What to Expect with Fixed Income Investments When the Federal Reserve Cuts Interest Rates

Written by: Catherine Buck, CFP®

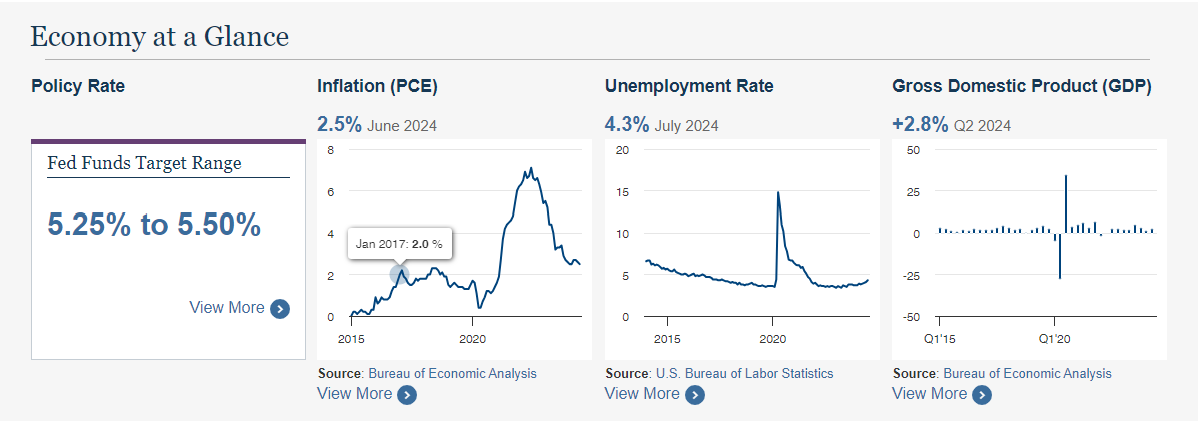

The Federal Funds Rate is the interest rate banks charge other institutions for lending overnight and is set by the Federal Reserve (Fed). It is one of the primary monetary policy tools the Fed uses to maintain their dual mandates of promoting maximum employment and price stability. Price stability means keeping inflation around their target rate of 2% and full employment means keeping unemployment below 5%.

The Federal Reserve began raising the federal funds rate in March 2022, increasing it eleven times until July 2023 from 0.25% to 5.25%. With inflation trending towards their 2% target and unemployment starting to move higher, the Fed has indicated that they would likely be lowering interest rates this September. For those with bonds in their portfolio, a cut in interest rates will impact those holdings.

We will cover:

- Bonds Prices & Interest Rates

- How Markets Will Respond with a Rate Cut

- What to do with Money markets or High Yield Savings

The Relationship Between Bond Prices and Interest Rates

The relationship between bond prices and interest rates is inversely proportional, meaning that when interest rates rise, bond prices fall, and when interest rates decline, bond prices move higher. This dynamic occurs because bonds have fixed coupon payments, so when new bonds are issued with higher interest rates, existing bonds with lower rates become less attractive to investors. Consequently, the prices of existing bonds drop to offer a comparable yield to new issues. Conversely, if interest rates fall, existing bonds with higher coupon rates become more valuable, pushing their prices up.

Market Expectations with Rate Cut

As noted above, when the Fed cuts interest rates existing bonds with longer maturities and higher coupon rates become more valuable because new bonds issued will have less attractive yields. Investors who were disciplined and added longer dated bonds with rates below money market funds will now benefit as the value of those bonds will increase and the yield for those bonds is locked in for the bond's term. This is not the case for money market funds, whose rates are variable.

Other areas of the market will benefit as well, including small cap companies. Since these companies have larger debt, a decrease in interest rates can provide financial relief for companies carrying sizeable debt. Companies with higher dividend yields such as utilities will also benefit as their dividends now look more attractive.

What to do with your Money Market or High Yield Savings Account

With the higher interest rate environment, some money market funds, and high yield savings accounts have been yielding greater than 5%. However, if interest rates are cut this September, the yields on these products will decrease. Bouchey Financial Group recommends keeping three to six months in an emergency fund. These funds can be kept in money market funds but anything above this amount should be invested either in a short-term bond ladder or longer dated bonds depending on their investment time horizon.

Conclusion

The Federal Reserve's potential decision to lower interest rates this September will have implications for various investment vehicles, particularly bonds, money market funds, and high-yield savings accounts. Understanding the inverse relationship between bond prices and interest rates can help investors navigate the changing landscape, ensuring they capitalize on opportunities in bond markets while also reassessing their strategies for cash reserves. Whether it's reallocating funds from money markets to short-term bonds or considering alternative investments, it's crucial to stay informed and consult with a financial advisor to make decisions that align with your financial goals in this evolving economic environment.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.