The Missing Jobs Report

Written by: Ryan Bouchey, Chief Investment Officer

I’ve been thinking a lot about the economy and, more specifically, the missing jobs reports from September and soon to be October. Many headlines over the past few weeks have included job cuts from major U.S. employers – Amazon slashing 34,000 jobs and almost 10% of their office workforce, UPS cutting 48,000 positions, and META cutting 20% of their AI division. Despite all of this, the market continues its rise. What’s driving this and should we be concerned?

More than ever, it would be helpful to get one piece of the economic puzzle to help fit into our overall review – and that’s jobs data. Remember, we had three months of slowing jobs, with some revisions even showing negative job growth back in June. Now with the Government shutdown fully in place, it looks like we could miss out on our second monthly jobs number. The positive in this trend is that from a high level, this feels more like a slow hiring / low firing environment, driven primarily by three forces: 1) AI trends; 2) Less workers due to a crackdown on the borders and 3) demographic trends. All of which we touched upon in our latest quarterly market update.

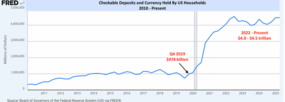

The rest of the economy, so far at least, seems to be doing quite well. Consumer spending continues its strength, earnings have been strong to very strong, and we continue to get an accommodative Fed which should continue to help stimulate economic growth. The other aspect of this, and why even a slowdown in jobs could be navigated within the markets, is the growth of wealth over the last five years. Take the following chart as an example for our chart of the week: checking account balances are up near FIVEFOLD since 2019 accounting for close to $4.5 Trillion in checkable deposits. This is a substantial increase, and while the markets feel like they are on a strong ride up, there is still plenty of cash on the sidelines which mirrors our assessment that we aren’t quite in the euphoric stages of a bull market.

*DataTrek

The St. Louis Fed posted an interesting research paper last week outlining how common it is to have job losses during an economic expansion. Over the course of the past 70 years, we’ve had 10 different economic expansions. Surprisingly, during these expansions we’ve averaged a 14% rate of job losses for the monthly payroll reports. So even with the negativity and potential for slowing job growth right now, it’s not uncommon to see actual jobs being lost while the economy continues to grow.

Only time will tell where we stand in the current environment, but there is enough good news out there to help substantiate a lot of what we’re seeing in the economy today. Even though we have experienced some volatility this week, we felt this may be the case given some short-term technical trends and underlying market data. Even in bull markets, the market averages a 14% intra-year decline annually, so short-term volatility is part of the price of being good long-term investors.

As always, if you have any questions or concerns, please contact an advisor to discuss your situation.