What Happens if the Debt Ceiling is Not Raised?

Written by: Nicole A. Gobel, CPA, CDFA®

Treasury Chief Janet Yellen’s announcement last week stated that we may reach the debt ceiling as soon as June 1st. While negotiations are in the works, we can provide background on the debt ceiling and possible future outcomes.

This article will address:

- What is the debt ceiling?

- What could happen if Congress does not raise the limit?

- Are there any other paths forward?

The Debt Ceiling

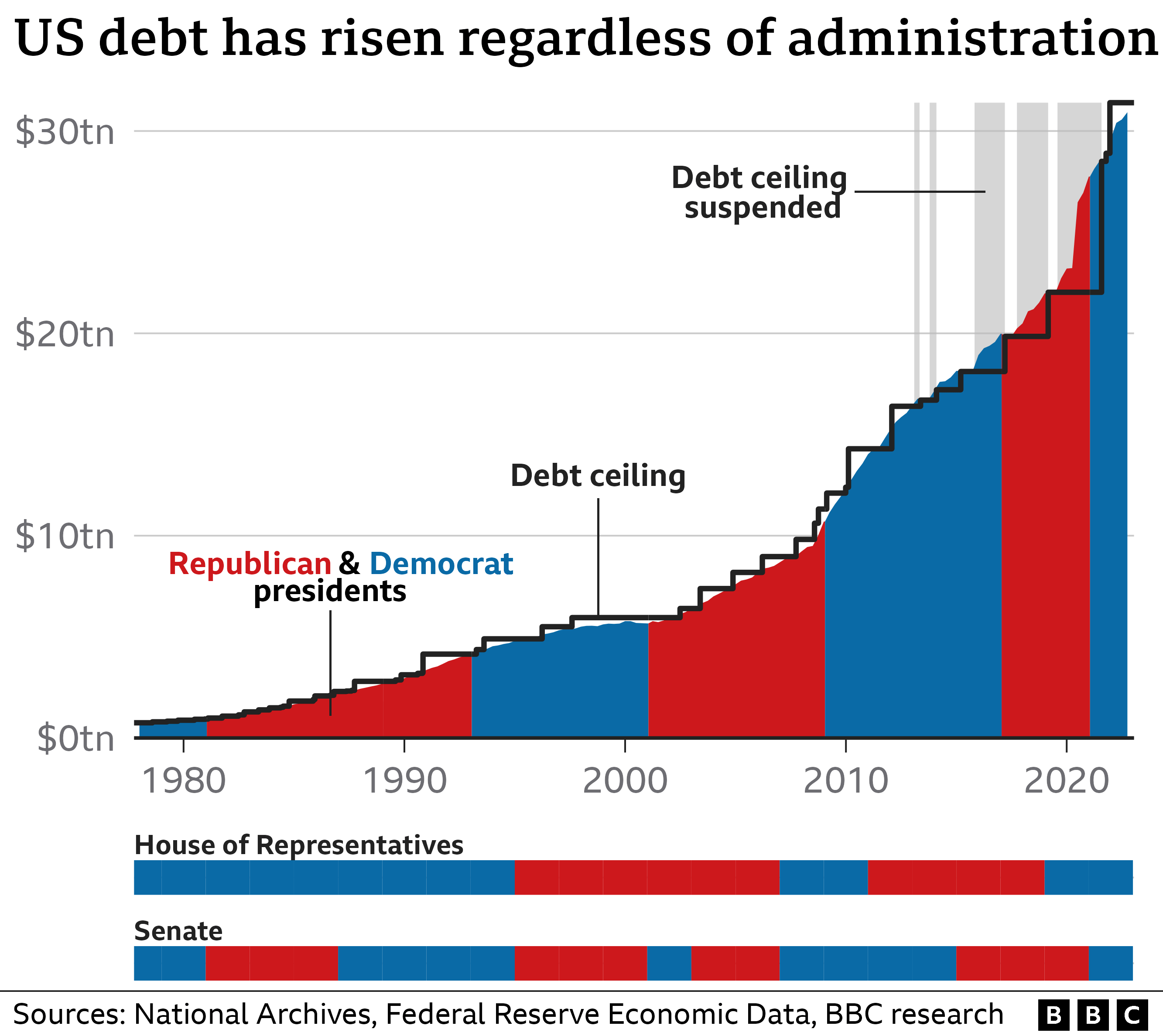

Simply put, the debt ceiling limits total borrowing by the federal government. It was first put in place in 1917 during World War I to allow the Treasury to issue bonds without Congress approving each instance, as long as total debt was under the set limit. The debt ceiling has been raised 78 times since 1960, 49 times under Republican presidents and 29 times under Democratic presidents.

Why does the federal government need to borrow money? The United States collects income taxes to fund government spending, however, as a country we spend more than we take in every year. Similar to any individual or business that spends more than they earn, the government takes on debt in the form of issuing treasury bills and bonds and pays interest in return.

Technically, the United States hit the debt limit earlier this year on January 19th. At that time, the Treasury Department implemented far-reaching accounting tools or so-called “extraordinary measures” to continue making all required payments. In Janet Yellen’s announcement last week, she stated we could run out of cash by June 1st. A separate, estimated date given by the Congressional Budget office estimated cash depletion in early July. In either case, the debt ceiling must be agreed upon by Congress sooner rather than later.

What Happens if Congress Doesn’t Reach an Agreement?

Treasuries are considered a high quality, safe-haven investment since the U.S. has never defaulted on its debt. As long as you hold the bond until maturity, you will receive your interest payments and principal.

Back in 2011 there was a similar standoff in Congress under the Obama administration that led to short-term volatility in the stock market. This resulted in a downgrade to US Government’s bond credit rating from Standard & Poor. Although the debt ceiling was eventually approved, the result of the delay was higher borrowing costs for the US and Democrats were forced to cut spending significantly.

Historically, Democrats have been willing to support increases in the debt ceiling regardless of who is in the White House, most recently in 2019. However, the current landscape in Washington is one where House Republicans are demanding significant cuts in spending of over $4.8 trillion over 10 years. President Biden has said he will veto the bill and invited house leaders to the White House for discussions this week.

Although we can’t say for certain what will happen if an agreement is not reached, experts have warned the result could be problematic for the global markets and economy. Keep in mind, the largest holders of US Treasuries are Japan, China, and the United Kingdom so potential default would not only affect our domestic economy but have global impact as well. Programs such as Social Security could see payments reduced or suspended affecting those reliant on the government for their basic necessities.

What Else Can Be Done?

When thinking about all that is at stake the question comes to mind, what else can be done to avoid default and the subsequent fallout.

What if Congress doesn’t act? Some potential short-term tactics could be for the US to prioritize payments to bondholders or for the Federal Reserve to buy back Treasury bonds. However, there is also a conversation around the 14th Amendment.

The position of the White House has remained clear: it is Congress’ constitutional obligation to act. Over the last decade, some have argued that there is a 14th Amendment clause that would allow the executive branch to act on the debt ceiling without congressional approval. The clause reads, “the validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and counties for services in suppressing insurrection or rebellion, shall not be questioned”. The quote simply states the United States must take priority on paying their debts, services, and pensions without any interference. In this case, President Biden would attempt to avoid default by taking executive action and raising the debt ceiling himself.

Conclusion

While we have shown that politics do not affect the financial markets when you take a long-term approach, there could be short-term volatility over the coming weeks. Although we will most likely see an agreement to increase the debt ceiling, as we have seen 78 times in the last 63 years. We cannot rule out that there may not be a resolution until the last minute.

If you found this topic useful and would like to schedule a follow up call, please contact our team.

Bouchey Financial Group has offices in Saratoga Springs and Historic Downtown Troy, NY, and Boston, MA.