Market Commentary

Written by: Paolo LaPietra, CFP® Whether you have been listening to the news or talking with friends and family, inflation has found it’s way into the conversation. It makes sense, inflation affects so many aspects of our lives. While stopping at the gas pump, shopping in the grocery store, or in the market for a…

It’s Saturday morning and I wanted to share some thoughts that both Ryan Bouchey, CFP® CPA, our Chief Strategy Officer and VP, and I had on the markets with all the volatility over the past couple weeks. Investors’ emotions are being tested again as we retest the lows of June 16th and there’s a feeling…

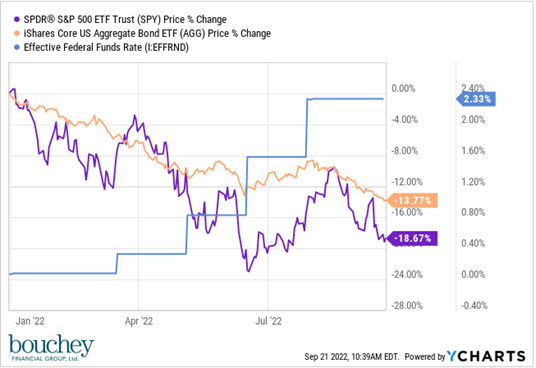

As seen in The Saratogian The Fed met this week and as expected, they hiked interest rates by 0.75%. I believe this was already baked into the cake, as they say. The Fed was late to this party and should have begun hiking rates last year but is now committed to fighting inflation as best…

Written by: Steven B. Bouchey, CFP® As seen in The Saratogian. The headlines in 2022 have been overwhelming; the Russia-Ukraine conflict, Covid-19 lingering on, China’s lockdowns adding to supply chain disruptions, and inflation at 40-year highs!!! So, what has changed on the inflation front? The May consumer price index (CPI) was red hot, rising +1%…

Capitulation means “to surrender or give up” when it comes to investing. I’m not sure how close we are to the low point of this market correction for the S&P 500 and bear market for Nasdaq, or just maybe we hit it already. We never know until time passes and we look back. I do…

After strong market volatility in the first quarter, the BFG investment team will provide guidance on what to expect with the markets and the economy with the Federal Reserve raising interest rates, higher inflation readings and the war in Ukraine. Listen to Steve, Marty and Paolo discuss these important topics.

Q3 Market and Economic Update

What a summer we enjoyed and here we are with foliage showing brilliant colors before the leaves start to fall, no pun intended. Before we know it, Thanksgiving will be here, and then the holiday season. Have you had your fill of pumpkin spice this and that yet? This is supposed to be our quarterly…