Q1 2025 Market Update

Tariffs or No Tariffs?

Written by: Ryan Bouchey, Chief Investment Officer

Market Update

Tariffs have dominated headlines over the past few months—and for good reason. We often encourage clients to tune out the noise from headlines and media to focus on the long-term and what’s important. But in this case, the concern isn’t just headline-driven hype. The uncertainty around tariffs has been very real. The current administration has made clear its intended use of tariffs, but what’s less certain is how far they’re willing to go —and whether these moves are part of along-term strategy or a short-term negotiating tactic. Without that clarity, it’s no surprise the markets have been on edge and reacting the way they have during the first quarter.

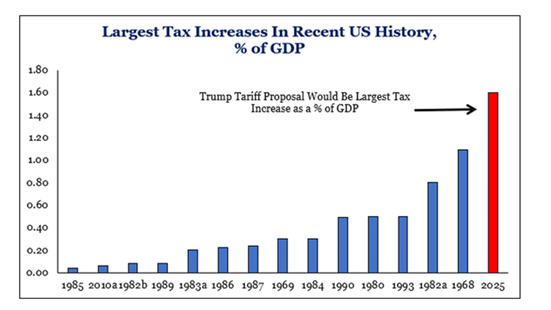

*Strategas Research Partners

Personally, as I think about the impact tariffs have on the markets and our economy, I can’t really make a good argument for them. Whether the added costs get passed on to consumers or the corporations who they affect, someone must pay. And while the end goal of a more competitive U.S. manufacturing sector, additional jobs and strong U.S. export market are all positives, our global economy has been evolving for decades and it’s hard to put the toothpaste back in the bottle once it’s been let out. So, while the intention may be good, I worry that too much needs to change for the administration to hit all its targets. My hope, much like what we saw in Trump’s first term, is that much of this ends up being a negotiating tactic that is more short-term in nature than anything else. Wednesday’s announcement of a 90-day delay in reciprocal tariff implementation may have given us the indication that it is mostly a negotiating tactic.

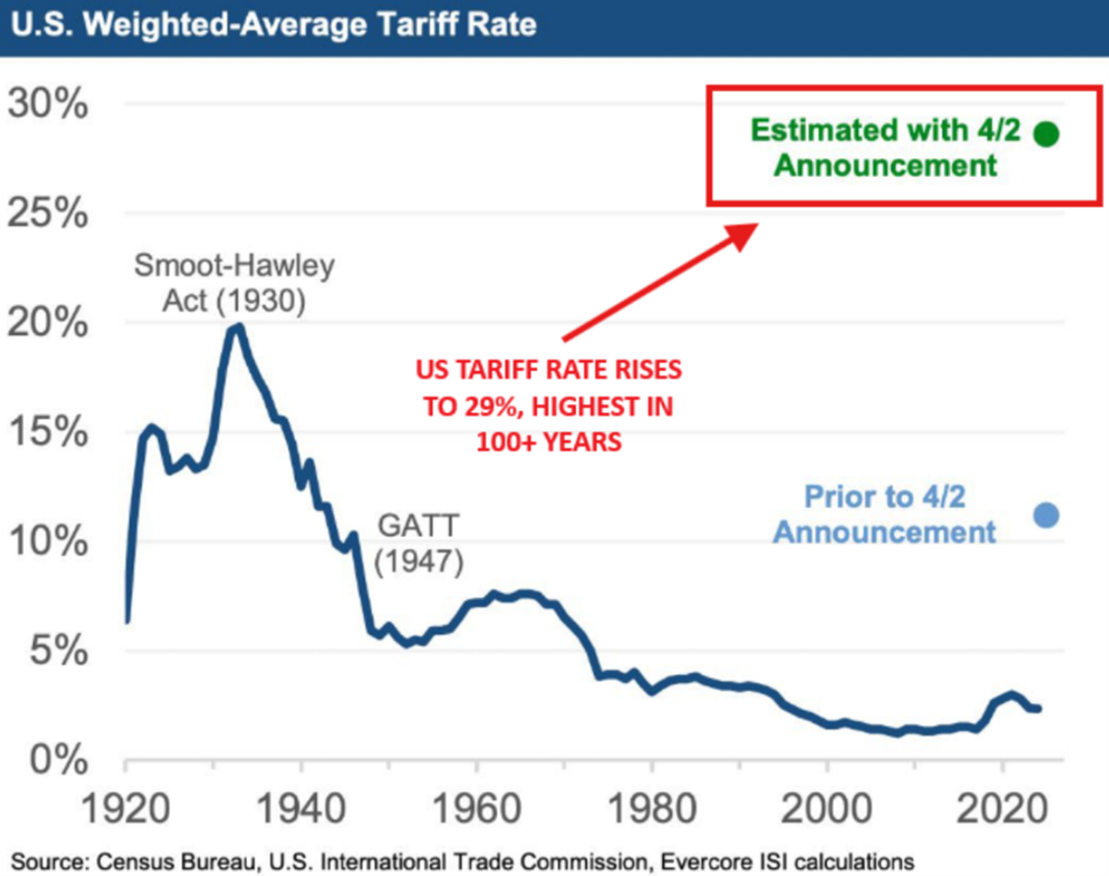

Tariffs & Trade

Tariffs have long been used to protect developing industries, and they were critical to the U.S.in the late 1800s and early 1900s as we built our industrial base. But after World War II, we became a mature, consumer-driven economy — the largest in the world today. It’s natural for economies like ours to run trade deficits as consumer spending makes up 2/3s of our economy. What’s been lost in all of this is the surplus we run in services like technology and intellectual property, which actually cuts our trade deficit down by 30%.

This economic evolution hasn’t come without costs. Manufacturing towns across the country have felt the pain of jobs moving overseas, and it’s important not to overlook that. Still, as our economy has grown and evolved, it’s largely benefited Americans.

What we’ve seen over the past few weeks, though, looks like a policy mistake. Markets responded sharply to the reciprocal tariff announcements, with a two-day selloff that ranks among the steepest since World War II — only Black Monday, the collapse of Lehman Brothers, and COVID-19 compare. The spike in market volatility (VIX) was just as striking, matching levels seen only during the financial crisis and the pandemic.

I’m fully on board with the goal of bringing more jobs back to America, and revisiting trade agreements where needed makes sense. The problem is the lack of clear messaging and direction. Mixed signals from Trump’s advisors and unclear objectives have only added to the confusion. For example, one advisor argued that zero tariffs with Vietnam weren’t enough because of our trade deficit. But Vietnam is an industrializing, low-income country — they simply can’t afford U.S. goods at scale. Trying to erase that deficit misses the point.

The bigger issue is that corporate America needs clarity and confidence to invest and grow —and right now, they have neither. Without a clear strategy, businesses are likely to wait: holding off on investment, slowing hiring, and focusing on controlling costs. No company is going to spend billions reshoring production without a stable policy roadmap.

Are there real issues with global trade? Absolutely. We should be doing more to strengthen our position. But the answer isn’t alienating our allies or pulling back from global partnerships. It’s building stronger, more resilient relationships with countries that can help fuel our growth. As we stand on the verge of the AI revolution, this matters even more. The current approach risks isolating us at exactly the moment when we should be building alliances. Without a shift in strategy, China could very well take the lead, setting the U.S. back decades. Now is not the time for isolationist policies — and I hope that realization comes sooner rather than later.

Markets Hate Uncertainty

Every time I go to finalize this market update; it seems we get a major policy change or announcement. The latest news is the 90-day delay implementing the reciprocal tariffs announced last week. Obviously, the markets liked this, with the S&P up almost 10%. This justifies our position that all it will take is one or two positive headlines to help reverse this market sell-off.

Even with the 90-day suspension, markets will likely be volatile until we get more clarity. The market hates uncertainty, and even though this has been a positive development, there is still plenty of uncertainty left in these trade discussions. Believe it or not, of the best 50 days in the stock market over the past 30 years, half of them have happened during bear markets. So, while this bounce has been positive, we aren’t out of the woods quite yet. Not only will corporate America need to see some clarity out of future policy, we also need to weigh what the rest of the world thinks in their ongoing negotiations with the U.S. Hopefully we haven’t eroded trust in our trading partners to make this right moving forward.

*Ned Davis Research, Morningstar

Giving us time to negotiate with the rest of the world before implementing crippling tariffs is a good thing, but it’s still unclear what the end goal is. It appears part of the strategy is to isolate China, which may have some positive outcomes. It doesn’t come without its risks as we enter a trade war against the 2 largest economy in the world and current 125% tariffs being implemented. We also still have 10% tariffs with the rest of the world in place, which will have an effect no matter what.

In this environment, we still feel staying the course is the best strategy. We don’t want to overreact during this time knowing how quickly the markets can rebound with any positive development. The “Trump put” came into play, which we said all along could be the case. Was it the falling of the stock market or the rise in interest rates on the 10-year treasury note? Tough to say. It’s clear the markets have an impact on policy discussion, and it may be our best way to saving the markets and economy as future negotiations take place.