Two Ways to Provide Cash Flow for an Early Retirement

Written by: Marty Shields, CFP®, AIF®

Many individuals who want to retire early and only have access to cash flow provided from their IRA or 401(k) run into a roadblock because they will trigger a 10% penalty on all distributions before the age of 59.5.

Below are the two potential work arounds to overcome this hurdle and provide distributions without incurring the 10% penalty:

- Rule of 72(t)

- Rule of 55

The Rule of 72 (t)

Internal Revenue Code section 72(t) allows penalty-free access to assets in IRAs and employer-sponsored retirement plans under certain conditions, such as account holder death or disability and first-time home purchases.

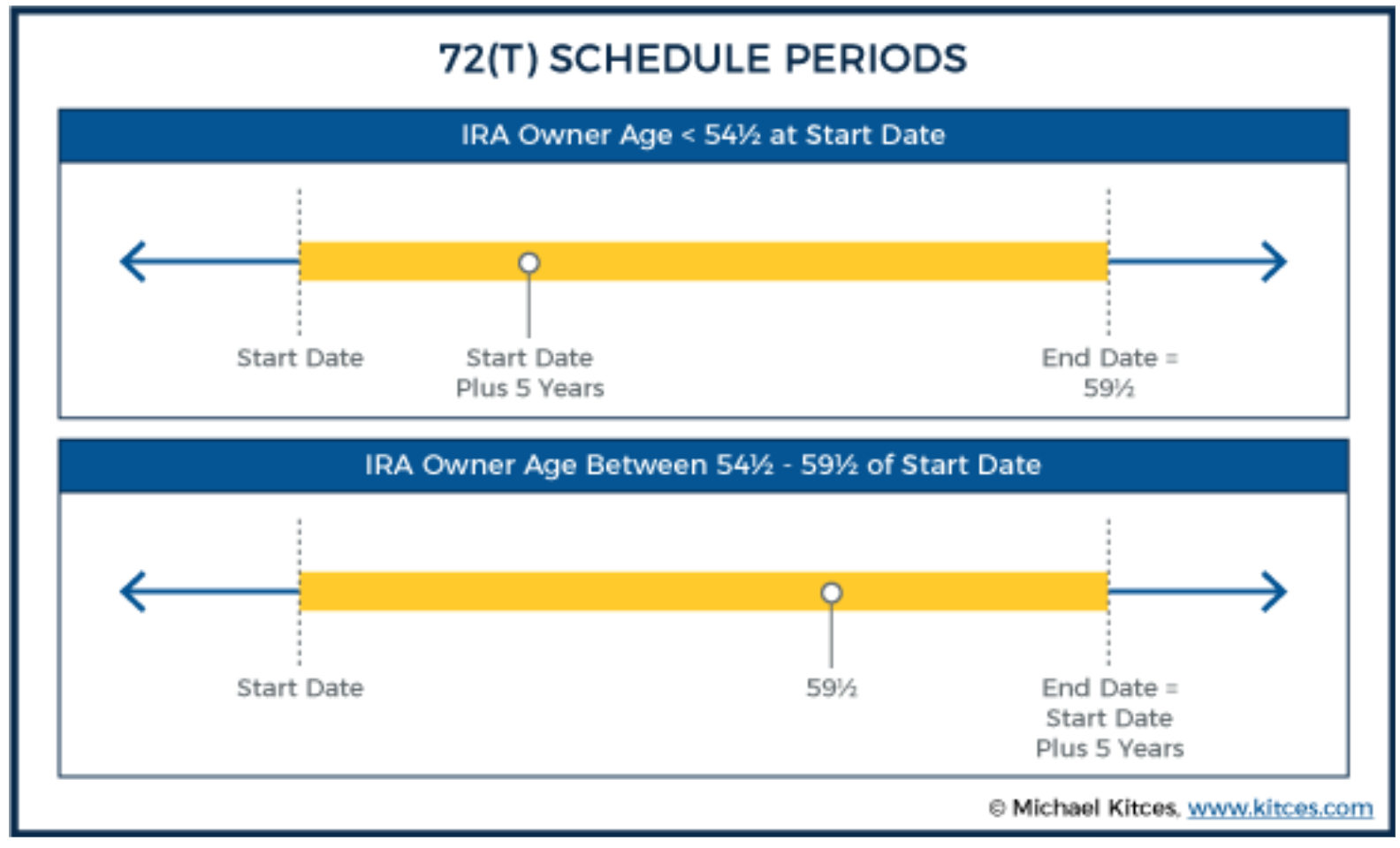

Under this code, there is also an option to take substantially equal periodic payments (SEPP) from a retirement account to avoid the 10% penalty. The main requirement of this option is that you must take a minimum of one withdrawal a year for five years or until you reach 59½ years of age, whichever comes later. If you modify your distribution schedule before then, you will be required to pay a penalty on all the funds you have already received.

The IRS allows you to choose from one of the following three approaches to determine the distribution amount.

- Required minimum distribution (RMD) method: This typically produces the smallest annual payment.

- Amortization method: This spreads your balance over life expectancy to produce a larger payment amount.

- Annuity method: This provides a fixed mid-range payment between the RMD and amortization methods.

You must calculate payments based on your life expectancy, so the older you are when starting them, the higher the amounts will be.

It is possible to split your IRA into two separates IRAs and only take the distribution from one IRA if you want to lower the annual distribution amount.

The Rule of 55

Just like IRAs, employer sponsored, tax-deferred retirement plans like 401(k)s and 403(b)s have rules about when you can access your funds and in most cases if you take a distribution before age 59.5 you’ll likely trigger an IRS tax penalty of 10%. The rule of 55 allows you to take a distribution from your employer plan as early as age 55 without incurring the 10% penalty.

There are a few requirements to take advantage of this option.

First, you can only take the distribution from a plan where you left the company in the year you turn 55 or later. If you leave a company before this year, you are not able to employ the rule of 55.

In other words, you can only take those penalty-free early 401(k) withdrawals from the plan you were contributing to at the time you separated from service. The money in other retirement plans must remain in place until you reach age 59.5 if you want to avoid the penalty.

The rule of 55 doesn't apply to IRAs. If you leave your job for any reason and you want to utilize the rule of 55, you need to leave your money in the employer's plan until you turn 59.5. Once you roll the money into an IRA, you can no longer avoid the penalty.

Finally, you can keep withdrawing from your 401(k), even if you get another job and unlike a 72(t) distribution, you can stop your distribution at any point.

If you are a police officer, firefighter, EMT, or other public safety employee you can start these distributions in the calendar year in which you turn 50 or later and you don’t have to wait until you turn 55.

Depending on your circumstance, either of these options may provide a new pathway to retire early and use your retirement accounts for cash flow. It is important to remember that if you retire early, your financial accounts will need to last longer, and you’ll need to determine how to cover your health care insurance before you are eligible for Medicare. Given the complexity of these rules and the potential of running out of funds, it is highly recommended that you talk with a fiduciary financial planner and tax expert before you make your final decision. As always, if you have any questions regarding these strategies or any retirement planning questions, please reach out to our office.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.