Q2 2025 Market Update

What a Ride It's Been

Written by: Ryan Bouchey, Chief Investment Officer

Market Update

What a ride 2025 has been so far – and to think we’re only halfway through it! Truth be told, I feel much better about where we stand today than I did three months ago when I wrote our last quarterly update. At that time, while I was optimistic that we’d see a resolution to the tariff discussions and the looming threat of another trade war, there was still enough uncertainty to keep us cautious.

Looking back to the lows of April 8th, it’s hard to believe how far we’ve come in just a few months. When we closed our last quarterly letter on April 10th, we wrote:

“In this environment, we still feel staying the course is the best strategy. We don’t want to overreact during this time knowing how quickly the markets can rebound with any positive development.”

At the time, we didn’t know the market had just bottomed out for the time being. While there is still some uncertainty surrounding tariffs today, the market has largely shrugged it off in light of the delays and ongoing negotiations we’ve seen throughout the year. It feels as though much of the tariff-related market volatility is behind us. However, we continue to contend with high valuations. At the same time, as we’ve seen in just the last week or so, the market has been encouraged by the accommodative “Big Beautiful Bill,” which we’ll discuss further in this update

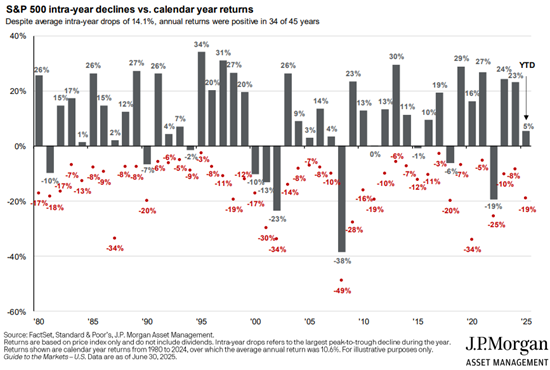

I’ll be honest – I wish I had a crystal ball earlier this year when things felt worse. It would have saved me a few restless nights thinking about the markets. But as we’ve shared time and time again, market volatility is part of the investing journey. While “staying the course” is much easier said than done, history continues to show that it’s the strategy that pays off more often than not. Looking back at the past 35-plus years of market returns, this lesson remains as true today as ever as we’ve averaged a 14% decline annually, while most years the market returns end in a positive.

Equity Overview

The markets came awfully close to the classic definition of a bear market to start the year, with a drawdown approaching 20%. While we may have briefly hit that level intraday back in April, the lowest closing decline from market highs ended up around 19.5%.

What’s been most interesting this year is the stark contrast between the first and second quarters – not just in overall market performance, with a steep decline in Q1 followed by a sharp recovery in Q2, but also in terms of market leadership. As you might expect, more defensive sectors held up best during the initial decline, with a notable rotation into classic cyclical sectors, particularly technology, as the market rebounded in the second quarter. Should the rally continue, we’d expect this rotation to persist.

As we closed out Q2, markets entered somewhat of a holding pattern through May and June – still experiencing their ups and downs, but far from the heightened volatility we saw earlier in the year. That holding pattern recently broke, as markets digested developments around the “Big Beautiful Bill,” viewing it positively given its nature as more of a stimulus package than a restrictive measure.

While I don’t see this bill as a catalyst for the 20%+ returns we experienced in 2023 and 2024, having accommodative fiscal policy alongside continued growth in AI could certainly provide a solid foundation for a further bull market. Given that stock valuations remain elevated, we will need to see continued earnings growth to support them. The good news is that, so far, economic data has remained strong, alongside healthy first-half earnings from corporate America.

Economy, The Big Beautiful Bill & The Fed Dynamic

A theme we’ve talked about quite often over the course of the year has been the soft data vs. hard data debate. One of the reasons we remained cautiously optimistic throughout the stock recovery in the 2nd quarter was that time and time again, the hard economic data continued to come in stronger than expected. Not only was it stronger than anticipated, but we never saw much of a slowdown or impact from the tariff uncertainty. While the soft data (consumer sentiment, business surveys) continued to come in at low levels, the carryover to hard data never materialized, helping to keep the market intact.

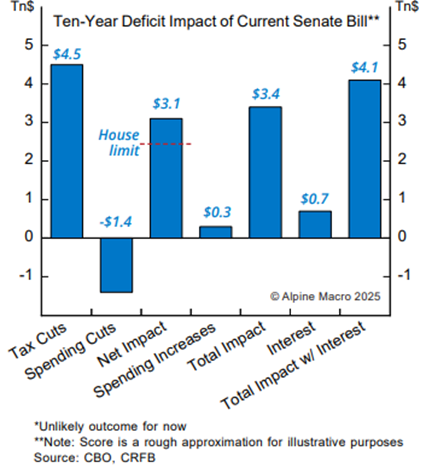

Although some uncertainty around tariffs remains, much of the focus has shifted to the Big Beautiful Bill and its passing last week. We will be providing an informational webinar on this topic on August 6th – stay tuned for an invite! Getting this policy passed has helped boost sentiment, leading to new all-time highs in the markets. A far cry from a few short months ago. As the bill is intended to stimulate the economy, the markets have breathed a sigh of relief. Where I think many folks have concerns over the bill, and the long-term effects are how it impacts the current deficit, which is already out of control. The administration says that economic growth will offset any additions to the national debt, however most forecast that it will add to the debt over the next 10-years, such as the chart and data from the CBO.

The other major headline out of Washington lately has been, for lack of better term, differing of opinions between President Trump and Federal Reserve Chair Jerome Powell. Trump insists that the Fed should be cutting rates, while Powell continues to tout the strength of the economy and hesitancy to cut rates. As we saw last year, the cutting of interest rates didn’t bring longer-term rates down. In fact, the 10-year has risen close to 1% since the Fed cut rates by 1%. The Fed fears overstimulating the economy, bringing back inflation, and with a stimulus inducing fiscal bill, they may not be in a rush to cut interest rates anytime too soon. The good news is that the markets haven’t seemed to mind and seem less interested in the daily or weekly interest rate movements like they were over the past few years.

With markets back at all-time highs, should we be cautious? It depends, but as we’ve shared in past newsletters and presentations, investing at all-time highs typically is good for investors. Momentum in the markets is a powerful thing, and while it seems counterintuitive to invest when markets are at highs, it has proven to be profitable throughout the course of history.

Future Outlook

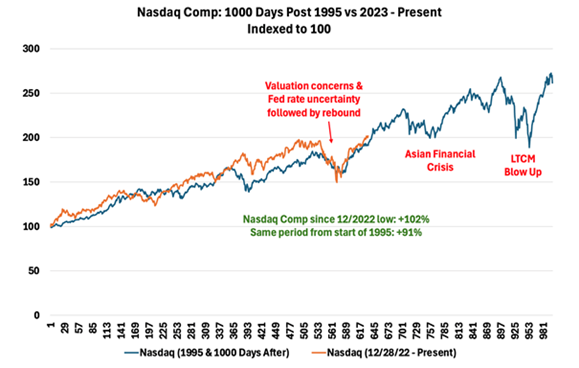

I recently saw an interesting graph comparing today’s market with the market of the mid-90’s. Over the past few years, when interest rate discourse was at its highest, we compared and discussed the current environment to the mid-90’s environment. This pertained to both the rise in interest rates but also what the equity markets were doing at the time. The other similarity was that both time frames had a built-in market catalyst – the 90’s was the advent of the internet and today is the AI technology revolution. Here’s a chart depicting what the Nasdaq today looks in comparison to the Nasdaq through 1995:

The path’s look eerily similar, and I’m sure the thought from many of you may be “but didn’t this end poorly?” And while it eventually did, it took another four years and the type of market enthusiasm which we are still a long way from seeing. The other major difference: the companies driving the market bubble of 2000 were made up of many unprofitable companies versus the leaders today driving the market to new highs are highly profitable, cutting edge technology companies. Should we continue to see earnings growth and AI advances, I believe we still have a catalyst to get behind for further gains.