Shutdown, Slowing Jobs… and All-time Highs?

Bouchey Newsletter

Written by: Ryan Bouchey, CFP®, CPA

As we enter the fourth quarter, it wouldn’t be unreasonable to ask: “Are we really still at all-time highs in the market?” Despite a government shutdown (with little sign of resolution on either side), a cooling labor market, and no shortage of headlines to scare us away, the market continues to reach new all-time highs. For all the fear that comes with investing in this type of environment, it’s a good reminder that it takes all-time highs to make new all-time highs!

As for the government shutdown, it’s anyone’s guess when it will end. Betting markets suggest sometime after next week. What we do know is that neither side seems ready to budge. Democrats are standing behind an extension of Affordable Care Act subsidies, an issue they’ve long prioritized. Strategically, they’re also looking to project strength against Trump and rally support ahead of next year’s midterms. Republicans, on the other hand, see the shutdown as an opportunity to push for reduced government spending, with early reports indicating cuts aimed at programs in Democrat-led areas. At this point, both sides appear emboldened and unwilling to back down without a fight.

What history shows us about government shutdowns is that the fear and uncertainty leading up to them often outweigh their actual market impact. The most recent government shutdown, which happened from December 2018 into 2019, was the longest on record at 34 days, yet markets rose during that period. Over the last 40 years, we’ve seen 20 shutdowns, with an average duration of just 8 days. Market performance during these periods has typically been flat, and in cases where shutdowns lasted more than 15 days, the average return has actually been a 2.9% gain. Could this time be different? Of course. But so far, the market doesn’t appear particularly concerned.

So, what’s catching our attention outside of Washington? For one, the recent string of weaker labor reports has stood out. It’s not all bad news, however. Most of the softness comes from slower hiring, not from a surge in layoffs or firings. That’s a positive sign and could be tied to trends we’re seeing around AI-driven workplace efficiencies, as well as the impact of immigration and border policies in place since the Trump administration. Unfortunately, due to the shutdown, we won’t be getting the September jobs report, which would have offered a helpful snapshot of where the labor market currently stands.

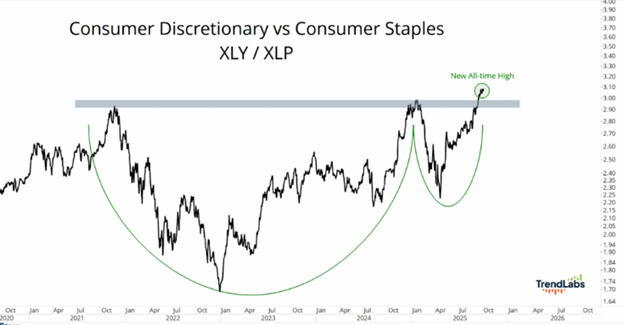

Given the recent labor market weakness, it’s fair to ask: why are markets still at, or near, all-time highs? From a technical standpoint, the following chart offers some insight into the underlying economic strength. We’re seeing continued outperformance in the consumer discretionary sector, think Amazon, Tesla, Home Depot, compared to consumer staples, which include everyday household goods people buy regardless of economic conditions. This kind of strength in discretionary stocks doesn’t typically occur in a weak economy. It signals growth, confidence, and optimism. Paired with resilient consumer spending and purchasing behavior, this is part of what continues to push markets forward.

Beyond consumer strength, earnings forecasts continue to rise as we head into the fourth quarter. The AI revolution is in full swing, with $100 billion-plus deals still being announced across the space. These kinds of investments and capital spending don’t typically happen in a weak or slowing economy. They reflect real optimism about the future of this technology. Of course, this isn’t the first time we’ve seen hype around innovation; the tech bubble is a clear historical parallel. But today’s market rally looks far more measured. That doesn’t mean a bubble can’t or won’t form over time, which is why maintaining the right balance remains our core focus.

We’ll share more in the coming weeks with our Quarterly Client letter, along with our Markets and Economic Quarterly webinar on Wednesday, October 15th 12pm ET.

Have a great weekend and please do not hesitate to reach out to us for any questions.

Ryan