Q3 2024 Market Update

Continued Strength

Written by: Ryan Bouchey, Chief Investment Officer

Q3 2024 Market Update

As we enter the 4th quarter, it’s still somewhat amazing to me the strength we continue to see in the current market landscape. It’s been roughly two years since every economist out there had predicted in impending recession, and all we’ve gotten since is two years straight of 20%+ returns in the overall stock market. It’s hard to predict what will happen from now until year end, but what’s evident is the importance of “time in the market” vs. “timing the market.” While this latest quarter bucked the trend of winners from 2023 and the beginning of this year (Mag 7 stocks), the growth in market breadth proved to be a welcome addition signifying strength in the overall market.

The U.S. economy continues to show resilience, with GDP growth remaining positive despite some softening in consumer spending and labor market trends. Unemployment has edged slightly higher, reflecting weaker hiring in certain sectors, but remains low overall. Market participants continue to grapple with a mixed economic picture, balancing optimism over cooling inflation against concerns about prolonged high interest rates and potential economic headwinds.

U.S. Equities Update

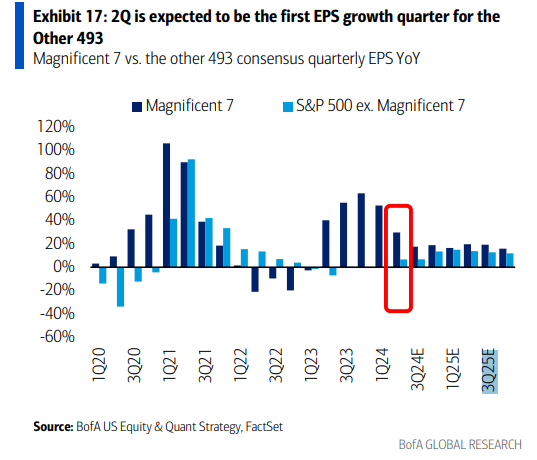

In the third quarter, U.S. equities encountered headwinds and volatility after a strong start to the year, but still managed to close the quarter on a strong note. Growth sectors, such as technology, saw more pronounced corrections as investors adjusted to the changing rate environment. While the so-called "Magnificent 7" tech giants remain pivotal, their dominance has eased slightly, with smaller-cap stocks gaining some ground. As you can see from the following chart, this falls in line with earnings growth expectations for those largest technology companies vs. the rest of the market. It’s a big reason why we have tactically added to our quality holdings and recently made a rebalance trade within clients qualified accounts to get to our target allocations.

Earnings growth continues to play a significant role in what we feel will be the most important moving forward. As we move into the final quarter of the year, there is a heightened focus on the upcoming earnings season, which will likely dictate market sentiment going into 2025. Forward guidance from companies has been mixed, with caution prevailing amid ongoing inflationary pressures and global economic and geopolitical uncertainties.

Fed Policy Changes and Their Impact

The Federal Reserve’s long-awaited decision to cut interest rates by 50 basis points in September signaled a shift from its previous tightening cycle. However, despite these cuts, longer-dated interest rates have remained elevated, with the 10-year Treasury yield rising 50 basis points since the rate cut, now hovering around 4.1%. This disconnect suggests that while the Fed has taken steps to stimulate growth, market participants remain wary of inflation risks, pricing in the likelihood that higher rates could persist for some time. We’ve shared this sentiment with clients in the past, but the interest rate environment following the global financial crisis feels like it may be more of an aberration. As the Fed lowers their own Federal Funds rate in the future, there is still the potential that longer-dated yields re-normalize and stay higher for longer.

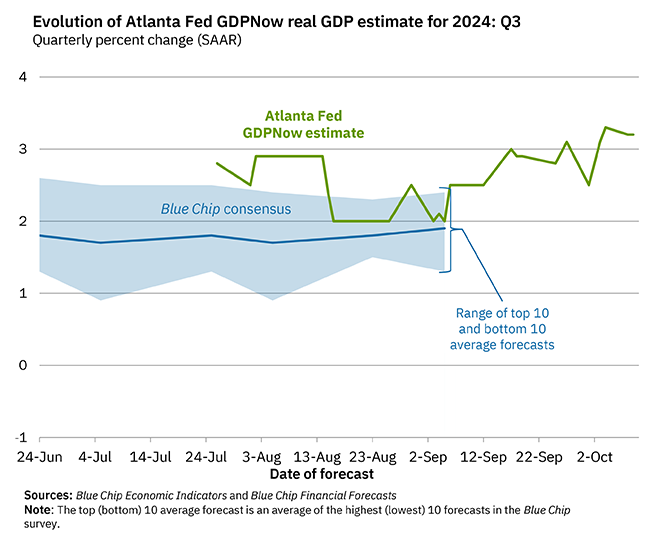

The September CPI report, which was released this week, came in higher than expected and could complicate further Fed strategy. Although inflation has cooled from its 2022 peaks, this recent uptick raises questions about how much more easing the Fed can afford to deliver without risking a resurgence in inflationary pressures. The Fed remains in a delicate balancing act, trying to prevent the economy from slipping into a recession while keeping inflation under control. While it felt the economy was cooling, specifically in labor and manufacturing, early estimates of 3rd quarter GDP growth continue to show an over 3% growth rate, which is quite strong.

Fixed Income Insights

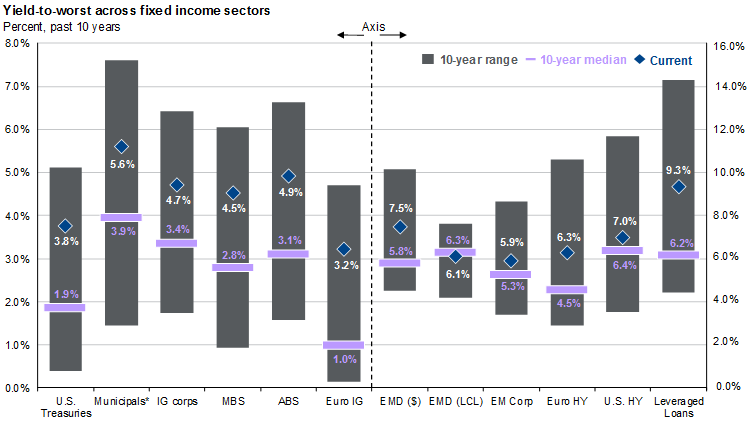

The Fed’s rate cuts have not translated into lower long-term rates, as evidenced by the sharp rise in the 10-year Treasury yield during the quarter. In fact, since the Fed cut rates by 50 basis points, the 10-year Treasury yield has moved upwards by 50 basis points from 3.6% to 4.1% This upward movement in longer-dated yields is driven by a combination of inflation concerns and global bond market dynamics, which suggest that inflation may be more persistent than originally anticipated. Due to these changes, you may see some future changes in areas of our fixed income portfolio to take advantage of these higher rates on the longer end. It does feel like we’re getting back to a normalized yield curve, following the longest period of inversion we’ve seen in quite some time.

However, the current environment also presents opportunities. Due to these changes, you may see some future changes in areas of our fixed income portfolio to take advantage of these higher rates on the longer end. It does feel like we’re getting back to a normalized yield curve, following the longest period of inversion we’ve seen in quite some time. We continue to emphasize that while the Fed’s short-term rate cuts may not immediately ease longer-term rates, a diversified fixed income strategy remains critical in navigating this environment. Based on the below chart, yields are still very attractive compared to the previous 10-years we were accustomed to.

Closing Thoughts

As we head into the final quarter of 2024, markets will have to weigh what’s most important – interest rates or the strength of the economy and corporations. On one hand, the Fed’s shift toward easing is a positive signal for economic growth and potentially easing pressure on corporate earnings. On the other, inflation remains a concern, and the rising 10-year yield underscores the challenges ahead. Our outlook remains optimistic, with earnings likely to be the key driver of market performance in the months to come along with continued economic strength. Even if economic growth slows, that brings us to the much-discussed “soft landing,” which would be a positive outcome for markets.

In this environment, maintaining a balanced approach remains critical. A focus on high-quality, diversified assets across both equities and fixed income will continue to help weather market volatility. We anticipate that the sectors that may have underperformed in 2023, and the early stages of 2024, may offer resilience amid uncertainty, while the fixed income market provides opportunities to lock in higher yields. We remain committed to navigating these challenges with your long-term goals in mind, always placing your best interests first as fiduciaries.

As always, should you have any questions or concerns, or would like to revisit some financial planning, please do not hesitate to reach out to our office.