The Retirement Gap Years

The Gap Years: Understanding Key Retirement Milestones to Maximize After-Tax Wealth

Written by: Harmony Wagner, CFP, CPWA

Many young professionals in their working years focus on building their wealth. As retirement approaches, the impact of taxes narrows the focus to maximizing the after-tax value of one’s wealth. With required minimum distributions on the horizon, a period of time referred to as the “retirement gap years” allows for strategic actions to help spread tax burden as efficiently as possible.

When IRA owners reach RMD age, they are required to pull a certain percentage of their IRAs each year, paying ordinary income tax on those withdrawals. The requirement presents a constraint on taxable income. In addition to RMDs, IRAs face a second implication when it comes to passing to beneficiaries. For most non-spouse beneficiaries (children, grandchildren, siblings, etc), IRAs must be distributed (and taxed) within 10 years of inheritance. These can present some tax situations where IRA dollars are taxed at high rates.

Due to the rules around IRA distributions and taxation, many IRA owners can benefit from pro-active IRA management that typically takes one of three forms:

- Roth Conversions – Converting IRA dollars (and paying taxes now) to a Roth IRA where all future growth and distributions are tax-free for the original owner and/or their beneficiaries

- IRA Withdrawals – Planning IRA withdrawals for cash flow needs prior to when they are required to cover cash flow needs

- Tax-Free Charitable Donations – Making any desired charitable donations from an IRA to move funds out on a tax-free basis

How can a retiree determine which of these strategies to use and when? It’s important to understand the ways that tax situations change throughout retirement based on changing income sources and other factors. Let’s discuss the key milestones in the gap years and how retirees can take advantage of this important window.

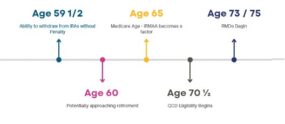

→ Age 59 ½ - At age 59 ½, IRA owners are able to withdraw from their IRAs without

early withdrawal penalties. While it may not make sense to withdraw from the

IRAs right away, it does open some doors to the possibility of utilizing IRA

withdrawals to fill up lower tax brackets whenever possible.

→ Age 60 – You may now be officially retired, or at least thinking about it. Once you

no longer have earned income, your tax picture may allow Roth conversions

and/or making withdrawals from IRAs at low tax rates.

→ Age 62 – you are potentially eligible to collect Social Security; however, it might

not make sense to collect benefits immediately. By holding off Social Security,

you can allow your benefits to increase, and also keep your taxable income low,

allowing for more IRA withdrawals in the early years.

→ Age 63 – Eligibility for Medicare doesn’t begin until age 65, but there is a 2-year

lookback period for IRMAA Medicare premium increases, meaning retirees must

start planning for income-related premium adjustments 2 years prior to eligibility.

This can be a limiting factor on taxable income as any additional income may

cause you to pay more in premiums in the future.

→ At age 70 ½ - IRA owners are allowed to make tax-free charitable donations

directly from their IRAs, reducing the IRA balance without paying taxes.

→ Age 73 or 75 – Depending on your birth year, you’ll be required to start RMDs at

either 73 or 75. At that point, any Roth conversions must happen after the RMDs

have been satisfied.

As retirees move through these important milestones, there may be “gap” years

where Roth conversions are more appealing due to the changing tax landscape as

Social Security, Medicare, and other elements come into play. By analyzing the tax

situation of each year individually, retirees can determine the best approach for

conversions, withdrawals, and charitable donations to strategically improve their after-

tax wealth.

Contact our office if you’d like to hear more about how a pro-active IRA

management approach can benefit you.