Investing 101: Understanding the Different Types of Accounts

Written by: Scott Strohecker, EA

Investing is a critical component of building wealth and securing your financial future. However, before you can start investing, it is important to understand the different types of accounts available to you. From retirement accounts to taxable brokerage accounts, each type of account has its own rules, tax implications, and investment options. This blog will explore the various types of investment accounts and how they can help you reach your financial goals.

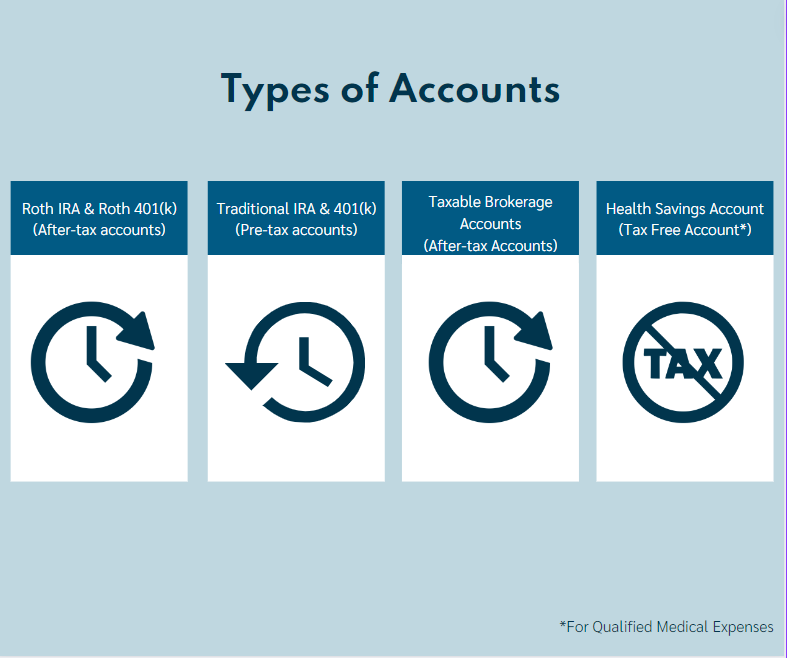

Retirement Accounts: Retirement accounts are designed to help individuals save for retirement while offering tax advantages to encourage long-term savings. Common types of retirement accounts include:

- 401(k): Employer-sponsored retirement plans that allow employees to contribute a portion of their pre-tax income to a retirement account. Some employers may offer matching contributions, effectively doubling the amount you save. Some employer plans now offer a Roth 401(k), in which you can after-tax contributions.

- Individual Retirement Accounts (IRAs): IRAs are retirement accounts that individuals can open on their own. There are two main types of IRAs: traditional IRAs, which offer tax-deferred growth, and Roth IRAs, which provide tax-free withdrawals in retirement.

Taxable Brokerage Accounts: Taxable brokerage accounts are investment accounts that are not subject to the same tax advantages as retirement accounts. While contributions to these accounts are made with after-tax dollars, they offer more flexibility in terms of investment options and withdrawal rules. Investors can buy and sell stocks, bonds, mutual funds, and other securities within these accounts without restrictions on when they can access their funds.

Education Savings Accounts: Education savings accounts, such as 529 plans and Coverdell Education Savings Accounts (ESAs), are designed to help families save for education expenses, including tuition, books, and room and board. Contributions to these accounts grow tax-free, and withdrawals are tax-free when used for qualified education expenses. Thanks to the SECURE ACT 2.0, 529 plans now offer more flexible than ever before.

Health Savings Accounts (HSAs): HSAs are tax-advantaged accounts that individuals can use to save for qualified medical expenses. Contributions to HSAs are tax-deductible, and withdrawals for qualified medical expenses are tax-free. HSAs offer a triple tax advantage, making them a powerful tool for both saving for healthcare costs and supplementing retirement savings.

Employer Stock Purchase Plans: Some employers offer stock purchase plans that allow employees to purchase company stock at a discounted price. These plans often come with favorable tax treatment, such as the ability to purchase stock at a discount and defer taxes on the gains until the stock is sold.

Conclusion: Understanding the different types of investment accounts is crucial for developing a comprehensive financial plan. Whether you're saving for retirement, education, or other financial goals, choosing the right accounts can help you maximize tax advantages and grow your wealth over time. By taking advantage of tax-advantaged accounts and investing wisely, you can build a secure financial future for yourself and your family.

If you have any questions about the different types of accounts and would like to speak with a financial advisor, you can contact our team for more information.

Related Blogs:

6 Strategies for Unused 529 Plan Funds

Health Savings Accounts Can Be an Integral Part of Your Retirement Plan – Here’s How

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.