasm and strength in large-cap tech

- The labor market may be showing signs of sudden weakness

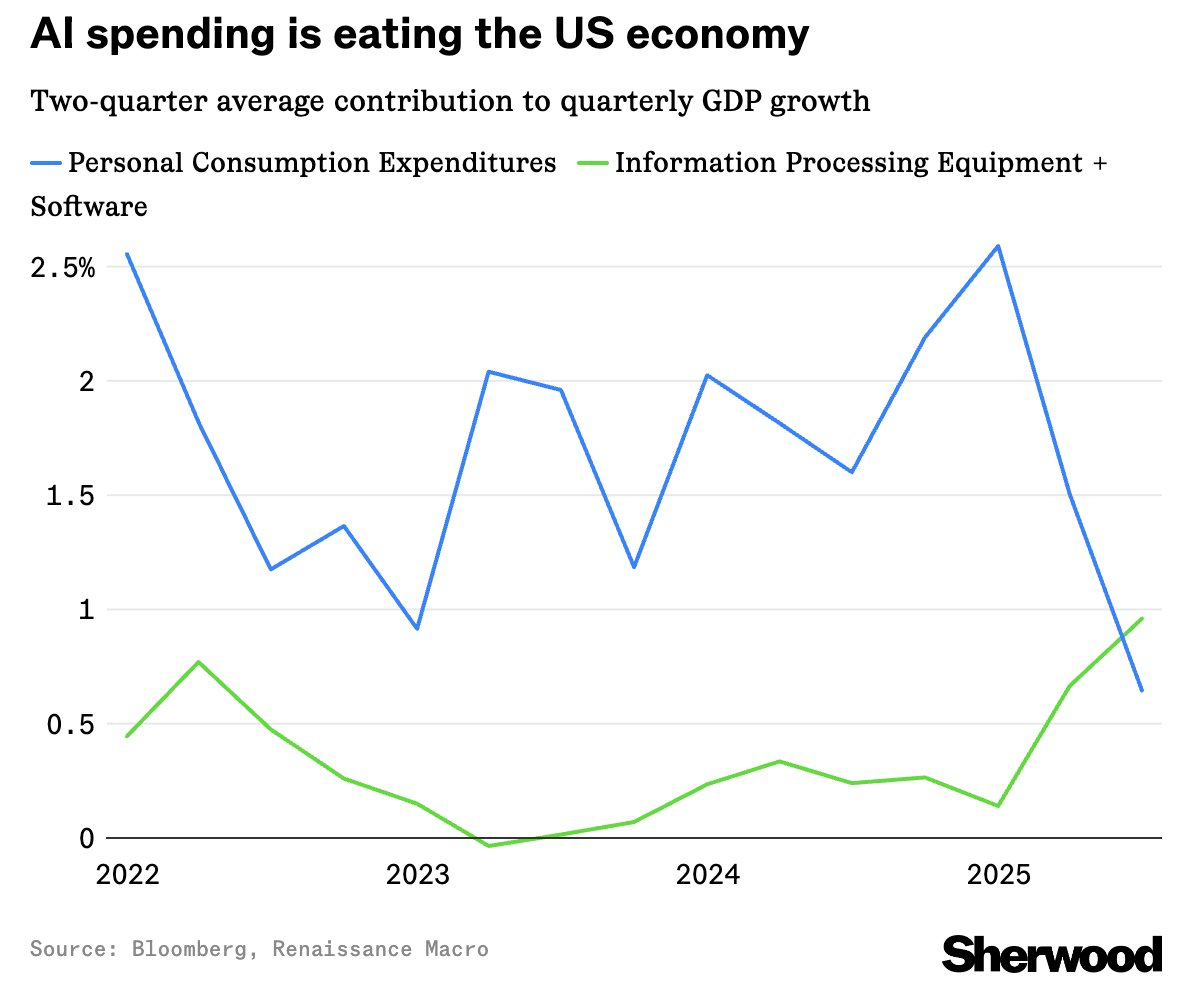

A recent chart highlights this dynamic well, showing the relative GDP contribution of AI-related capital expenditures by tech companies compared to consumer spending.

What’s striking is that AI capex has now overtaken consumer spending in terms of its contribution to GDP growth. For this trend to continue meaningfully, one or both of the following must happen:

- Consumer spending stabilizes or strengthens, and

- Tech companies begin realizing a measurable return on their AI investments.

The market is clearly pricing in future growth—but at some point, it will want to see present-day results.

Turning to the July jobs report: while some of the labor market data raised eyebrows, it’s still too early to sound alarm bells. There are plausible early explanations for what we’re seeing. For one, labor participation and the unemployment rate are being influenced in part by past immigration policies, especially those from the Trump era. We're also beginning to see how AI may be affecting the hiring of entry-level positions.

One underreported trend: the unemployment rate for men aged 20–24 is nearing 10%, while the rate for women in the same age group remains closer to the national average of 4.2%. Historically, technological innovation has led to more job creation over time, but we may be experiencing a short-term adjustment in entry-level hiring due to the efficiencies created by AI. This will be a trend worth watching.

All of this reinforces the importance of staying grounded in your financial plan. It’s not a time to panic—but it is a good time to check in: Do you have upcoming cash needs? It may be prudent to raise some liquidity now. Sitting on excess cash? Let’s put a thoughtful plan in place for getting it to work.

In our latest quarterly webinar (before the recent jobs data), we emphasized the importance of staying disciplined. That message holds even more weight now. As sentiment and reality begin to converge, discipline and long-term perspective remain the cornerstones of sound investing.