Artificial Intelligence – The Engine to Drive Growth in the Markets and the Economy

Written by: Martin Shields, CFP®, AIF®

Since the start of 2023 it has become clear that the beginning of Artificial Intelligence’s (AI) role in the economy is upon us. Just as .com became part of every earnings call in the late 1990s, AI has taken that role in today’s earning calls.

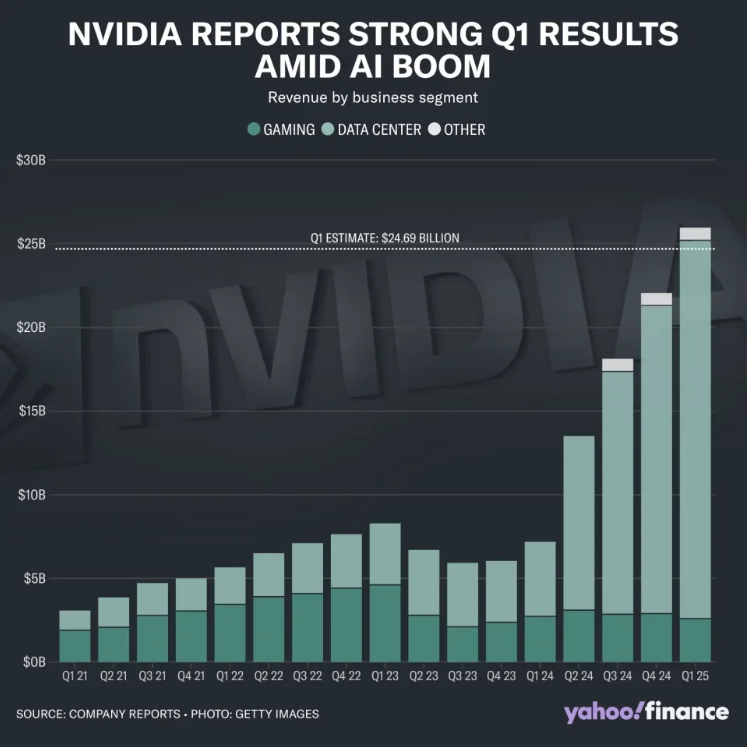

The company that has benefited the most from the beginning of the AI revolution is Nvidia (NVDA). As shown in the graph below, revenue for the company has grown exponentially over the past year and with gross profit margins of 78.3% (yes 78.3% - that is not a typo) the future looks pretty bright for AI especially when their CEO states that their biggest hurdle is keeping up with the demand and that is before their new chip launches in December.

Of course, this is not to say that they won’t have challenges moving forward with a price to earnings (PE) ratio of 47.6 (S&P 500 forward PE is currently 21) the stock is not cheap and with many competitors ramping up capabilities they won’t be the primary producer of these chips for too long.

Strong AI related earnings were evident in many of the tech names this quarter. One of the drivers is the significant amount of capital expenditure (capex) in this space. To provide some perspective on the magnitude of this spending, according to Forbes, the big tech names will likely increase their 2024 capex spending on AI to $210 billion an increase of 35% versus 2023.

As the AI technology revolution evolves, there will be some winners and some losers. It is difficult to determine who is going to be in which category. Many of the Magnificent Seven companies have touted increased revenue and profitability because of AI, while Salesforce reported slowing growth as their customers are investing more into AI rather than utilizing Salesforce’s Customer Relationship Management services.

There are real indications that AI is impacting the broader economy. Let’s look at the second strongest performing sector in the S&P 500 this year (as shown in the chart below). Yes, that is the very staid utilities sector.

The reason for this strong performance is the dramatic increase in demand for power from these new AI data centers. This higher energy usage can vary from 300 megawatts to several gigawatts which is 10 to 40 times greater than the standard legacy, energy-hog data center. To provide a comparison, one megawatt of energy is enough electricity to fulfill the instantaneous demand of 750 homes at once, according to one utility estimate.

What is important to remember when talking about AI and its impact on the markets and the economy is that we are in the first inning of this game and there will be many areas of investment and business applications that do not provide a return. The best road map for how this plays out is to consider the expectations and excitement when the internet economy was started in the 90s. After 30 years of that industry evolving and maturing, it is almost laughable to look back on the businesses from that time period versus the business applications today. The same thing will most likely be true with AI, where we will look back on these days and laugh at the simplicity of the AI applications. But compared to the internet revolution, the speed and impact that AI will have on our lives will probably be 5 – 10-fold versus that of the internet economy.

In a McKinsey Global Institue study that was released last year, it was estimated that generative AI technologies could increase profits by $4.4 trillion annually. With numbers of this magnitude, you can appreciate the amount investment corporations will employ to become a leader in utilizing AI versus their peers.

If you have any questions about your portfolio and getting exposure to AI technologies, please reach out to our team at Bouchey Financial Group.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.