Two Ways to Receive a Tax Deduction and Avoid Capital Gains Tax

Written by: Nicole Gobel CPA, CDFA

This time of year, we prioritize year-end tax planning with our clients. As an advisor and CPA, I review my clients’ accounts to identify any opportunities for loss harvesting. However, we’ve had two great years in the markets, so thankfully, there haven’t been any losses to utilize in our portfolios. The tax strategy I will be highlighting in this blog will allow you to reposition your portfolio while fulfilling your charitable inclinations that can be used as a tax deduction.

In this article we will cover

- Donating appreciated stock directly to a charitable organization

- What is a Donor Advised Fund (DAF) and how it works

- Who is a good fit for these charitable giving strategies

Donating Appreciated Stock

The vast majority of the market has done well in the last two years. This has hopefully increased the market value of your accounts, but if you’re taking distributions from a brokerage account, you’re most likely having to sell positions at a gain and pay capital gains tax to generate cash. While this is a normal part of investing, we don’t find this to be the most efficient way to fund any charitable donations.

Most charitable organizations are able to receive donations of stock or funds directly into their own brokerage accounts. Why is this advantageous? As the donor you would receive a tax deduction for the full fair market value of the stock and not pay any capital gains tax on the amount above your original cost basis. Once the charity receives the stock they can immediately liquidate for cash since they are exempt from income tax. Therefore, you receive a full tax deduction, the charity receives the full value of the donation, and no one pays capital gains tax.

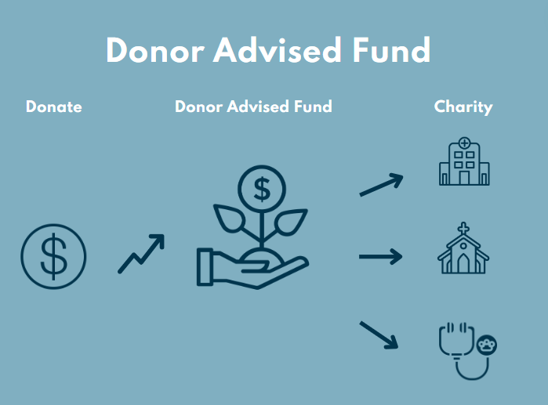

Donor Advised Fund (DAF)

Donating appreciated stock to a single organization may make sense if you’re making a substantial contribution. However, if you’re more inclined to make smaller donations over a number of years a Donor Advised Fund (DAF) may be a better fit.

A Donor Advised Fund is a charitable account that is set up at a custodian, such as Charles Schwab. You can transfer securities directly into the account and receive a tax deduction for the full market value. Once any securities are transferred into the account you are no longer the owner. Instead, the XYZ Charitable Account is the owner. Once the holdings are in the charitable account the custodian will immediately liquidate, but similar to a charitable organization liquidating securities, no capital gains tax will be assessed. You will then be able to choose from a variety of investment options from conservative to aggressive depending on whether you intend to use the funds short-term or grow for longer-term donations.

Once the funds are in the Donor Advised Fund you can then make cash donations directly through the account to any 501(c)3 organization. You do not receive a further tax deduction for this donation since you received a full tax deduction when the account was initially funded. If the charity you would like to donate to is not on the initial list for the custodian, you can request that they add and issue a check to that organization as long as they qualify. For example, we have many clients who do this for local fire and policy departments.

Similar to donating appreciated stock directly, a Donor Advised Fund provides you with the ability to receive a full tax deduction for the initial contribution to your account and avoid capital gains tax but also provides flexibility to spend down the amount over time to a number of charities.

What is the ideal situation for these strategies?

First and foremost, you need to be charitably inclined for either of these donation tactics to make sense. We don’t tell clients to give away their money if that is not their intention just to save on income taxes.

However, if you are charitably inclined here’s a few examples of situations where there is a significant benefit:

1.You have a highly concentrated stock position, possibly employer stock that you would like to diversify out of but there are a lot of built-in gains. You can donate this directly to a charity or donor advised fund to receive a tax deduction, diversify your portfolio and avoid paying tax on the capital gains.

2. You are not itemizing deductions and therefore not receiving any tax benefit for charitable contributions. By potentially donating a larger amount to a donor advised fund in a single year and itemizing in that year you can receive a tax deduction in the year you fund the account and spend down over time allowing you to utilize the standard deduction in other years. This is ideal if you’re donating smaller amounts to a number of charities.

3. You are in a very high tax bracket in a single year, for example from the sale of a business. In this case donating a large amount of stock directly or funding a donor advised fund in a high tax year would provide for a large tax deduction to offset some of your income.

It is important to work with your investment advisor and tax professionals when considering the use of these strategies. Care must be taken to ensure you are choosing the right stocks or funds to donate as well as the right amount to make the strategy worthwhile. If you are not increasing your itemized deduction significantly above the standard deduction, although you are saving on capital gains tax you are not receiving a tax benefit.

If you have questions regarding these topics, please reach out to the team at Bouchey Financial Group.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.