Posts by Samantha Masey

Good vs Bad Debt: Does Good Debt Exist?

Written by: Samantha Masey – Associate Wealth Advisor I recently had a conversation with someone who shared that his parents taught him that all debt is bad, and it has significantly influenced his financial decisions. Since becoming a financial planner I hear this sentiment more and more from clients, friends, and family. Many people believe…

Read MoreA Son Gone Too Soon

Ayshawn Davis was an 11-year-old boy who was tragically shot in Troy, NY. Steve, a community advocate, connected with the family to help guide them through something they weren’t prepared for. Steve was instrumental in getting the City of Troy to dedicate a tree in the park near where Ayshawn lost his life and secure…

Read MoreAmerican Cancer Society Gala of Hope 2021

Bouchey Financial Group is a long time supporter of the American Cancer Society. On November 13, 2021 Steven Bouchey, a past Beacon of Hope honoree, was proud to recognize this year’s recipient and good friend, CJ DeCrescente. As Steve often says, “Cancer doesn’t discriminate and once you are part of the Cancer Club, you’re…

Read MoreAlbany Business Review’s Best Places to Work

Bouchey Financial Group is proud to be honored as one of the Albany Business Review’s 2021 Best Places to Work! We are proud of our team, and their hard work and dedication to our clients. Our staff is second to none and we give them all the credit for creating a thriving and encouraging work…

Read MoreShould My Investment Allocation Become More Conservative in Retirement?

Written by: Harmony Wagner, CFP® Retirement is one of the biggest financial transitions for many people, and one that often leaves people wondering if they should become more conservative with their investment allocation. Going through this type of significant life transition can make people feel like they must make a major corresponding adjustment in their…

Read More3 Reasons Why You Should Consider a Roth Conversion

Written by: Nicole Gobel, CPA – Wealth Advisor & Tax Planner As seen in The Saratogian At least twice a week, I have a client who asks me whether a Roth conversion is something they should consider in their financial planning. This is also a topic that I often bring up in conversations with clients. …

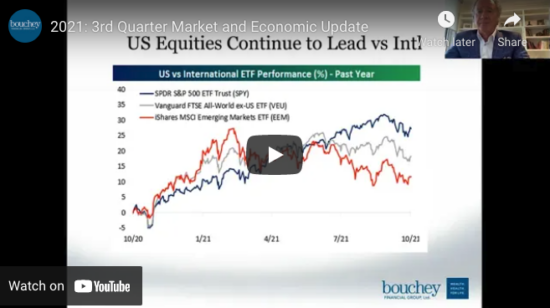

Read MoreQ3 2021 – Quarterly Webinar Recording

Join Steve Bouchey, Jason Alonzo, and Paolo LaPietra as they recap the 3rd Quarter economic activity and give their opinions about Q4.

Read More