Removing the Emotions from Investing

Written by: Martin Shields, CFP®, AIF®

When we meet with a prospective client in an initial meeting, we discuss the value we provide for our clients which can be broken down into the following categories:

- Personal CFO – We provide guidance regarding any finance related question.

- Tactical Investment Management – We manage ETF portfolios and adjust based on what we see in the markets and the economy.

- Client Service Team – We handle all interactions with our custodian Charles Schwab. Our clients always get a real person with no phone trees when they call us.

It is the combination all these three items together that provides value to our clients and allows us to have an industry high client retention rate.

Drilling down on our investment management, one element my colleague Steve Bouchey highlights is that we take the emotion out of managing investments. This alone can prove to be a tremendous relief to clients who have a psychological and emotional burden of managing their ever-growing portfolio. All this stress can be removed by delegating portfolio management to our firm.

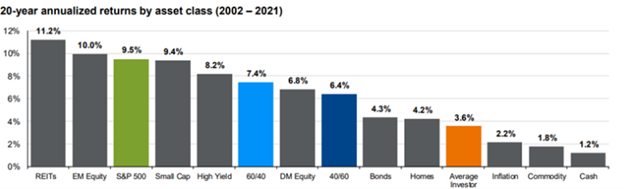

The graph below is a great illustration of the challenges facing individual investors. For the 20 years from 2002 to 2021 the annualized return for the average investor is 3.6%. Compare this to the 6.4% annualized return of a portfolio with 60% bonds and 40% stocks and you can see that the average investor consistently makes investment decisions that negatively impact their portfolio performance.

Source: JPMorgan

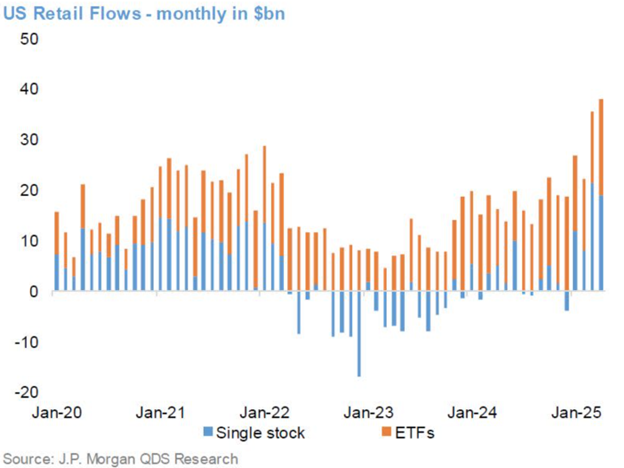

There can be many reasons for underperformance but one of the strongest is their decisions to follow their emotions from headlines about the markets and the economies. The graph below shows inflows and outflows of assets into the markets for individual investors. What becomes clear is that when the market is hitting all-time highs the inflows hit their peak levels and when markets are at their lows, inflows drop or even become negative. The successful approach to investing would recommend doing the opposite.

The one requirement for a client to be successful working with our firm is they need to feel comfortable delegating this responsibility. For individuals who have been managing their portfolio for years this can be more difficult than they expect. To help provide them with an outlet for their investment urges we sometime open a brokerage account with 1-3% of their investable assets and let them buy what they want in that account while we manage the bulk of their assets.

At the heart of our investment philosophy is the belief that removing emotion from the decision-making process leads to better long-term outcomes. By combining personalized financial guidance, disciplined portfolio management, and high-touch client service, we offer a structured, supportive environment where clients can feel confident about their financial future. For those ready to let go of the day-to-day stress of managing their investments—and the emotional rollercoaster that often comes with it—delegating to a trusted advisor can be both a practical and empowering step. Our goal is to provide peace of mind, consistency, and clarity in a world where markets and headlines often deliver the opposite. If you’d like to speak to one of our advisors about our investment management, please contact our office.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.