Q3 2025 Market Update

Shutdown, Slowing Jobs... And All-Time Highs?

Written by: Ryan Bouchey, Chief Investment Officer

Market Update

We begin the fourth quarter in the midst of a government shutdown, slowing of the labor market, worrying headlines and….all-time highs. Quite the backdrop for the current state of markets and the economy, but one that doesn’t feel all that far outside the realm of possibilities. The major themes of the year have primarily hinged on what’s going on in Washington, an area we ask clients not to pay too much attention to. While at the end of the day, I think we get to the same place, many of the headlines of market volatility have derived from Washington, both the good and the bad.

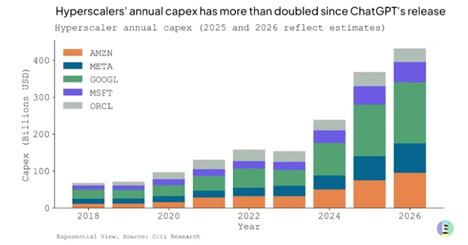

The First quarter started with a lot of hope and anticipation, followed by uncertainty surrounding tariffs. Once we bottomed out and saw that the administration was willing to negotiate, stocks recovered and have been a solid recovery ever since – helped in part by the Big Beautiful Bill at the end of the 2nd quarter, and more recently by deals being made between the government and public companies (Intel, Nvidia, Pfizer). As we enter the 4th quarter, the headlines have been dominated by the shutdown, yet the market hasn’t blinked, and given the history of past shutdowns, it’s unlikely to. What has been driving most of the positive headlines has been the AI revolution, which the following chart captures well and we’ll discuss later in the update.

Equity Overview

It takes all-time highs to reach new all-time highs, and it’s the exact environment we find ourselves in today, despite a shutdown and slowing labor growth. The markets have continued their winning streak through the 3rd quarter as we enter the final stretch of the year. Since the volatility subsided in April and markets bottomed out post liberation day, we’ve been in a steady growth mode these last 2 quarters, with little volatility to speak of. Could that change? It may. Based on some data as it relates to correlations between different sectors, it wouldn’t be a surprise to see a little volatility on the horizon. But in terms of the overall market, there is still quite a bit of momentum and excitement around the AI trade which continues to propel the market forward.

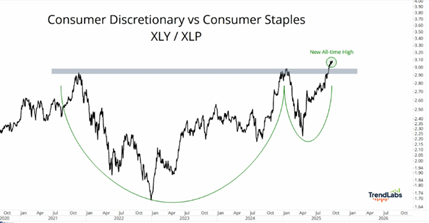

For all the markets have been through this past year, stocks have generally performed as expected in Q3, given all the data and information we have in front of us. Most of the upside and growth came from three sectors - tech, communications (META, GOOG), and consumer discretionary (AMZN). The following chart shows the recent trend of consumer discretionary stocks(+10.3% Q3) versus consumer staples (-3.2% Q3). I think the chart tells you all you need to know about the current state of the market and economy – the consumer, which makes up 2/3rd’s of our GDP is driving this economy and stocks higher. This type of trend typically happens in times of growth and optimism, as staples act as more of a defensive sector within the market.

Economy, Government Shutdown & The Labor Dynamic

The two biggest economic headlines at the moment are currently intertwined, for better or worse. On the one hand, we have the government shutdown, which could take some time sort out. It feels like both sides are digging in on issues important to them and it’s hard to say who blinks first. With the House being out of session this week, and the Senate needing 60 votes to pass, it’s likely this could continue until next week. The good news is, of the previous 20 government shutdowns from the last 40-years, the ones lasting over two weeks have averaged a market return of 2.9%. So far, the market hasn’t shown much concern.

Due to the government shutdown, the Bureau of Labor Statistics did not release the September jobs report, which is one of the most influential indicators of the economy, especially at a time when we were beginning to see signs of a slowing labor market. If you remember, the two previous labor reports were not good and showed clear signs of a declining labor market. September’s report would have been nice to see if things had stabilized or if the weakness continued. With labor having a major impact on overall strength of our economy, it’s important to note that it may be a while before we have good data on this front as a prolonged shutdown could impact October’s jobs report. Time will tell.

As for the current state of our labor market, it may not be as bad as it looks on the surface. Both the July and August jobs reports showed considerable slowdown. Some of this weakness can be attributed to factors such as the Trump administrations crackdown of the border, limiting immigrants joining the workforce. We’re also seeing many older workers reach and enter retirement age, so demographics could be playing a role. Lastly, the rise of AI can be connected, to some degree, to the slowing of hiring for entry level jobs. Aside from these main factors, what the data is showing so far is a low hiring, low firing environment, which aligns with the soft-landing narrative which was so popular a year ago. This may be the current base-case for the economy moving forward.

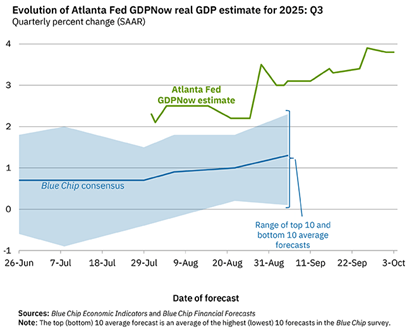

While labor has seemingly stalled for the moment, GDP continues to chug along at a considerable pace. The Atlanta Fed estimates for 3rd Qtr. GDP is currently at 3.8%. These initial reports typically come with revisions, sometimes large, however it’s a good sign to see there are positive signs within the economy, despite the negative headlines.

Future Outlook – AI & Fear of Bubbles?

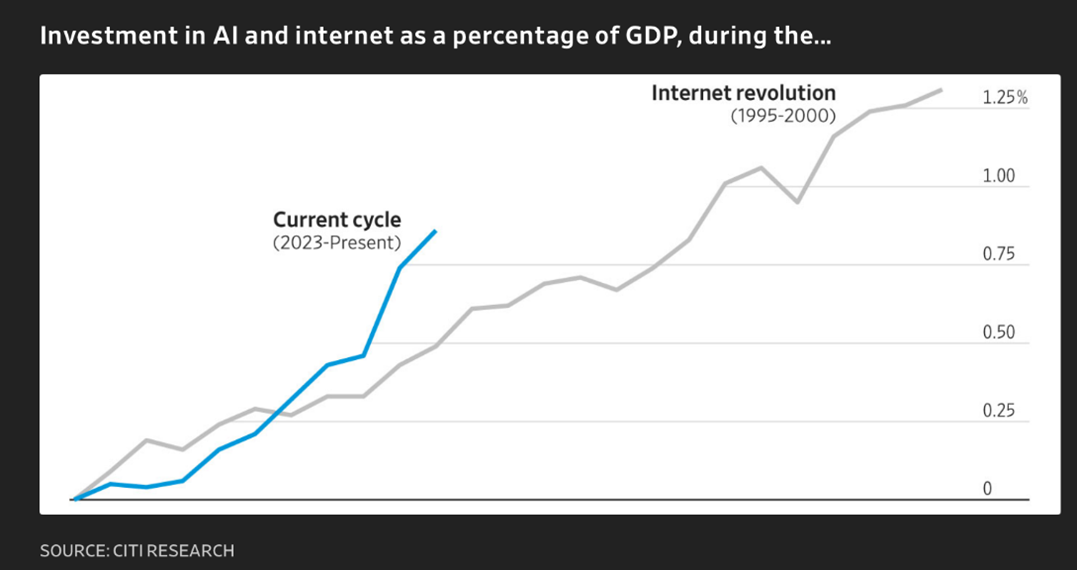

Aside from the noise in Washington, there is no question that the theme of this current market cycle is the AI revolution taking place before our eyes. You can look at any area of the market today and see the impact – energy, infrastructure, technology, communication services – all around this theme of AI. Along with the positive elements of the AI revolution, we’re also starting to see more and more fears of a bubble, with similarities being pointed to the tech bubble of the 90’s. You can see from the chart below just how prevalent the current investment in AI is on our overall GDP, as well as some of the parallels to spending during the internet revolution of the late 90’s.

Where do we go from here? We’ve talked in the past about how we take into account three elements when looking at the markets – fundamentals, technical and human behavior. From a technical perspective, it wouldn’t be a surprise to see some volatility in the immediate short-term. Not volatility in the sense of a market crash or pullback, just a short-term sell-off. When you look at technical factors of how stocks have traded in the past 6-months and of the correlation metrics, which point to the possibility of some volatility, anything in this realm is treated as normal market ups and downs, and not really indicative of how we’re treating the portfolio.

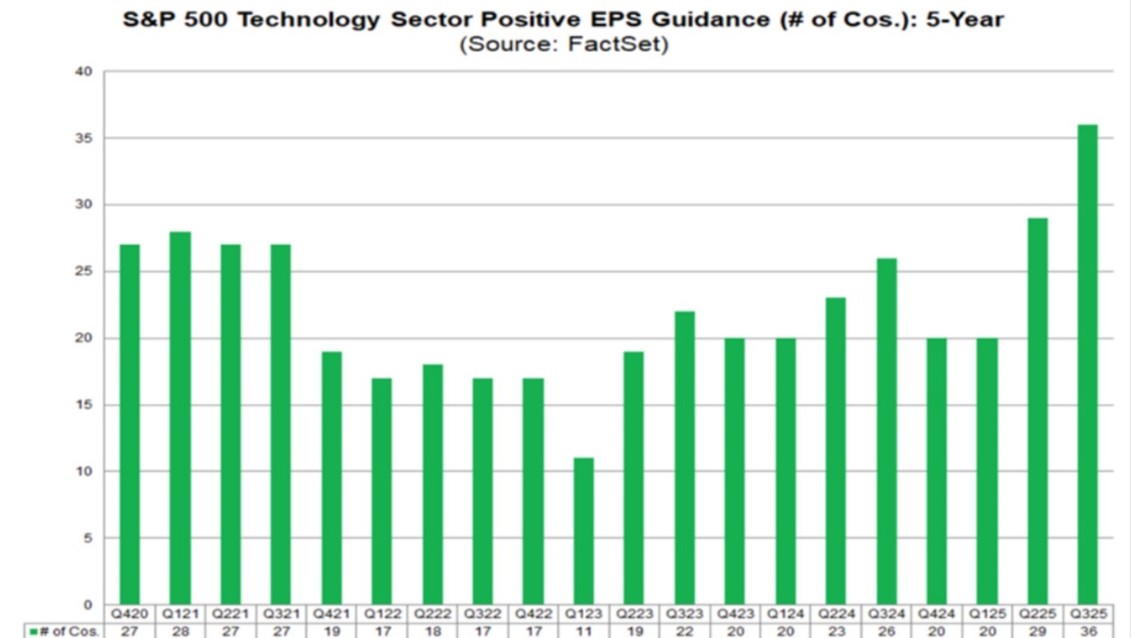

Fundamentally, it’s been said time and time again just how expensive the market is right now, trading at the higher level of valuations when you look at it from a price-to-earnings perspective. How should we view the market in this type of fundamental environment? For one, technology companies currently make up close to 50% of the overall S&P 500 – a level we haven’t seen before. This is neither good, nor bad, just different based on our economy and which companies show the most growth. These types of companies require higher multiples as their prospects and incentives to buy come in the form of future growth. And right now, technology companies are seeing their best prospects of future earnings growth in some time. If you look at the chart below, technology companies just posted the highest positive forward guidance in the last five years, and in fact the highest since 2006. Even with these higher multiples, these companies are, at least for the moment, justifying their rich valuations.

Now, from a human behavior perspective, markets continue to hit new all-time highs, and momentum is certainly in play. Even with new all-time highs, it feels we have yet to hit a “euphoric” moment in the stock market. As sir John Templleton said:

“Bull markets are born on pessimism, grown on skepticism,

mature on optimism and die on euphoria.”

In this current environment, it feels more like a maturing on optimism timeframe versus an all out investor euphoria moment. From an intermediate term, it does seem like the momentum in the market has some room to run, and it could be an environment to be slightly risk on.

This leads us, finally, to the risk we need to be aware of. While not euphoric, there is plenty of optimism in the market without a ton of actual results. According to a survey by Nanda, an AI initiative at MIT, 95% of organizations they surveyed had a zero return on their AI initiatives. This is one of the concerns with some of the big tech companies of today. They are investing a ton of their free cash flow and Capex into AI, and that is helping boost certain sectors of the market, however we are yet to see much impact to the bottom line. This is not surprising, but earnings will need to catch up at some point.

Finally, and one of the biggest concerns, is this concept of “circularity” we are seeing across the space – where it seems all of the technology and AI companies are interconnected in some way shape or form, and all relying on future growth prospects to support their price targets. While this can work for the moment, there is a house of cards feel to it, in that, if one company falls down or doesn’t hold up its end of the bargain, the structure could come crashing down. I think this is the most justifiable sense of concern and risk mitigation we should all be aware of.

My biggest takeaway, and theme we discuss within our investment committee is finding this right balance. We feel we are currently doing so at the moment, and as I said earlier, it does feel like we can be slightly risk-on in this environment. As we move ahead, being cautious, protecting short-term cash needs and having proper planning will be key, especially if we see any overheating of the market.

Please make sure you join us next week for our quarterly webinar, and as always, don’t hesitate to reach out with any questions.

Ryan