Tax Planning

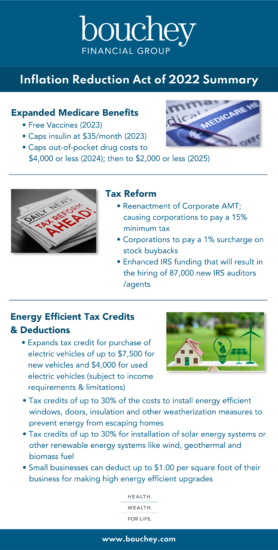

President Joe Biden signed a $750 billion healthcare, tax and climate bill into law at the White House on Tuesday, August 16th. Take a minute to read our team’s summary where we break down some of the major changes and how it might affect you. Download Download created by Vincenzo Testa, CPA

Written by: Vincenzo Testa, CPA Equity compensation is one of many benefits that employers are offering more frequently to hold onto their valuable employees. Sure, in general, employees know when they are granted their stock options, when they vest or their strike price. But are those same employees able to calculate the potential significant tax…

Written by: Samantha Masey Qualified charitable distributions are an excellent tax-advantaged strategy for IRA owners in or near retirement. If you are charitably inclined or already making charitable donations to support non-profits, a qualified charitable distribution (QCD) might make sense for you. A QCD is a distribution from an IRA paid directly to a qualified…

Written by: Nicole Gobel, CPA In every industry there are acronyms. In the investment advisory and tax planning world, RMD or MRD is often used. Both stand for Required Minimum Distribution. This is the minimum amount one must take as a distribution from various retirement accounts each tax year and is specific to each individual…

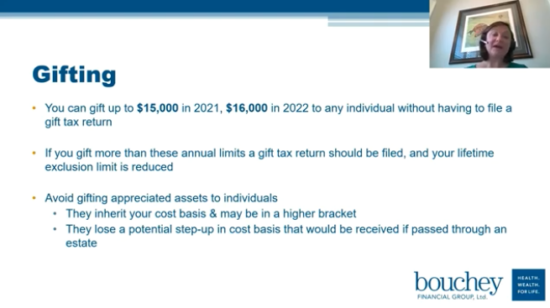

Join Nicole Gobel, Jennifer Foley, and Vincenzo Testa as they present their year-end tax planning tips and what to expect for 2022. Learn about: Gifting Strategies Maximizing Retirement Contributions Potential Tax Changes in the Build Back Better Act Bouchey Financial Group is a fee-only, fiduciary, financial advisory firm with locations in Saratoga Springs & Troy,…

Written by: Jennifer D. Foley, CPA – Wealth Advisor & Tax Planner As the end of the year approaches and is filled with holiday distractions it is important not to forget year-end tax planning. In this article, I have provided some tips to help reduce your tax bill and potential changes to pay attention to…