Bouchey Blog

Written by: Marty Shields, AIF, CFP® In this time of high inflation, rising interest rates and volatile equity markets, it is difficult to find investments that can provide a rate of return that is greater than inflation and not volatile. Well one does exist, and it has become very popular recently. It is the Series…

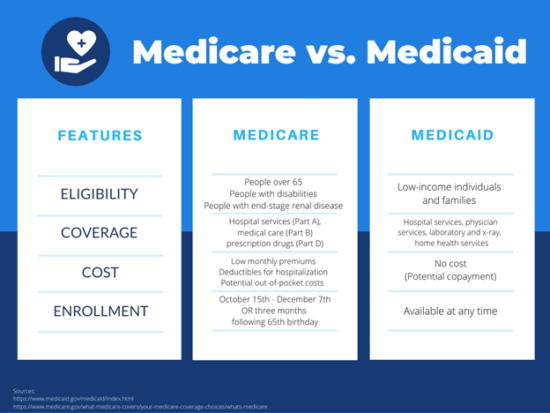

Written by: Jenny D. Foley, CPA As the baby boomer generation continues into retirement, a common financial planning question we hear is, what are the best options for medical insurance and long-term care needs for retirees? This article will answer: What is the difference between Medicare and Medicaid? Who is eligible for Medicaid? How does…

Written by: Samantha Masey Qualified charitable distributions are an excellent tax-advantaged strategy for IRA owners in or near retirement. If you are charitably inclined or already making charitable donations to support non-profits, a qualified charitable distribution (QCD) might make sense for you. A QCD is a distribution from an IRA paid directly to a qualified…

Written by: Harmony Wagner, CFP® Welcoming a new child into the world is an exciting time for parents, grandparents, friends and family. As we guide clients through many different phases and transitions of life, we often provide counsel to people who are interested in transferring wealth to the next generation. My husband and I just…

Written by: Nicole Gobel, CPA In every industry there are acronyms. In the investment advisory and tax planning world, RMD or MRD is often used. Both stand for Required Minimum Distribution. This is the minimum amount one must take as a distribution from various retirement accounts each tax year and is specific to each individual…

Written by: Vincenzo Testa, CPA In the 21st century, the cost of college tuition has nearly doubled. The annual growth rate of college tuition has been 6.8%. The cost of college tuition is growing at a rate that is significantly outpacing average annual inflation. If you plan to pay for a child or grandchild’s college…

Is This What Capitulation Feels Like???

Capitulation means “to surrender or give up” when it comes to investing. I’m not sure how close we are to the low point of this market correction for the S&P 500 and bear market for Nasdaq, or just maybe we hit it already. We never know until time passes and we look back. I do…