Posts by Samantha Masey

Qualified Charitable Distributions from IRAs

With another year coming to an end, year-end planning decisions are on the minds of many of our clients. During these planning discussions, I am surprised about how many people are unaware of what a qualified charitable distribution (QCD) is. Whether used to satisfy charitable goals or reduce taxes, it is a beneficial strategy to…

Read MoreLook to the Stars

We are all guilty of it, me especially. When looking for a product online, a restaurant to try, or a movie to rent, we look at a crowdsourced ranking to determine if it is worthy of our time and/or money. Quick aside: I once caught myself reading reviews for a set of dinner forks on…

Read MoreA Quick Guide to Dollar Cost Averaging

Written by Harmony Wagner As most investors know, it is nearly impossible to predict the perfect time to invest outside cash. When stocks are performing well, investors may be concerned that the market is at its peak; during a market correction, investors may fear how much more it could drop before recovering. The unpredictability of…

Read MoreRisk to the Upside

The first law of thermodynamics, also known as the Law of Conservation, states that energy cannot be created nor destroyed, it can only be transformed. Within investments, that same law applies to risk. To start, risk is a tricky thing to define. The financial world has settled on a measure of volatility called standard deviation.…

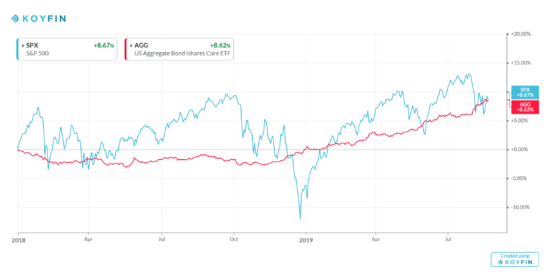

Read MoreWhy do we Own Bonds?

Written by: Ryan Bouchey It’s a question we often hear from clients – “Why do we own bonds?” This became a common theme at the start of 2018 as interest rates were rising and the price of bonds were declining. The general rule of thumb is the price of bonds move in the opposite direction…

Read MoreThe Necessities for a Bear (and Bull)

Certain words and phrases are used so frequently in everyday conversations that we often don’t know the origins. Think about how often we utter things like, “it’s raining cats and dogs” without knowing why. Even the internet can’t agree (crazy, right?) on the genesis of that expression and many other idioms. With that being said,…

Read MoreQ2 2019 – Quarterly Webinar Recording

Visit the link below to watch our latest webinar and hear Ryan Bouchey, Martin Shields, and David Rath give their thoughts on recent moves by the Federal Reserve and the current economic outlook.

Read More