Am I Retiring at the Wrong Time?

Written by: Harmony Wagner, CFP®, CPWA ®

The decision to retire is not just one decision, but the culmination of many smaller ones. A soon-to-be retiree faces questions that will affect their retirement success, such as when to take Social Security, to where they may want to live in retirement. While some of these what-ifs have a low overall impact on financial outcomes, there is one particular risk factor that can have a surprisingly large effect on portfolio sustainability. Sequence of return risk, or the risk of experiencing a significant market downturn in the first few years of retirement, can have major consequences for retirees who fail to prepare for it. This article will explain the effects of sequence of return risk as well as three ways to protect yourself from an ill-timed bear market.

What is Sequence of Return Risk

Bear markets and corrections are a normal part of market cycles, and a 20-30 year retirement timeframe is likely to contain not just one, but multiple down markets. The issue is not whether bear markets will occur during the retirement timeframe, but whether or not one of them may be poorly timed. Significant corrections in the early years of retirement (particularly the first two years) have an exponential effect, even if the overall average portfolio return over the long run is as expected. When portfolios are down the first few years of distribution, the overall distribution rate tends to be much higher than planned, and it makes it more challenging to recover those early portfolio losses in order to support a long-term distribution plan.

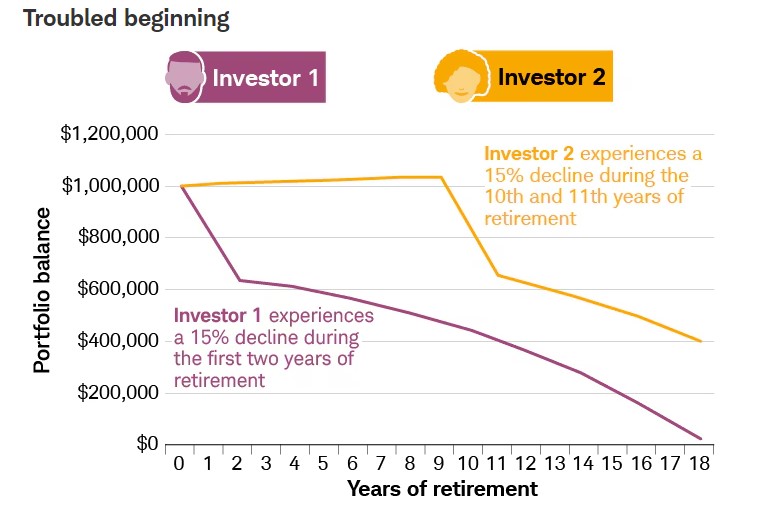

The chart below shows the impact of sequence of return risk on two otherwise identical investors. Both hypothetical investors start out with investment portfolios of $1M, take $50K in annual distributions, and have average portfolio returns of 6%. However, Investor 1 experiences a decline of 15% in the first two years of retirement, while Investor 2 experiences the same decline in years 10 & 11 instead. As the chart shows, Investor 1 runs out of money after 18 years, while Investor 2 maintains her portfolio 8 years longer (not depicted on the chart).

Chart taken from www.schwab.com/learn/story/timing-matters-understanding-sequence-returns-risk

We’ve established that the sequence of returns risk is a significant one for soon-to-be retirees. Unfortunately, there is no strategy to guarantee a smooth market trajectory for any year, month, or even week, so it’s impossible to completely avoid the sequence of return risk. However, there are ways to prepare for this risk and to potentially reduce its impact.

Ways to Protect your Portfolio from Sequence of Return Risk

Prepare a cash management strategy. The true risk of an early retirement market correction is having to sell out of positions when values are down, locking in those losses and making a full portfolio recovery more difficult. By setting aside 1-2 years of upcoming cash needs in a highly conservative allocation (such as a high yield savings account, money market fund, or ultra-short duration bond fund), investors can greatly reduce the likelihood of needing to access the equity side of their portfolio during a correction. Nearly every bear market in the last 75 years has recovered in less than 24 months, so having two years of cash set aside prior to retirement will help protect the equity side of your portfolio during volatility.

Model what would happen to your portfolio during an early-retirement bear market. Most retirement cash flow plans assume an average rate of return over the life of the plan (i.e., 6% annual portfolio growth). While this is an adequate way to measure portfolio performance over time (especially when an assumption is used that’s more conservative than historical averages), it is also important to consider a scenario where the first two years contain a significant correction. Ask your advisor to model this bad timing scenario for you, so you can understand how your specific portfolio and situation could be affected by sequence of returns risk. For those who aren’t relying heavily on their portfolio, and/or who are open to adjusting their retirement date or spending, the effects may be minimal. For others whose success depends on their ability to access their portfolio at a high distribution rate early in retirement, the impact is likely to be much more severe. Once you understand how your specific portfolio would be affected, you can develop a plan to address that situation if it occurs.

Maintain a flexible mindset. Focus on the areas of your financial life where you are able and willing to be flexible. Some examples might be:

- What elements of your discretionary spending would you consider cutting back for a year or two?

- Do you have the option to work part-time temporarily to supplement your income without accessing your portfolio?

- Are you open to collecting Social Security earlier than planned if you need an income stream that is not affected by the markets?

- You’ve spent your entire career planning for retirement, but have you planned for the possibility of a bear market in the first couple years after you retire?

By identifying a few ways to temporarily adjust your retirement plan in the event of a poorly timed correction, you are much less likely to experience the magnified negative impact to your financial stability. Knowing exactly what changes you would make and in which order can also help reduce anxiety about retiring during a down market.

Conclusion:

After years of planning your retirement, don’t let your financial future be derailed by an early retirement market correction. If you are concerned about how the sequence of return risk might impact your financial success in retirement, please contact our advisory team.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.