Avoiding Unforced Errors and Staying in the Game: What Eli Manning Can Teach Us About Investing

Written by: John Millet, CPA

As a lifelong New York Giants fan, I’ve always appreciated the career of Eli Manning. Not just for the two Super Bowl wins or the iconic moments, but for something less flashy: his steadiness. Eli was legendary for his durability, starting 210 consecutive games as quarterback for the New York Giants. He wasn’t the most athletic or the most vocal leader, but he was consistently prepared, rarely rattled, and tried to avoid costly unforced errors. That kind of dependability kept him in the game, year after year, and is a big part of why many (including the author of this Blog) believe he deserves a spot in the Hall of Fame.*

I think there’s a powerful lesson there that can translate to investors, especially in times like these when the market feels unpredictable. With all the recent volatility driven in part by the Trump administration’s tariff policies and broader global economic uncertainty, the temptation to “do something” can be strong. But long-term success in investing, just like in football, often comes down to avoiding unforced errors and simply staying in the game.

What Are Unforced Errors in Investing?

Unforced errors are mistakes we make not because of the market, but because of how we respond to market changes. They’re behavioral missteps. Which could be decisions made under stress, fear, or overconfidence, that can derail a well-constructed financial plan. In volatile markets, these types of missteps tend to multiply.

Here are some of the most common ones to watch out for:

1. Trying to Time the Market

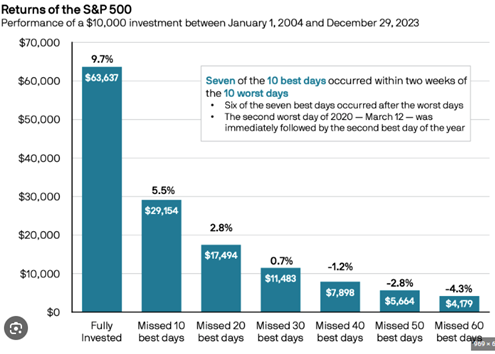

We’ve all heard the old saying, “Buy low, sell high.” The problem is, no one rings a bell at the top or the bottom. Trying to jump in and out of the market based on short-term news or predictions rarely works. In fact, missing just a few of the market’s best days can significantly hurt your long-term returns. Staying invested, even when it feels uncomfortable, is the better strategy.

The chart below illustrates just how much of a difference it makes when investors miss just a handful of the market’s most valuable days.

2. Letting Emotions Drive Decisions

Fear and greed are powerful forces. When markets drop, fear tells us to sell. When markets soar, greed whispers that we’re missing out. Reacting emotionally can lead to poor timing and unnecessary changes to your investment plan. Staying disciplined, especially when it’s hard, is one of the best things you can do as an investor.

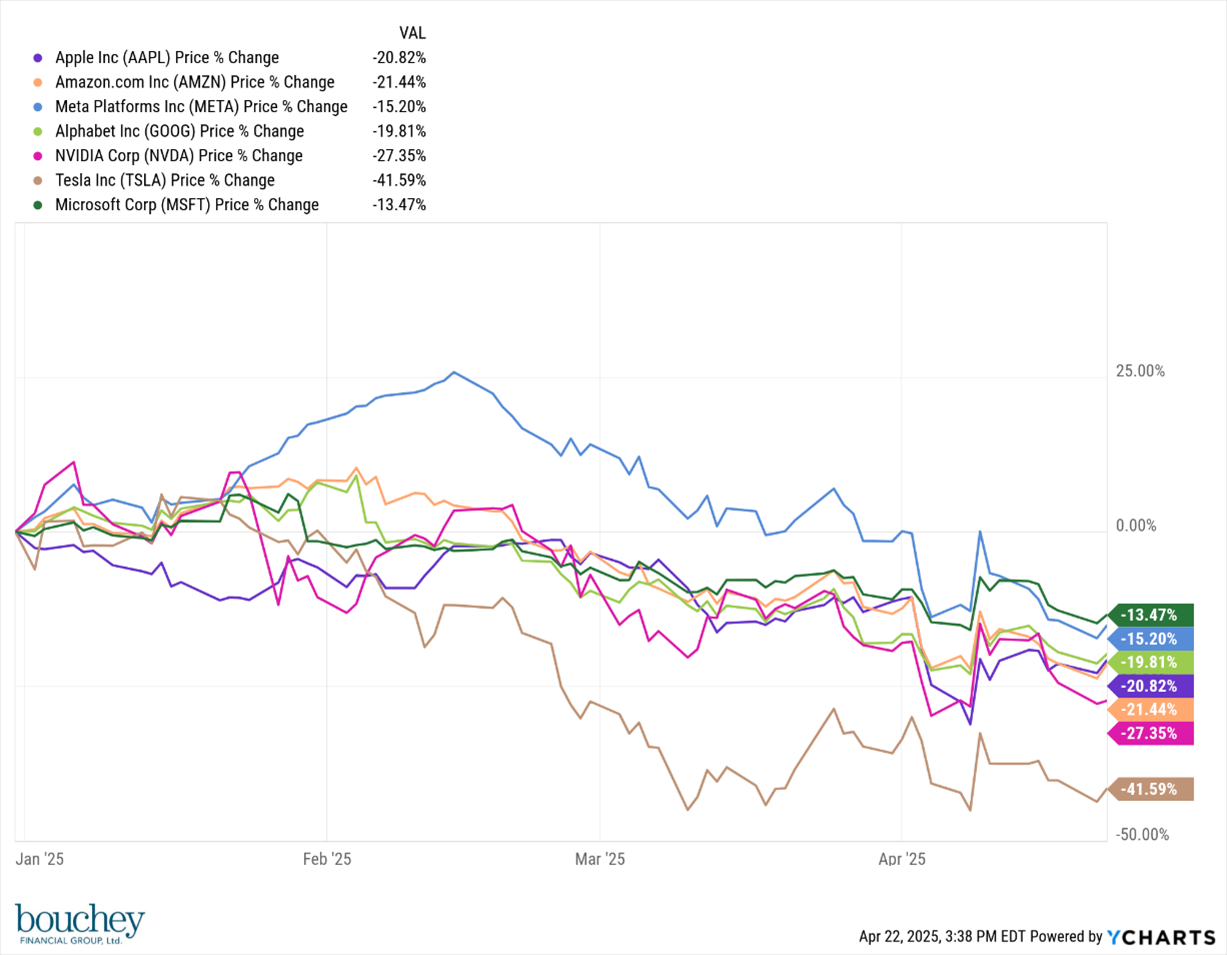

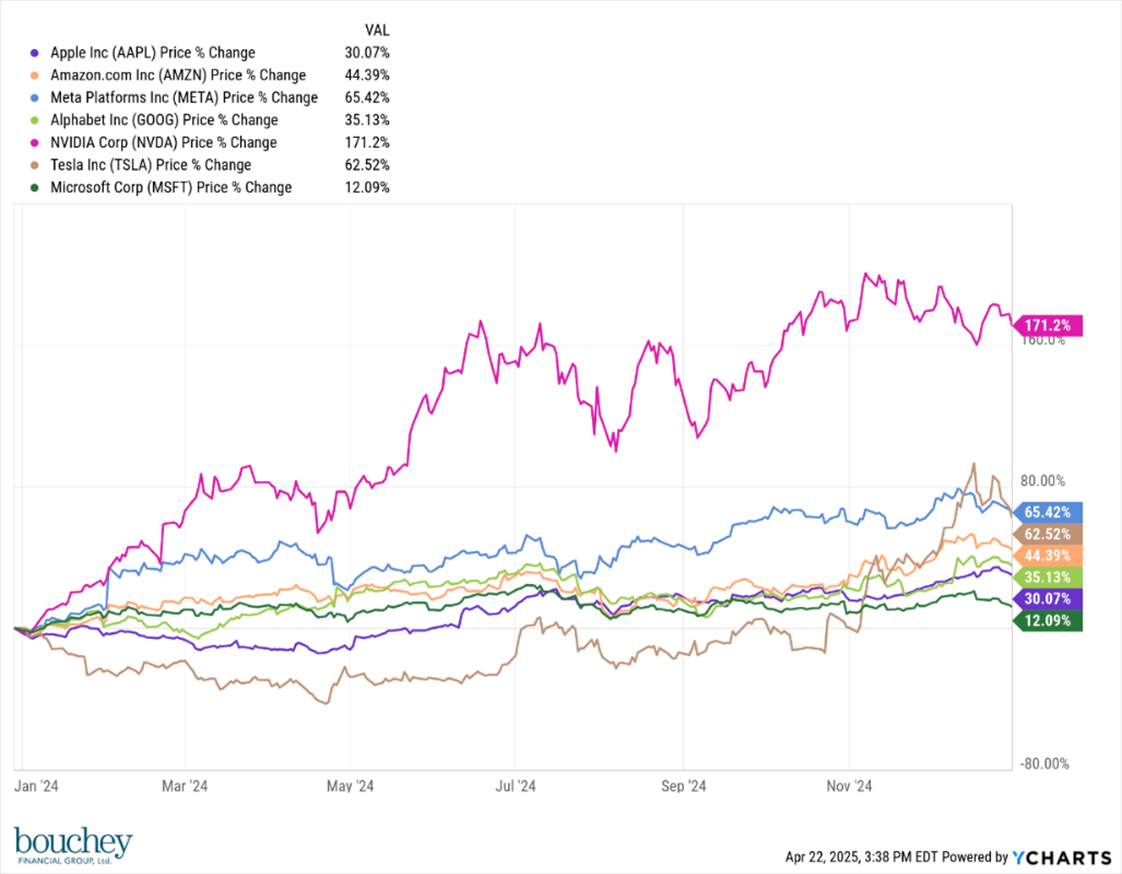

3. Chasing Performance

It’s natural to want to own whatever stock did best last year, but this often leads to buying high and selling low. Today’s winners may not be tomorrow’s leaders, and performance tends to be cyclical. A well-diversified portfolio built for your goals and risk tolerance is far more reliable than chasing whatever’s hot. The charts below show the performance of the "Magnificent 7" stocks in 2024 compared to 2025. This highlights the risks of chasing last year’s stellar returns, as strong performance in one year does not guarantee continued success the next.

2024 Magnificent 7 Stock Performance

2025 Magnificent 7 Stock Performance

4. Neglecting Your Plan

Every investor needs a roadmap. A clear financial and investment plan that aligns with your goals. Without one, it’s easy to drift from strategy to strategy, reacting to headlines or market moves. A solid plan helps anchor your decisions and provides the discipline to ride out the ups and downs.

The Power of Staying in the Game

Eli Manning didn’t make headlines every week, but he showed up every Sunday, did his job, and avoided the big mistakes. That’s how he helped his team win when it mattered most. Investors can take a similar approach. You don’t have to make spectacular calls or time the market perfectly. You just have to avoid the major pitfalls, stick to your plan, and stay invested.

At our firm, we help clients navigate challenging markets by focusing on long-term fundamentals and sound financial and tax planning. We know that markets will fluctuate, headlines will shift, and uncertainty will always be part of the equation. But we also know that those who stay the course and avoid unforced errors are the ones most likely to succeed.

If you ever find yourself unsure during turbulent times, reach out. We’re here to help you stay focused, stick to your plan, avoid unnecessary mistakes, and keep moving toward your goals—just like Eli, one play at a time. You can schedule a free consultation by calling our office at 518-720-3333.

*Hall of Fame update - In his first year of eligibility, Eli Manning was named a finalist for the Pro Football Hall of Fame Class of 2025. However, during the final vote in February, he was not selected for induction. While he didn’t make it this year, there’s strong hope for a future class. Go Eli!!

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.