Bouchey Blog

Written by: Martin X. Shields, CFP®, AIF® When couples or individuals plan for retirement, they are primarily focused on their financial picture and whether they have the income and assets to cover their expenses. What they often fail to plan or consider are the other factors that will drive happiness and fulfillment in retirement. In…

Inflation is a term that has been dominating the financial news in recent months, and as investors, it is important to understand what the term inflation means and how it affects our investments. Key Takeaways: Understanding inflation and its causes Central Bank responses to support economic growth have increased inflationary pressures How inflation can affect…

Written by: Harmony Wagner, CFP® and Samantha Masey It’s not just billion-dollar corporations that are at risk for cybercrime. Businesses of all sizes and industries are at risk, and once a breach occurs, it can be detrimental, particularly to small businesses. Once a breach occurs, the costs incurred by the affected business may include financial…

Written by: Dave Clarke, Director of Operations & Chief Compliance Officer As the days grow shorter, we at the Bouchey Financial Group want to bring your attention to the very important issue of Cybersecurity. Since the pandemic began, the FBI has reported a 300% increase in reported cybercrimes (TheHill, 2020). To help protect and educate…

Written by: Dave Clarke, Director of Operations & Chief Compliance Officer As the days grow shorter, we at the Bouchey Financial Group want to bring your attention to the very important issue of Cybersecurity. Since the pandemic began, the FBI has reported a 300% increase in reported cybercrimes (TheHill, 2020). To help protect and educate…

Join Steven Bouchey, Marty Shields and Paolo LaPietra as they share insights to the current market and economic environment. Please feel welcome to follow along with the presentation slides by clicking here: 2021_Q2_Webinar Presentation

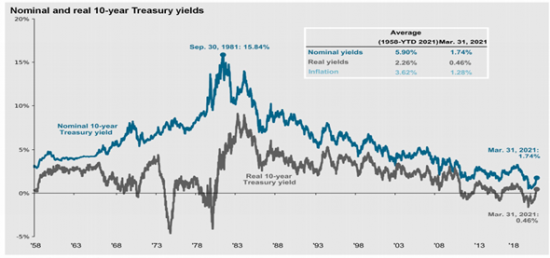

Author: Martin X. Shields, CFP For most investors, bonds play an important role in their portfolio of providing income and capital preservation in times of volatility. For the past 40 years, having a bond allocation in a portfolio has been very beneficial because the U.S. 10-year Treasury rate has declined from a high of more…