Advisor Blog

Catherine Buck suggests seven financial goals to strengthen your foundation for 2026: increase retirement contributions, contribute to a 529 plan, refresh your net worth statement to address high-interest debt, rebalance your portfolio, move cash to high-yield savings, utilize health insurance wellness programs, and make IRA contributions before the tax deadline.

Money is one of the most common sources of stress in a marriage. These 10 practical financial planning guidelines help couples improve communication, align long-term goals, and reduce financial stress as they build a life together.

Written by: Scott Strohecker, CFP®, EA As the year draws to a close, charitable organizations ramp up their fundraising efforts-and many individuals begin thinking about how to give back. For donors, year-endcharitable giving isn’t just an opportunity to make a meaningful impact; it’s also a valuable moment for thoughtful tax planning. While working with clients on…

Written by: Paolo LaPietra, CFP® Every generation gets its defining investment story, and right now it is AI. Not the harmless “let’s ask ChatGPT” version, but the trillion-dollar, power guzzling, data center everywhere version that is reshaping the market. The numbers have reached a point where they barely feel real. Nvidia reached a five trillion-dollar…

Prepare for the Changes from the One Big Beautiful Bill: What Can I Do? Written by: Vincenzo G. Testa, CPA, CFP®, ECA The One Big Beautiful Bill (OBBB) takes effect in 2025 and brings some of the most significant tax changes in years. While much of the law aims to simplify taxes, the real…

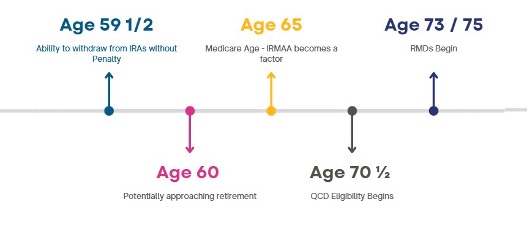

The Gap Years: Understanding Key Retirement Milestones to Maximize After-Tax Wealth Written by: Harmony Wagner, CFP, CPWA Many young professionals in their working years focus on building their wealth. As retirement approaches, the impact of taxes narrows the focus to maximizing the after-tax value of one’s wealth. With required minimum distributions on the…