Q1 2024 Market Update

Market Momentum

Written by: Ryan Bouchey, Chief Investment Officer

2024 Off to a Strong Start

We’re a quarter into the new year and the markets feel awfully similar to 2023, but for different reasons. We are seeing the stock market continuing to reach new highs with little volatility. For many investors this would feel like a good thing. Yet, overall consumer and investor confidence is still low compared to the current performance of the stock market. However, this may actually be a good thing.

How is this year’s market similar to 2023? We saw continued strength in stocks early in the year in the midst of contradictory consensus thinking of economists. Now, the consensus thinking in 2024 is different from 2023. At the start of last year, the consensus was for an imminent recession and stock market volatility. However, as we know, the reality of the markets in early 2023 was far from that. This year’s consensus thinking gravitated towards cooling inflation and 5-6 interest rate cuts from the Fed. With continued job market strength and an ever-sticky inflation reading, based on this week’s CPI report of 3.5%, it looks like this year’s consensus thinking may be wrong yet again. It’s still early in the year, but the lesson here is to not rely on headlines and herd mentality.

U.S. Equities

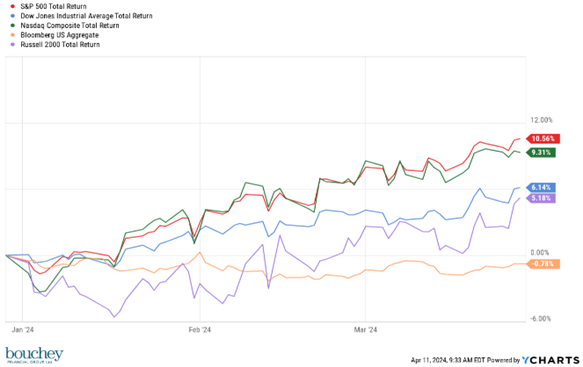

U.S. equities are off to another hot start this year, with the broad market S&P 500 Index up close to 10%. The Nasdaq composite was slightly behind at 9%, with the Dow and the Russell 2000 lagging a bit up 6% and 5%, respectively. Much like 2024, the market is being led by a handful of the notorious “Mag 7” companies, along with a few outsiders like Eli Lilly and Broadcom. The good news is that within our portfolio, most of these companies are our largest positions in the ETF’s we hold, especially with some of our tactical holdings we’ve been discussing over the last year like Dividend Growers (Broadcom) and our High Profitability tactical ETF (Eli Lilly). A fascinating stat I came across is that six stocks have accounted for 75% of gains in the stock market YTD.

The most logical question after a stat like that – is that a good thing? Believe it or not, it is and is pretty typical for a bull market. I remember sharing a white paper with clients last year that showed over the past 30-years, less than 2% of global stocks have accounted for the entirety of stock market gains. And of those winners, 70% are U.S. based companies. Seeing market strength in a concentrated form is not unusual, even though it may seem risky. It’s important that along with these leaders, we see expanded market participation which is also happening, just to a lesser extent than the major winners.

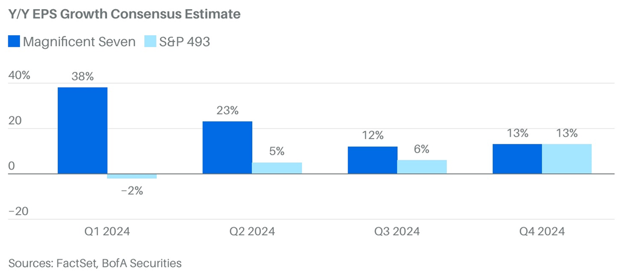

It does bring up some risk elements, however. We’re seeing a much higher concentration at the top of the S&P 500, with the 10 largest companies accounting for over 33% of the entire market. This is the highest we’ve seen in history. It’s hard to accurately quantify what level of risk this entails. The good news is that the concentration at the top is of high-quality, highly profitable companies. It’s what has led the charge last year and this year, with 6 of the Mag 7 companies showing up at the top of the S&P. Looking at the chart below, these companies earnings are what has driven the market higher. From a risk management perspective, you can see that moving forward we think there is the ability for companies outside the Mag 7 to help add to the stock market success. This is where diversification can play a significant role in market participation on a forward basis.

As we’ve stated since the start of 2024, we truly believe that earnings will matter most for the market to continue its strength. We are of the mindset that we mid cycle market and rates will matter less and less, which we are seeing so far year to date. The past two years have been ALL about the Fed and interest rates – 2022 bear market caused by rising interest rates, and 2023’s recovery came during times of lowering of rates. So far in 2024, as rates have been on a steady rise, so has the stock market. Again, this just shows us that moving forward, the market success will be dictated more by earnings and less by Fed policy.

Economy & The Fed

Along with the success of the stock market, we continue to see economic growth across the board. While this has been a bad sign for inflation and the lowering of interest rates, we do believe this is a good sign for the future health and success of the markets. If the economy isn’t improving, especially when 2/3rd’s is made up of consumer spending, then the stock market will have a hard time growing its earnings.

Job growth has been steadily improving since December, which also corresponds to when inflation started to tick back up. Higher inflation and higher rates may just be the price we have to pay in this environment for a stronger economy. The alternative would be lower inflation potentially due to a slowing economy. I’m not sure this would help bottom line growth for stocks.

When thinking about today’s economy, it’s so important to account for the impact Covid has had on all of us over the last four years. It’s difficult to quantify the impact, but its impossible to minimize. I think that’s why forecasting economic growth, inflation, the markets has been so hard these last few years. We’re trying to analyze it from a historical context, however the disruption Covid caused can still be felt today and needs to be a factor when predicting what’s next.

Between the financial crisis and the beginning of Covid, the personal savings rate as a percentage of disposable income held steady at around 6%. This was a much higher rate compared to pre-financial crisis as that number was steadily declining to around 2% in 2007. As we stand today, the post Covid environment for savings is about 4%, much less than pre-Covid. While this may be an issue down the road, we are seeing an increase in spending and economic activity as a byproduct of less savings. Again, just one example of how things have changed and people are spending and living differently than before the pandemic.

Closing Thoughts

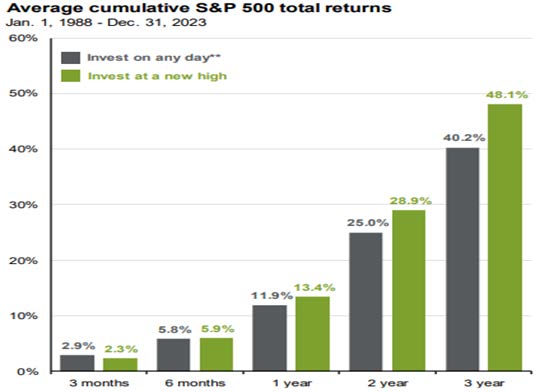

As we shared in this week’s quarterly market webinar, we see a lot of momentum all around us – both in the markets and the economy. Oftentimes, investors get spooked when the market is hitting all-time highs. They naturally want to become more defensive in their holdings, or maybe continue to sit on cash waiting for the next pullback. Believe it or not, however, history shows that investing at all-time highs can be a good thing. Typically, it shows momentum and most bull markets are constantly making all-time highs.

As we continue forward for the year, we think the “higher for longer” interest rate trend stays in place, and you may see us move from our short-term holdings to some intermediate term as interest rates rise. The market is less dependent on the Fed, although at some point higher rates may be difficult for earnings but we aren’t quite there yet. There will always be risks in the market, whether its market concentration, geopolitical concerns or the unknown. But as we sit here today, the economy continues to grow and stocks are benefiting from it. Earnings will be key, and I think diversification will continue to help investors weather any volatility we may see down the road.