Q4 2023 Market Update

What a Year!

Written by: Ryan Bouchey, Chief Investment Officer

2023 Look Back

For most of us, the New Year is all about having a healthy reset and looking ahead. I couldn’t agree more. I’m all about what the future has in store and focusing on how we can make small changes in our lives to better ourselves to overcome anything that lies ahead. Personally, I’ve focused on joining a group of motivated individuals all working together to attain health and wellness goals through our work with a performance coach. Through two sessions I’m already feeling more motivated than I have in quite some time. A new year and fresh start can help get us into the right mindset entering 2024.

That said, in our line of work it’s always important to look back and be self-reflective about the year that we’ve been through. I find it’s a helpful exercise for me as I think about our portfolio and the decisions we made. Take a moment to think back to January 1st, 2023 (I know it isn’t easy!). If you remember the worst was supposed to be ahead of us. A near 100% chance of recession and markets at their lows (S&P down 25%, Nasdaq down 35% in 2022, worst year ever for bonds). It was not an easy time to be an investor, and everything seemed to be stacked against us.

Fast forward to the end of 2023, and most of the “experts” could not have been more wrong! By no means did they have bad intentions, but as we’ve learned through past experiences, when it feels like all hope is lost it can oftentimes be the best time to be invested. 2023 certainly played out that way. We had a strong recovery in U.S. equities, the Fed continued to raise interest rates with little harm to the markets, and even bonds had a bounce back year solidifying our feelings that now could be the best time to be a diversified investor as higher interest rates meant more yield for years to come. Having a long-term mindset and not overreacting was the best thing to capture the benefits of a year like 2023.

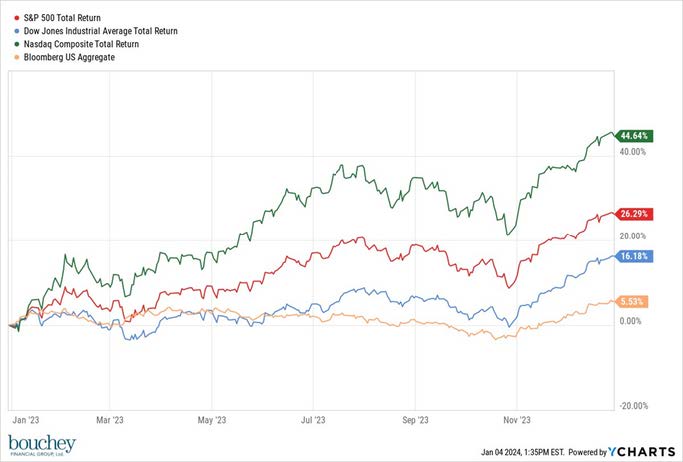

U.S. Equities

It was quite the year for U.S. equities in 2023. The Nasdaq led the way returning 43%, while recouping much of the losses it suffered in 2022. The S&P 500 returned 24%, while coming within mere points of reaching its all-time highs just before the year end. The Dow Jones and Mid/Small caps lagged a bit, all returning approximately 15% for the year. Again, patience was the key.

So, what does 2024 have in store for us? I wish I had a crystal ball. But for the time being, there is still a lot of positive momentum in place as we enter the new year, even though the first few trading days started a bit rocky. We know from experience that shouldn’t deter us.

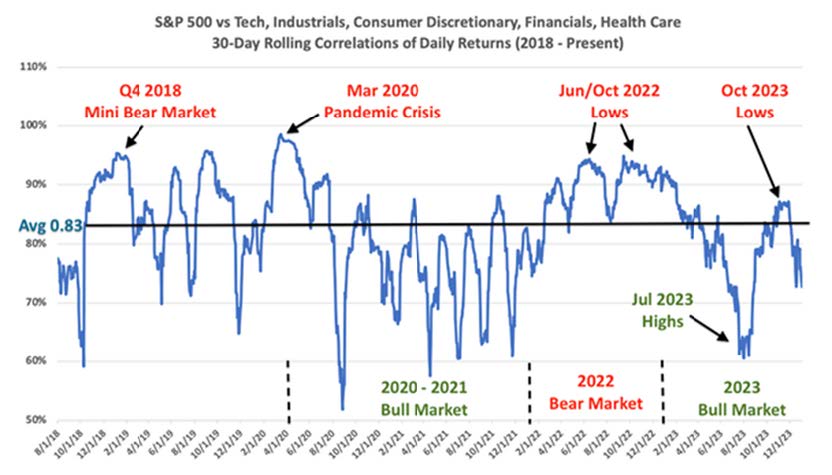

Two positive market themes we’re focused on. 1) We appear to be in a “holding” pattern from the Fed, meaning they are probably done raising interest rates and we’re anticipating their next move to be a rate cut sometime in 2024. Historically, this is a good time to be invested in stocks. 2) There is much more market “breadth” and correlation is low relative to the last few years. When market breadth expands, as we saw with small and mid caps doing well in the 4th quarter of 2023, this brings more market participation. Most of the talk in the first half of the year was that all the returns were brought on by the “Magnificent 7.” With more participation, and less correlation, this tends to bode well for stocks as well.

Fixed Income & Interest Rates

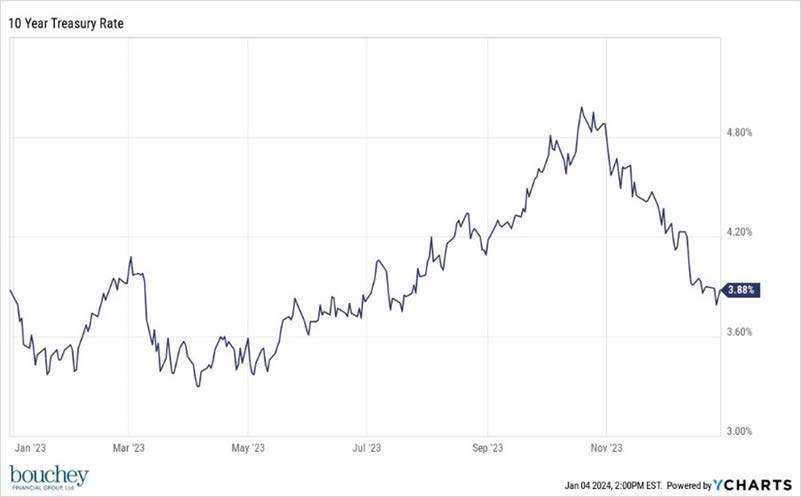

We saw another significant year for the bond and interest rate market. Not only was the rate environment a rollercoaster of a ride, but the events and forecasts were just as volatile. Federal Funds rate (which is dictated by the Federal Reserve) remains at 5.25-5.5%, this is what we consider the “short-end of the curve.” This was last raised by the Fed back in July 2023. But for purposes of our discussion here, I want to focus on the 10-year Treasury yield, as that is a true indicator of borrowing costs for most consumers as it’s tied to mortgages, consumer loans etc.

The 10-Year Treasury yield started the year at around 3.7% and started to rise in the first quarter along with strength in the stock market. I know we’ve talked about it a lot, but Silicon Valley Bank’s collapse back in March really spooked the markets, with both the stock market and bond market quickly moving down with the 10-Year going all the way to the 3.2% range. Our outlook and strategy remained patient, as we felt we were in a higher for longer environment. Fortunately, this came to fruition, as the yield for 10-Year treasuries rose all the way to just about 5% in October.

The bad news to higher rates is that it hurt the market value of bonds, which is why when rates first went up in 2022 we held very little fixed income, and moved much of that sleeve to alternatives. The good news, however, and we think long-term this outweighs the bad news, is that we are now in a higher interest rate environment which is so important to investors looking for yield. We haven’t seen rates as high as this in over 15-years, and to be able to take advantage of these rates for the next 5-10 years is a real benefit to more conservative investors. We’ve balanced taking advantage of higher yields on the short-end of the curve, while feathering in some of our alternative allocation back into longer-dated bonds. We think this will pay off for our fixed income investors for years to come. Even though rates came crashing back down to close the year, we think there is still potential for rates to go up from here even if the Fed begins cutting their interest rates sometime in 2024. Remember, the 10-year rose from July to October from 3.7% to 5% without the Fed making any interest rate changes, so this range is not all about the Fed.

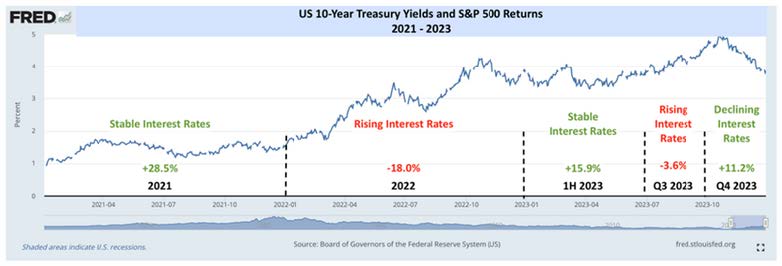

Economy & The Fed

Although there are parts of the market that aren’t fully dictated by the Fed (see above), it’s impossible to overstate just how impactful the Fed’s interest rate decisions have been on the markets over the past few years. It seems that every market fluctuation, good or bad, has had something to do with what the Fed will do next. Much of the recent growth in the market, 8-straight weeks of gains to close 2023, has been predicated on the fact that the Fed was done raising rates and would pivot sometime in 2024.

This has been welcomed news by the markets, as well as by market commentators. It seems following the last meeting and comments by Fed Chairman Jerome Powell that it is a foregone conclusion that we’re entering a soft-landing environment, where inflation comes under control without tanking the economy. Most of the current economic data for now supports this path forward, and hopefully it can continue. We are still living through the disruption of Covid four years later, and it’s hard to compare this time to many previous economic environments due to the changes we have all lived through.

Following Friday’s job report for December, it’s clear that the economy is still humming along at a reasonable rate. We added another 216,000 jobs which well outpacing the anticipated number of 175,000. What was even more impressive in my eyes was that the previous few months saw significant slowdowns. Another lackluster report could have been a sign of a slowing economy. Instead, this was a nice bounce back number indicating further labor market strength. This could indicate the need to hold rates as is, rather than a quick pivot from the Fed. The good news is that the economy seems to be on stable footing, and we’ll continue watching 4th quarter earnings reports in the weeks to come.