Health Savings Accounts Can Be an Integral Part of Your Retirement Plan – Here’s How

Written by: Marty Shields, CFP®, AIF®

A Health Savings Account (HSA) is a type of savings account that lets you set aside money on a pre-tax basis to pay for qualified medical expenses. These expenses include deductibles, copayment, and long-term care insurance. HSA funds generally cannot be used for health insurance premiums, and you can only contribute to an HSA if you have a high deductible health plan with certain minimums deductions. For 2023, individuals can contribute $3,850 to an HSA and families can contribute $7,750. Individuals 55 and older can contribute an additional $1,000 annually.

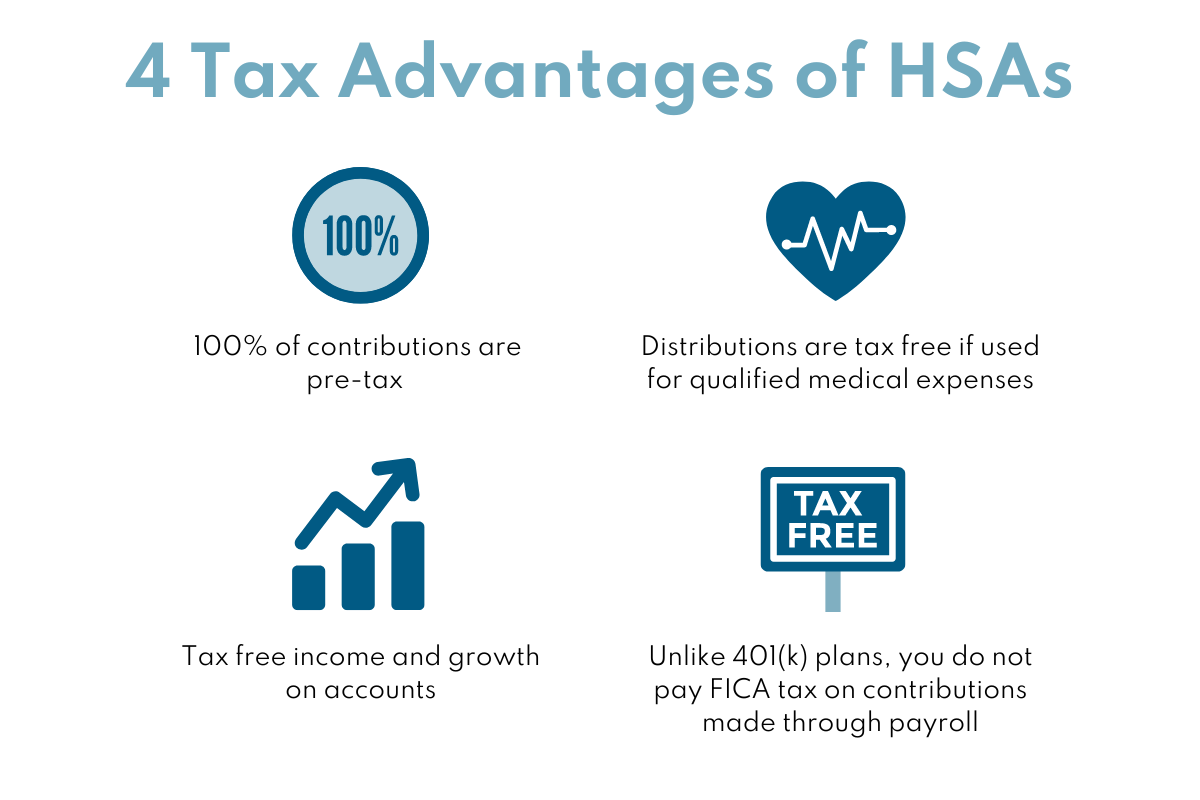

Quadruple Tax Benefit

These accounts have the best tax preferential treatment versus any other savings accounts. Not only are contributions to an HSA pretax but all income and growth is tax free, and all distributions are tax free if used for qualified medical expenses. Also, unlike 401(k) contributions, if you make HSA contributions through your payroll, you don’t pay FICA tax either which is 7.65% if you are an employee or 15.3% if you are self-employed. No other accounts have all four benefits.

Long-Term As Well As Short-Term

HSAs can be used for annual healthcare expenses, but they can also be used for long-term expenses as well. Unlike Flexible Spending Accounts (FSA) that need to be spent within the year or you lose those dollars, HSA assets can continue to build and don’t need to be spent during the year. It is also possible to invest HSAs assets and taking this approach can build your account to a sizable amount to cover expenses in retirement.

According to the Fidelity retiree health care cost estimate, an average retired couple age 65 in 2023 may need approximately $315,000 saved (after tax) to cover health care expenses in retirement.

Obviously, this is a large expense to cover and there will need to be multiple accounts used to cover these expenses. But if you can save the maximum annual amount into an HSA and invest this money, your HSA account can be an integral part of.

Non-Qualified Expenses

If you take a non-qualified distribution, you are subject to ordinary income tax on the distribution and a 20% penalty tax. The penalty will not apply:

- if you are age 65 or older,

- if you are disabled or

- for the year in which you die.

The IRS requires that you confirm your distributions are for qualified medical expenses. It is your responsibility to keep all documents (such as receipts) that show how you used your HSA, including for non-qualified transactions, and self-report accordingly on your annual tax return.

Beneficiaries of HSAs

If your medical expenses are much lower than average (or you don't live that long), you may have money in your HSA that you can pass along to your heirs.

If your spouse is the designated beneficiary of your HSA, it will be treated as your spouse's HSA after your death with the same triple-tax-free treatment. If your spouse isn't the designated beneficiary of your HSA, the account stops being an HSA, and the fair market value of the HSA becomes taxable to the beneficiary in the year in which you die.

If you have any questions regarding HSAs and how you can use them in your personal financial planning situation, please contact one of our wealth advisors.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY, and Boston, MA.