A Pattern Emerges in the U.S. Employment Market

Bouchey Newsletter

Written by: Ryan Bouchey, CFP®, CPA

If once is an accident, twice a coincidence, and three times a pattern, then this latest labor report may be pointing to a more consistent signal about the underlying strength of the U.S. economy.

The August jobs report showed a continued slowdown in labor market momentum, with only 22,000 jobs added versus expectations for 75,000. The unemployment rate also ticked up to 4.3%, from 4.2% the month prior. While one weak report doesn't make a trend, this marks the third straight month of softer labor data.

It’s important to remember that the labor market is often viewed as the backbone of the U.S. economy. So, when we begin to see repeated signs of softness, it can raise concerns about the durability of economic growth. That said, we haven't seen the sharp revisions we experienced last month, but even a modest revision to June’s numbers now shows a net loss of 13,000 jobs.

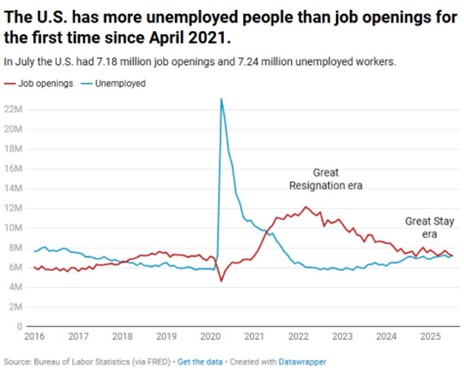

Earlier this week, the JOLTS (Job Openings and Labor Turnover Survey) report added to the narrative, revealing that job openings have now fallen below the number of job seekers — the first time we've seen this since 2018 (excluding the brief COVID period). While on the surface this isn’t cause for concern, job openings were often below seekers throughout the 2010s, it’s the direction of change and speed of the decline that matters most.

Where Do We Go From Here?

On the positive side, we’re not seeing widespread layoffs or panic in the labor market. What we're seeing instead is more of a jobs "freeze.” Companies may be holding steady amid uncertainty, from trade tensions to questions about Fed policy. In some ways, this could reflect delayed effects from earlier fears tied to tariffs or slowing global growth as economic data tends to show some signs of lag.

This labor report almost certainly increases the likelihood of a Fed rate cut at their upcoming meeting in 10 days. That brings both potential optimism and an important reminder: Fed policy can provide a tailwind, but it’s not a guarantee of market success. More than ever, it’s more important to see what the underlying data shows.

Soft Landing or Something More?

If the Fed can cut rates while keeping the economy on track, think back to the mid-1990s or even late 2024, the market could continue to advance. But if these cuts are in response to deeper economic weakness, that could be a different environment. As we’ve seen historically, and shared in past webinars, most interest rate cutting environments have been bad for the stock market since they are meant to stimulate a weak or recessionary economy.

In our view, the most likely scenario for now is one of slowing, but not collapsing, growth paired with still-elevated inflation. That kind of environment often leads to a more sideways market, with both ups and downs along the way. Much like we’ve seen these past few months. Even though we are experiencing weakness in labor, we continue to see strength in the consumer as well as strong GDP readings from the second quarter. We’d be more concerned if the job market was collapsing due to strong job cuts, but right now feels more like a wait and see approach to hiring.

This is the type of backdrop we’ve been preparing portfolios for: steady, risk-aware positioning designed to weather short-term volatility while capturing long-term opportunity. As always, we’ll continue to assess the data and adjust accordingly.

Staying Focused Amid the Noise

As we shared in last month’s newsletter, having a sound financial plan is more important than ever. Market volatility is the price we pay for long-term investment success and it’s a price we plan for with each of our clients. Our commitment remains steadfast: to help you stay on track through thoughtful, disciplined portfolio management grounded in your financial goals.

We’ll continue to monitor developments closely and communicate as conditions evolve. As always, should you have any questions or concerns please don’t hesitate to reach out to an advisor or team member to discuss your situation.