Should Investors Be Concerned About the rising U.S. National Debt?

Written by: John Millet, CPA

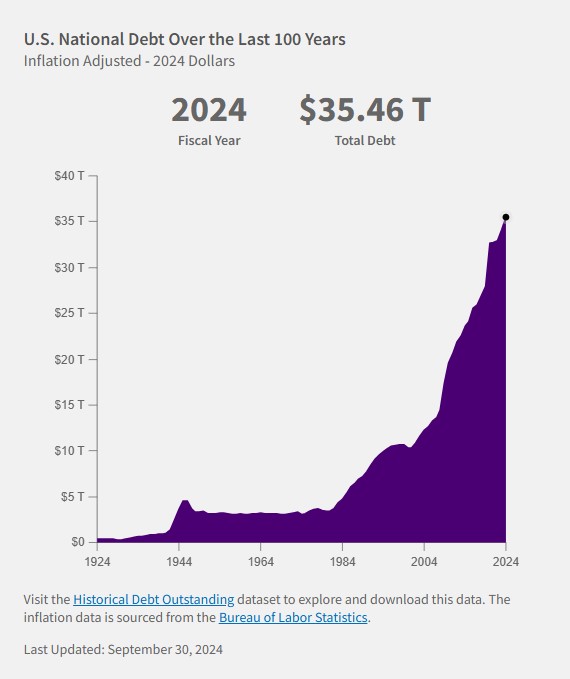

The U.S. national debt has been an important topic in economic and financial discussions. As of early 2025, the national debt now exceeds $36 trillion. As individual investors, we are advised to effectively manage our debt levels. Should we be concerned about the level of the US National debt and specifically the rate at which it is increasing?

Over the past decade, the U.S. national debt has grown significantly, increasing from approximately $17 trillion in early 2014 to now over $36 trillion. This represents more than a doubling of the total debt, driven by factors such as increased government spending on social programs, defense, and COVID-19 pandemic relief efforts, coupled with slower-than-expected growth in revenues.

For investors, understanding the nuances of the national debt and its implications is essential to make informed financial and investment decisions.

What Is the National Debt?

The national debt represents the total amount of money the federal government has borrowed to cover expenses exceeding its revenues over time. It accumulates when the government spends more than it collects in revenue, primarily through taxes, which results in a budget deficit. This shortfall or deficit is financed by issuing Treasury securities such as bills, notes, and bonds. These instruments are considered among the safest investments globally because they are backed by the "full faith and credit" of the U.S. government.

To put it simply, the national debt is like a credit card balance. If someone spends more than they pay off each month, the unpaid amount becomes a deficit. Over time, these deficits add up to a larger debt.

The Role of the Debt Ceiling

The debt ceiling is a legislative limit on how much debt the U.S. government can incur. It does not authorize new spending but allows the Treasury to borrow funds to cover obligations already approved by Congress. Periodically, the ceiling must be raised or suspended to prevent a default on the government’s obligations. In 2025, the U.S. has again approached the debt ceiling limit, requiring prompt action from Congress and the President to address this issue. With fiscal policy a continuing point of contention, reaching a resolution will be a critical early priority for the new administration.

Though raising the debt ceiling has traditionally been routine, it has increasingly become a contentious political issue. Prolonged debates or delays in raising the ceiling can create uncertainty in financial markets, with fears of potential government defaults.

A deal previously reached by Congress suspended the U.S. debt limit through January 2025, after previously capping it at $36.1 trillion. While a last-minute deal in December was struck to avoid a government shutdown, it failed to eliminate the returning debt-ceiling threat. Treasury Secretary Janet Yellen, in a late December letter to Congress, warned the U.S. could reach its new limit between Jan. 14 and Jan. 23, “at which time it will be necessary for the Treasury to start taking extraordinary measures” to keep up with its bills and obligations. It is expected that the Treasury’s actions may delay any debt ceiling issue until mid-2025.

The Cost of Servicing the Debt

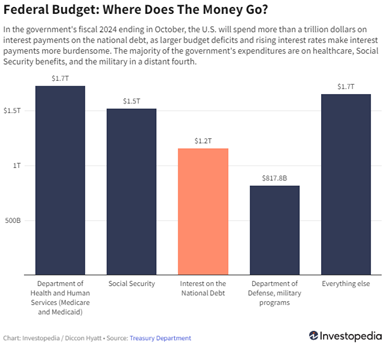

A significant concern with rising national debt is the increase in the interest cost associated with servicing the debt. In 2025, annual interest payments on the national debt are projected to exceed $1 trillion, making it one of the largest items in the federal budget.

To put this in perspective:

- Interest on the debt has surpassed spending on defense and Medicare.

- Spending on interest is now the second largest line item in the budget.

- It also surpasses discretionary spending on education, infrastructure, and other vital areas.

This trend is driven by the growing size of the debt and higher interest rates set by the Federal Reserve to combat inflation. Rising interest costs take resources away from other priorities, compounding fiscal challenges.

Implications of Rising Debt

- Higher Interest Rates: As debt levels grow, so do concerns about the government's ability to service it. Investors may demand higher yields on Treasury securities to compensate for perceived risk, pushing up interest rates. Higher rates ripple through the economy, increasing borrowing costs for businesses and consumers.

- Inflation Risks: Financing the debt through central bank purchases of Treasury securities can lead to inflation if money supply growth outpaces economic output. Inflation erodes the purchasing power of fixed-income investments like bonds and savings accounts, forcing investors to seek higher returns to offset the impact.

- Potential Tax Increases: To manage rising debt levels, the government may increase taxes. Higher corporate taxes can reduce earnings, potentially lowering stock valuations. Additionally, increased individual taxes can decrease disposable income, impacting consumer spending—a significant driver of economic growth. As an investor with tax-qualified accounts, such as IRAs and 401(k)s, rising tax rates can create a risk to your long-term financial strategy. Withdrawals from these accounts are typically taxed as ordinary income, meaning higher tax rates could reduce the net income available to you during retirement.

Debt as a percentage or GDP or Total National Assets?

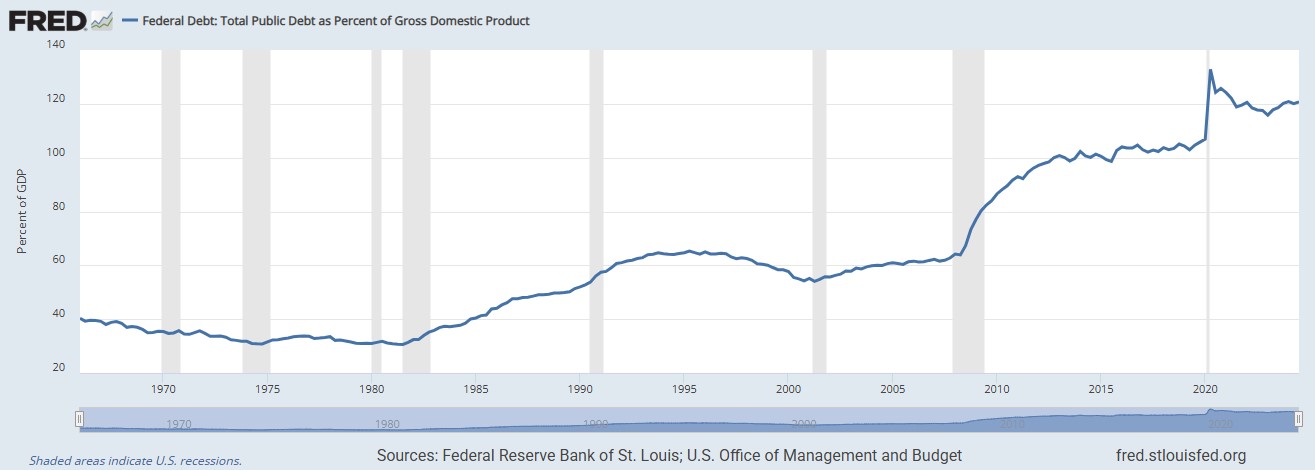

While the debt-to-GDP ratio exceeds 120%, higher than historical averages and signaling a growing reliance on borrowing, it’s important to view this in context. The U.S. also possesses immense resources, with total national assets estimated to exceed $200 trillion. This means the debt represents a lesser percentage of the country’s overall wealth—a reassuring perspective. Furthermore, U.S. Treasury securities remain a cornerstone of global financial markets, valued for their stability and liquidity. While the rising cost of servicing the debt deserves attention, the nation’s robust economy and global investor confidence continue to provide a solid foundation.

How Investors Can Navigate the Risks

Investors should stay vigilant and consider strategies to mitigate risks associated with rising debt levels:

- Diversify portfolios to spread exposure across equities, bonds, and alternative investments.

- Explore opportunities like Roth conversions to hedge against potential increases in individual tax rates.

- Monitor developments in fiscal policy and debt ceiling debates to adapt investment strategies accordingly.

Final Thoughts

The U.S. national debt is certainly a complex topic with wide-ranging implications, but it doesn’t signal a dire outlook for investors. The United States remains a global economic leader, supported by robust financial markets that consistently attract investment.

That said, the increasing cost of servicing the debt highlights the importance of sound fiscal management and thoughtful policy decisions. For investors, staying aware of developments such as debt ceiling discussions and shifts in fiscal policy is an opportunity to adapt and strengthen their financial strategies.

By staying informed and proactive, investors can confidently navigate the evolving landscape, turning potential challenges into opportunities to safeguard and grow their wealth.

If you are interested in learning more about how the National debt may affect your financial situation, please contact our team to set up a call.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.