Is Inflation Trending in the Right Direction?

Written by: Paolo LaPietra, CFP®

Last week was another step in the right direction for the fight against inflation with December’s CPI coming in at 6.5%. This would make the sixth consecutive month of declining inflation, down from 7.1% in November. Inflation has been a dark cloud hovering over the stock market, bond market, and most importantly, consumers. While a six-month trend of inflation coming down is a positive, 6.5% is still well above the Federal Reserve’s target of 2%. Aside from putting more stress on your monthly budget with goods and services becoming more expensive, inflation also weighs heavily on stocks and bonds. The Fed’s strongest tool for combating inflation is raising interest rates which is a headwind for stocks and bonds as we saw in 2022. If this trend of regression in inflation continues, this will allow the Fed to slow or even pause its pace of raising rates.

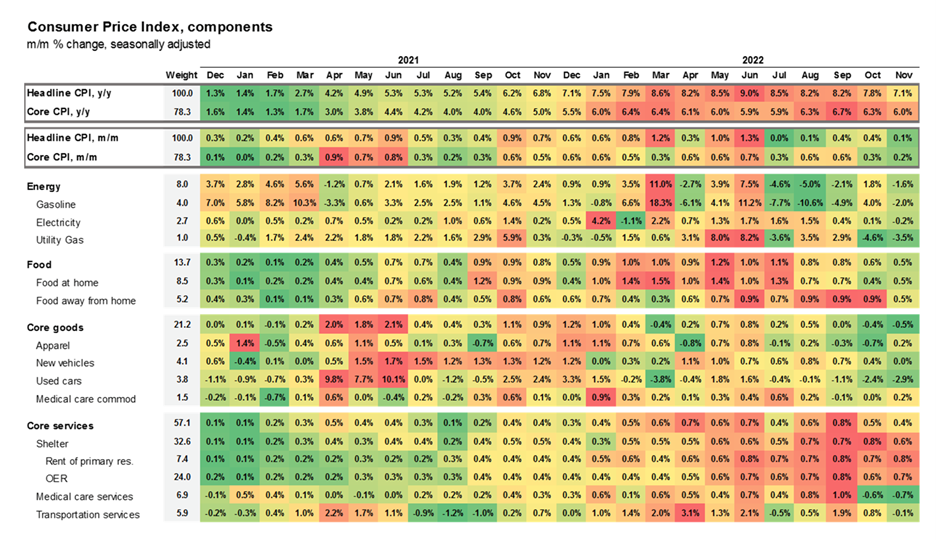

It's important to understand how the worst inflation bout the US has faced in nearly four decades started in order to see where it’s going. Below is an inflation heat map for the US. This chart shows different components of spending for the U.S. consumer split between energy, food, core goods, and core services. Green indicates price increases that are at or below historical norms, yellow is slightly above, and red is well above historical norms. When you take a few minutes to study this chart, you can see how inflation has moved through the economy.

The inflation trend started in the 2nd quarter of 2021 with core goods rapidly increasing. Interest rates were at all-time lows, consumers were flushed with cash from the combination of the COVID stimulus package and lack of spending in 2020 due to the pandemic. Consumers took advantage of this by purchasing new appliances, clothes and vehicles. With the overwhelming demand for these products and limited supply, prices drastically increased. As we move towards the end of 2021 and consumers reached their fill of core goods, we can see the shift towards energy, food, and core services. As COVID restrictions eased, consumers felt more comfortable traveling, which we can see as a direct connection to rising energy prices. We can also see an increase in food, especially “food away from home” as consumers felt more comfortable going out to restaurants. Finally, we see core services prices increase as home buyers were looking to take advantage of low mortgage rates and renters felt comfortable moving back into major cities.

When we look at the November 2022 reading, we can see a return to normalcy across the board with the exception of core services. While housing and rental costs are still growing above normal trends, they have cooled since their peak. On top of that, real-time measures of new homes and rentals tracked by Zillow and Apartments.com show that increases in rental prices and home prices are slowing. Coupling this data with December’s CPI report, one can certainly make the assumption that inflation is trending back towards historical norms which is a positive not only for the markets but the economy as well. If you have any questions regarding inflation and how it affects you, please contact our team at Bouchey to set up an initial meeting.

You may also be interested in: Inflation Adjustments That Benefit You

Bouchey Financial Group has local offices in Saratoga Springs and Historic Downtown Troy, NY.