What is a Qualified Charitable Distribution?

Written by: Samantha Masey

Qualified charitable distributions are an excellent tax-advantaged strategy for IRA owners in or near retirement. If you are charitably inclined or already making charitable donations to support non-profits, a qualified charitable distribution (QCD) might make sense for you. A QCD is a distribution from an IRA paid directly to a qualified charity. This article explores who is eligible to make qualified charitable distributions, the benefits of QCDs, and some commonly asked questions. Discover if you can be taking advantage of Qualified Charitable Distributions now or in the future.

This article answers the following questions about Qualified Charitable Distributions.

- Who is eligible to make a qualified charitable distribution?

- What type of charity can receive a QCD?

- What are the benefits of making qualified charitable distributions?

Who is eligible to make a qualified charitable distribution?

Qualified Charitable Distributions were first introduced in 2006 as part of the Pension Protection Act of 2006. The provision was made permanent in 2015 by the Protecting Americans from Tax Hikes Act of 2015.

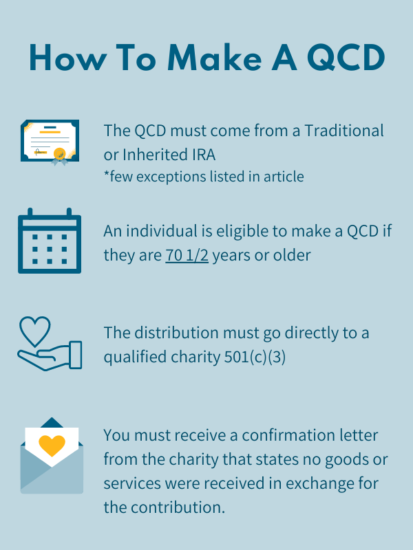

An individual is eligible to make a QCD if they are 70 ½ years or older. The Secure Act changed the Required Minimum Distribution (RMD) age to 72. However, the QCD eligible age remained the same. Each individual can contribute a maximum of $100,000 annually and is not limited to the amount of their RMD. If married, each spouse can contribute up to $100,000 individually.

A QCD must come from the following eligible account types:

-

- Traditional IRAs

- Inherited IRAs

- SEP IRA (inactive plans only*)

- SIMPLE IRA (inactive plans only*)

*401k and 403b accounts are not eligible for QCDs.

What type of charity can receive a QCD?

Qualified charitable distributions must be made to qualified charities as determined by the IRS. These charities fall under the 501(c)(3) portion of the US Internal Revenue Code that allows for federal tax exemption of charitable organizations.

Additionally, the charitable organization must not operate for the benefit of private interests. If you are unsure if the charity has 501(c)(3) status it is worth calling their staff to confirm. QCDs cannot be made to donor-advised funds (DAF).

To make a QCD, simply request that your IRA custodian issue a check from your IRA payable to the charity. You can request that the check be mailed to the charity or forwarded to you for you to personally deliver. For many financial custodians, they are able to provide a checkbook where you can write a check yourself directly to the charity. If the check is made payable to you then the distribution will not qualify as a QCD or receive the favorable tax treatment.

What are the benefits of making qualified charitable distributions?

There are three main benefits of making qualified charitable distributions. In conjunction, they provide a powerful tax benefit if you are eligible.

1. Reduce your income taxes

A normal IRA distribution is taxed at ordinary income levels. When using a QCD strategy, the distribution is paid directly from an IRA account to the qualified charity and excludes the donation amount from federal taxable income. Some but not all states offer the same exclusion for QCDs. New York State residents are able to take advantage of QCDs while New Jersey does not provide any exclusion.

Keep in mind that the entire IRA distribution amount will still be listed on your 1099-R tax form. It is important for you to communicate the donation to your tax professional as an adjustment is required on your tax return with the full amount in box 4a of your Federal 1040 and the reduced amount in box 4b for the taxable portion with a “QCD” label. Your custodian will be able to provide a record of the checks sent to any charitable organization.

This represents an opportunity for eligible individuals who are charitably inclined and/or already make charitable donations to take advantage of drawing from their IRA account to eliminate taxes associated with those specific distributions.

2. IRA owners can deduct QCDs from their Required Minimum Distribution (RMD)

Qualified charitable contributions are one of the only ways to reduce your required minimum distribution. Let’s say your RMD is $30,000 for the 2022. If you make $20,000 of QCDs in the same year, then your remaining RMD for 2022 would be $10,000. Alternatively, if your QCDs for 2022 totaled $30,000 then your remaining RMD for 2022 would be eliminated.

There is no limit on the number of QCDs you can make in a year, as long as the sum of the dollar amounts does not exceed the $100,000 maximum. Some individuals choose to make one large qualified charitable distribution while others have smaller recurring ones throughout the year. However, for the QCD to count toward the year’s RMD the funds must come out of your IRA by your RMD deadline which is generally December 31st.

To learn more about RMDs, you can read my colleague Nicole Gobel’s article here: Do I Need to Take a Required Minimum Distribution?

3. QCDs are more advantageous than cash Charitable Contributions

There are two reasons QCDs can provide a larger tax impact than making cash charitable contributions. Many taxpayers are no longer itemizing deductions due to the $10,000 limit on state and local income tax deductions. Therefore, if utilizing the standard deduction in 2021 you can only deduct up to $300 per person or $600 as a married couple in addition to the standard deduction. Many individuals donate a lot more per year but do not receive any tax benefit. Utilizing QCDs allows you to receive a direct write off for the entire amount of your donation.

In addition, because QCDs reduce taxable IRA distributions the deduction is taken before “Adjusted Gross Income” or AGI is calculated. AGI is an important figure as this amount is used when determining Medicare Part B and D premiums and whether an individual has to pay a higher rate than the base amount. In addition, if you are still itemizing other deductions, some such as medical costs are limited based on AGI so the lower amount allows a larger deduction.

One important note is that you are not allowed to receive a benefit from your qualified charitable distribution for it to be eligible.

In conclusion, if you are eligible to make QCDs and are charitably inclined, it is strongly recommended that you take advantage of this strategy. Not only will you have the ability to reduce your taxable income, but you can benefit from reduced or eliminated RMDs once you turn 72. If you would like to continue this discussion, please contact our team to set up a meeting.

Bouchey Financial Group has local offices in Saratoga Springs and Troy, NY.