The Not-So-Simple Rules for Inherited IRAs

Written by: Nicole Gobel CPA, CDFA®

Do you or your loved ones have savings in IRAs or Roth IRAs? Do you want to understand how these assets will be taxed upon the owner’s passing? Prior to 2020 the rules around inheriting IRAs and Roth IRAs were relatively straight-forward but since then there have been a number of changes to Beneficiary IRA laws. In this article we will cover:

- How inherited IRAs and Roth IRAs were treated prior to 2020

- What changed after the SECURE Act

- Tips and tricks when choosing beneficiaries

Beneficiary IRAs and Roth IRAs prior to 2020

The original Setting Every Community Up for Retirement Enhancement or SECURE act became effective January 1, 2020. Before that time the rules around inheriting an IRA or Roth IRA were relatively simple.

Upon the passing of the original owner of the IRA, if the sole beneficiary was the surviving spouse, that individual had several options that still exist today. The IRA or Roth IRA could be rolled over to their own IRA or Roth IRA and treated as if it was their own for required minimum distribution (RMD) purposes. They could also keep the account as a separate inherited IRA. This would allow them to delay distributions until the original account owner's required beginning date or take distributions based on their own life expectancy, at a minimum. One reason a surviving spouse may have chosen this option is if they were not yet over 59 ½ and therefore not eligible to withdraw from their IRA without an early withdrawal penalty while they would have full access to the inherited account’s balance.

All non-spouse beneficiaries were required to receive the account as an Inherited IRA or Roth IRA. These beneficiaries were required to take RMDs based on their own life expectancy. Therefore, someone who inherited an IRA or Roth IRA at a young age would only have to withdraw a small amount each year. One item of note is that Inherited Roth IRAs were still subject to this distribution requirement while the original owner was not required to take distributions from their Roth IRA.

Post SECURE Act

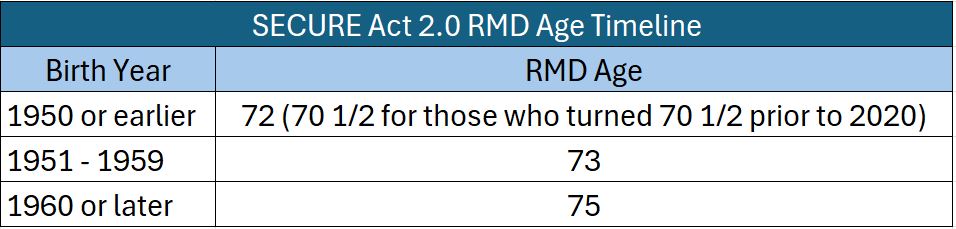

After January 1, 2020, there were a number of changes to retirement account guidelines due to the SECURE Act and further changes through SECURE Act 2.0 which became effective after December 29, 2022. While some of the changes, including extending the RMD age several times, allow retirees to keep funds growing within their tax-deferred accounts longer, the changes to inherited IRAs and Roth IRAs resulted in the opposite effect.

A surviving spouse still has the same options as they would have prior to 2020. There are also several other classes of individuals noted below as eligible designated beneficiaries that receive special treatment.

- Minor child of the deceased account holder

- Disabled or chronically ill individual

- Individual who is not more than 10 years younger than the deceased account holder

These eligible designated beneficiaries are still able to take distributions over the longer of their own life expectancy or the original owner’s life expectancy. However, once a minor child of a decedent reaches age 21, they are now subject to the new 10-year rule.

All other individual beneficiaries are now subject to the 10-year rule which applies to both inherited IRAs and inherited Roth IRAs. Basically, the clock starts in the year after the decedent passes and requires that the entire account balance is spent down by December 31st of the 10th year. For inherited IRAs with significant balances this accelerates the income taxes paid on the distributions. For those inheriting Roth IRAs, although no taxes are paid on the distributions it prevents heirs from keeping funds in the account growing tax free as long as possible.

In addition to the 10-year draw down requirement it also matters whether the decedent was required to take distributions before they passed. This is a point that was only recently confirmed by the IRS but has been debated since the original SECURE Act was passed. If the original owner of the account was past their required beginning date for RMDs the inherited IRA account owner will need to take annual distributions, based on their own life expectancy, in addition to spending down the account by the end of the 10-year period. However, if the original account owner was not yet RMD age there is no requirement for annual distributions. Also, one key difference is that Roth IRAs are not subject to the required annual distribution in either scenario.

Tips & Tricks

Making the right decisions when choosing beneficiaries for retirement accounts can save your heirs thousands of dollars in taxes. The new 10-year rule has not only accelerated the timeframe for accounts to be spent down but since many individuals are inheriting large tax-deferred accounts in their prime earnings years these taxes are being paid at a much higher marginal tax rate. Unless you expect to have a taxable estate, leaving an IRA or Roth IRA to a surviving spouse still provides the most flexibility. However, if that is not possible there are other options to consider.

If you intend to leave any funds to younger beneficiaries who are just starting their careers and in a lower tax bracket, leaving a portion of your IRAs could be a great option. Also, if you would like to leave a charitable legacy, naming a qualified non-profit as an IRA beneficiary saves income taxes as the organization is not subject to income tax. In addition, naming someone who falls into one of the eligible designated beneficiary categories, such as a sibling that is no more than 10 years younger could allow them to stretch the distributions over their lifetime. By choosing to leave your IRA to the most preferential beneficiaries you can then ensure the most tax advantageous assets such as a brokerage account or home that typically receive a step-up in cost basis are left to your adult children.

It is important to work with an experienced financial advisor and tax professional both in choosing the right beneficiaries for your accounts but also when you receive an inherited IRA or Roth IRA to ensure you are following the appropriate distributions guidelines. Here at Bouchey Financial Group we make sure to regularly check in with our clients on their beneficiary designations. We review their overall estate plan and make suggestions when we feel updates should be made to benefit the overall net received by heirs. We also ensure that our clients who own inherited IRAs and Roth IRAs take their annual distributions when required and guide them on tax withholdings. In addition, we assist our clients with cash flow planning to determine the most tax efficient way to draw down any accounts under the 10-year rule.

If you have questions or have specific questions regarding these topics, please reach out to the team at Bouchey Financial Group.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.