RMD

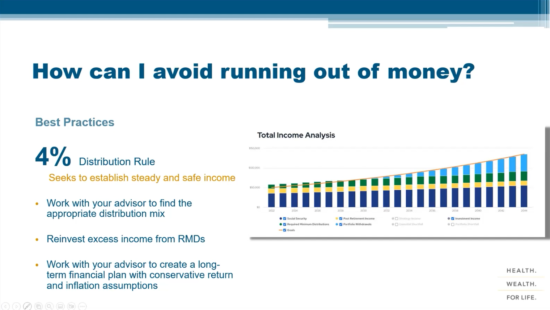

You have saved for this day and retirement is here! Now what? This webinar will guide you through the ins and outs of distribution planning in retirement and answer the commonly asked question, “How do I avoid running out of money?” We will discuss: How much you can withdraw from your accounts Which accounts you…

Written by: Samantha Masey Qualified charitable distributions are an excellent tax-advantaged strategy for IRA owners in or near retirement. If you are charitably inclined or already making charitable donations to support non-profits, a qualified charitable distribution (QCD) might make sense for you. A QCD is a distribution from an IRA paid directly to a qualified…

Written by: Nicole Gobel, CPA In every industry there are acronyms. In the investment advisory and tax planning world, RMD or MRD is often used. Both stand for Required Minimum Distribution. This is the minimum amount one must take as a distribution from various retirement accounts each tax year and is specific to each individual…