Inflation Adjustments That Benefit You

Written by: Nicole Gobel, CPA

There have been several big announcements this past week that will benefit taxpayers and are meant to be a means of combatting the high inflation we continue to see in many areas of the economy. Social Security recipients will be receiving a substantially larger benefit in 2023 on top of the 5.9% cost-of-living adjustment that was implemented last year. There are also several adjustments related to Medicare that should benefit taxpayers. There were also two recent announcements from the IRS. The first relates to inflation adjustments to the Federal tax brackets, standard deduction and annual gift exclusion. The second provides increased contribution limits for retirement plans beginning in 2023.

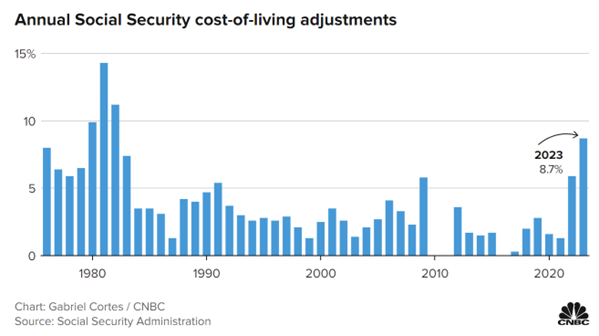

Social Security Cost-of-Living Adjustment and Earnings Limits

On October 13th the Social Security Administration announced that the cost-of-living adjustment for 2023 will be 8.7%. This year’s increase is the largest since 1981 but there have only been three years since the cost-of-living adjustment began in 1975 that have topped this year’s increase. The average monthly retiree benefit will now be $1,827 an increase of $147.

Another inflation adjustment to Social Security provisions included raising the earnings subject to Social Security tax from $147,000 to $160,200. In addition, the maximum an individual can earn annually while still collecting benefits prior to full retirement age increased from $19,560 to $21,240. In addition, an individual can now earn up to $56,520 in the year they reach full retirement age without receiving any reduction in benefits increased from $51,960 in 2022. The full retirement age for those born in 1960 or later remains the same at age 67.

Medicare Premiums

Another positive surprise was the announcement that Medicare Part-B premiums will DECREASE 3% for those paying the base rate from $170.10 per month to $164.90. This was not the case in 2022 when Medicare participants received an increase in premiums of $21.60 or close to 15% that offset much, if not all, of their 5.9% Social Security benefit increase.

In addition, the modified adjusted gross income (MAGI) figure that is used to determine whether someone will have to pay a higher Medicare premium known as IRMAA (Income Related Monthly Adjustment Amount) was also adjusted upward for inflation. For a single taxpayer the first threshold increase now begins at $97,000 vs. $91,000 in 2022 and for a married couple $194,000 vs. $182,000 in 2022. This is close to a 6.6% increase!

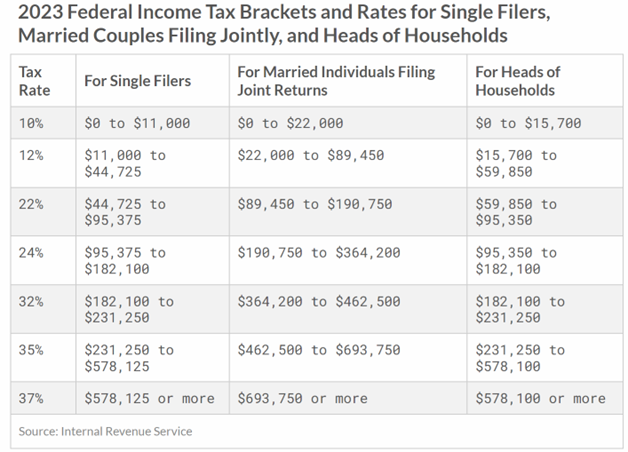

Federal Tax Brackets, Standard Deduction and Gift Tax Exclusion

The Internal Revenue Service announced on October 18th that Federal tax brackets will increase by 7% in 2023 in an attempt to keep pace with inflation. As an example, the 12% tax bracket now includes any single individual with taxable income up to $44,725 and a married couple with $89,450 up from $41,775 and $83,550 respectively in 2022.

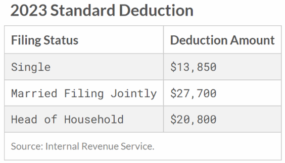

In addition, the standard deduction will increase by $900 for single individuals to $13,850 and by $1,800 for a married couple to $27,700. For those individuals over 65 the additional deduction will increase $100 to $1,500 or $1,850 for those who are not married. The same increased deductions apply to those taxpayers who are blind. This represents the largest adjustment to deductions since 1985 when automatic annual inflationary adjustments began.

In addition, the standard deduction will increase by $900 for single individuals to $13,850 and by $1,800 for a married couple to $27,700. For those individuals over 65 the additional deduction will increase $100 to $1,500 or $1,850 for those who are not married. The same increased deductions apply to those taxpayers who are blind. This represents the largest adjustment to deductions since 1985 when automatic annual inflationary adjustments began.

For those individuals that are concerned with future changes to estate and income tax laws, the increase in the annual gift exclusion is also a positive. For 2023 you will now be able to gift up to $17,000 per year to any individual, up from $16,000 in 2022, without utilizing any of your lifetime gift tax exclusion.

Increased Retirement Account Contribution Limits

On Friday, October 21st the IRS announced increased contribution limits for both employer and individual retirement accounts. For those saving into a 401(k), 403(b), most 457 plans along with Thrift Savings Plans for Federal employees the limit has increased to $22,500, a $2,000 increase from the current limit of $20,500 representing the largest increase in decades. Individuals age 50 or over can also save a catch-up contribution that has now increased from $6,500 to $7,500 beginning in 2023. That means an individual over age 50 can contribute up to $30,000 annually into a retirement account through their employer, a full $3,000 increase from the previous combined limit.

Those individuals saving into a Traditional or Roth IRA can also contribute a higher amount beginning in 2023. The new maximum contribution for either account is $6,500, an increase of $500. In addition, those age 50 or older can still contribute an additional $1,000 for a total of $7,500.

The income limitations for those eligible to make deductible Traditional IRA contributions, if covered by an employer plan, increased with the phase-out range now beginning at $73,000 for an individual and phasing out completely at $83,000. For a married couple, the phase-out begins at $116,000 and ends at $136,000.

For those interested in contributing to a Roth IRA the income phase-out now stands at $138,000 to $153,000 for an individual and $218,000 to $228,000 for a married couple. This is a significant increase of $7,000 and $14,000 respectively to where the phase-out limit begins for Roth IRAs.

SIMPLE Plans which are often used by small employers also saw an increase in contribution limits from $14,000 to $15,500 and the catch-up contribution increased from $3,000 to $3,500.

We realize that many of our clients, colleagues and community members have been hit hard by inflation this past year. It is good to see that there are some measures being put in place to offset some of the hurt we have felt in our wallets. While we know there is much work to be done by the Federal Reserve to continue to curb inflation with rate hikes, we hope these few pieces of positive news will brighten your day.

If you have questions and would like to discuss your personal tax or cash flow situation, please reach out to the team at Bouchey Financial Group.