What is a Mega Backdoor Roth and Is it Right for You?

Written by: Marty Shields, CFP®, AIF®

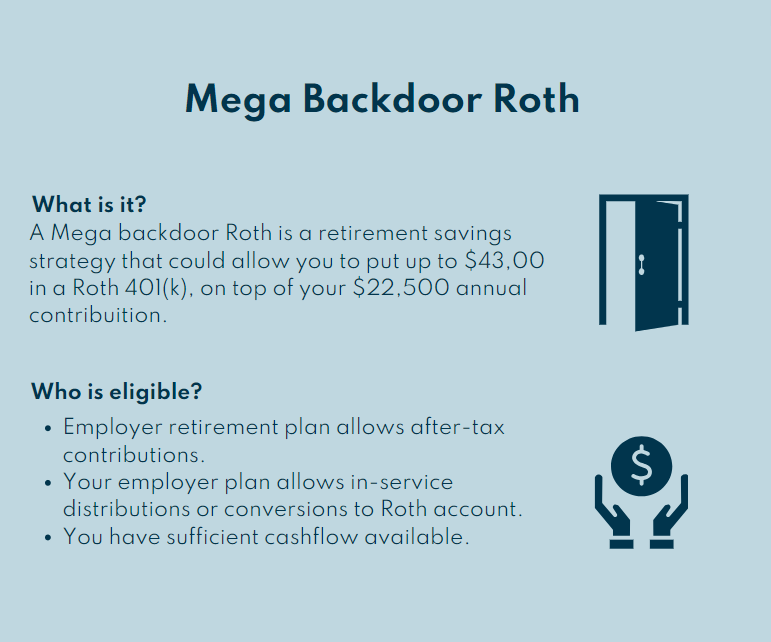

A mega backdoor Roth is a strategy that allows individual investors to contribute more to a Roth IRA and/or Roth 401(k) than the standard contribution limits. It can also be beneficial to those who exceed the income phaseout limits for Roth IRA contributions. The income phaseout amounts for 2023 are $218,000 - $228,000 ($230,000 - $240,000 for 2024) for individuals and head-of-household taxpayers and $138,000 - $153,000 ($146,000 - $161,000 for 2024) for married filing jointly. Those with incomes exceeding those levels cannot normally contribute anything to a Roth IRA. However, with a mega backdoor Roth, it may be possible for those with high incomes to contribute to a Roth IRA and/or Roth 401(k).

How a mega backdoor Roth works.

Here’s a quick overview:

- Pre-tax contributions: The individual must make the maximum pre-tax contribution to their 401(k) for the year. For 2023, the maximum pre-tax contribution is $22,500 ($23,000 for 2024) for all accounts ($30,000 for those aged 50 and over).

- After-tax contributions: Once the individual has reached their maximum pre-tax contribution, they can make additional after-tax contributions up to the total 401(k) limit for the year. For 2023, this limit is $66,000 or $73,500 for those aged 50 and over. These limits include the individual’s contributions, employer contributions and after-tax contributions.

Example

John is 55 years old and maximizes his employee 401(k) contribution of $22,500 and $7,500 for the 50 plus catch-up amount. His company has a 3% employer match on 401(k) contributions which adds another $6,000 of contribution. He could potentially contribute an additional $37,500 post tax into this plan to then convert it to a Roth.

- Roth conversion: The final step is to roll the after-tax contributions into a Roth IRA or convert them into a Roth 401(k) if the plan allows. This lets the money in the account not only grow tax-free but also be withdrawn tax-free in retirement. Remember that conversions could trigger a tax event, so it’s best to consult with a tax professional about your specific situation.

Who is eligible for a mega backdoor Roth?

Generally, the plan document of your employer-sponsored retirement plan will determine whether you are eligible for the mega backdoor Roth strategy.

Here are some things to keep in mind:

- 401(k) plan rules: Your employer’s retirement plan must allow after-tax contributions beyond the standard pre-tax or Roth contribution limits. For 2023, the maximum is $22,500, or $30,000 for those aged 50 and over.

- In-service distributions or conversions: Your employer’s plan must allow you to either make in-service distributions or conversions to a Roth account. This allows you to roll the after-tax contributions into a Roth IRA with an in-service distribution or convert to a Roth 401(k) while you’re still employed. Many plans allow in-service distribution for employees 55 and older.

- Those who have enough funds: Of course, you must have enough money available to contribute the maximum to your 401(k), which is $22,500 in 2023 or $30,000 for those 50 and over. You must then still have the cash to contribute additional funds beyond the standard limit, which you will use for the mega backdoor Roth strategy.

Bottom line

A mega backdoor Roth is a strategy that lets investors, who normally couldn’t add to a Roth account due to their high income or contribution limits, move sizable 401(k) contributions into a Roth IRA or Roth 401(k). Not all plans allow this, and you must have enough cash to contribute extra amounts. However, the strategy can be effective for those who are eligible.

If you have questions regarding this strategy or would like to discuss your financial future, please reach out to the team at Bouchey Financial Group.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY as well as Boston, MA and Jupiter, FL.